Why content has the hots for ecommerce: Little Black Book, POPxo, others are celebrating this union

The Indian ecommerce market is estimated to be worth $84 billion by 2021, and content platforms are looking for a piece of the action.

Little Black Book, The Better India, ScoopWhoop, and POPxo have more than one thing in common – yes, they are digital media platforms, but there are now trying to serve up more than just content. They all not only want you to read, but also buy!

The concept of content commerce, as it is called, is not new. China and the US, both have companies with a strong content commerce presence with popular platforms such as, Little Red Book and Refinery29, as well as BuzzFeed, and the idea is simple – why not use the wide reader base that content websites have to create an alternate source of revenue? BuzzFeed, in fact, reported $50 million in commerce revenues in 2018, though it continued to lay off employees as it fell short of its revenue and profit targets.

While the concept is catching up in India, there is some a way to go before ecommerce becomes a significant part of a content platform’s business model. Especially since one player has already quit the game.

A natural progression?

Advertising and paid content will continue to remain the primarily source of revenue for these platforms, say market analysts, but ecommerce seems like a natural extension. The user base and content itself gives most platforms the opportunity to sell differentiated and niche products. Ujjwal Chaudhry, Engagement Manager, RedSeer Consulting, believes that with content commerce, platforms can help with sales to relevant target audiences.

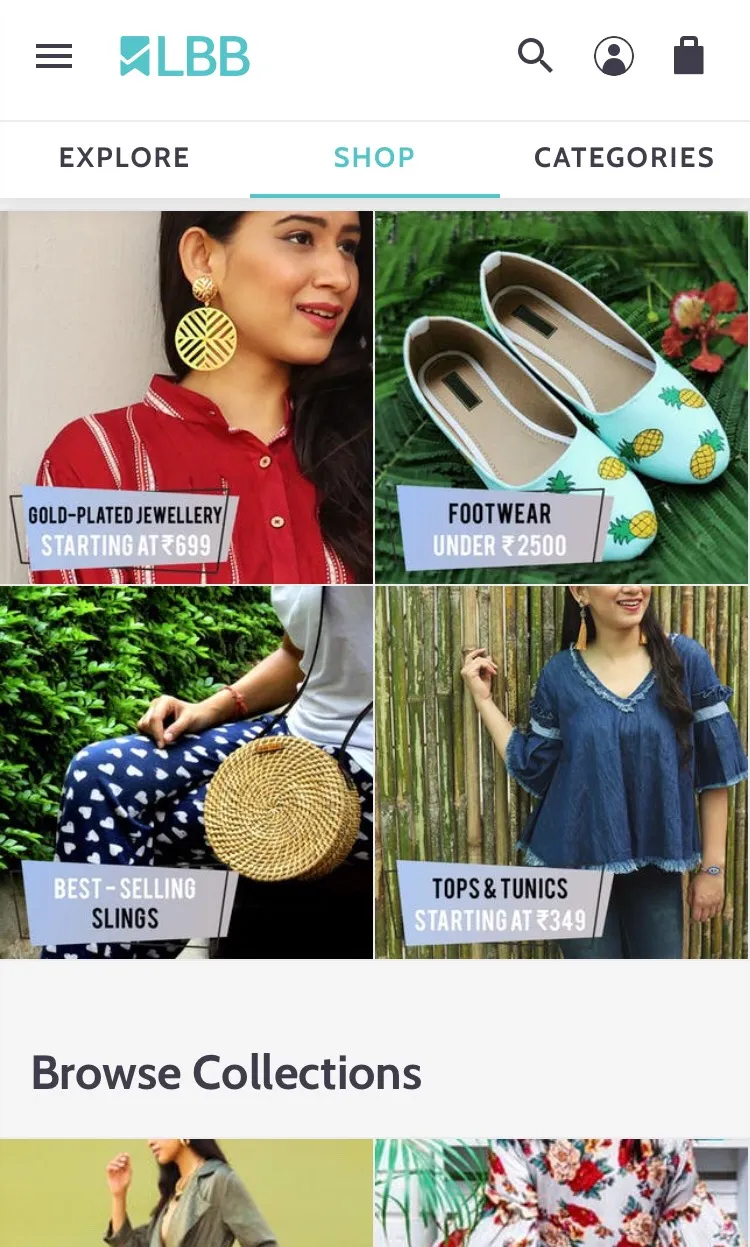

For business discovery platform Little Black Book, or LBB, as it’s called, it was a matter of giving their readers more to do. LBB provides recommendations for shopping, travel, adventure, food, gyms, health and more.

Also read: Local discovery platform Little Black Book raises funding from IDG Ventures, Indian Angel Network

Suchita Salwan, Co-founder Little Black Book, or LBB, says, “I don't think we ‘came up with the idea’, as much as commerce or direct purchase being a natural extension of what we do. We connect users to local brands and businesses."

"Up until 2017, we were making these connects by providing users with information and recommendations. We actually see a fantastic conversion from a user discovering a brand or business to actually getting in touch with that business.”

For LBB, direct purchases on the platform became a way to create a bridge between potential customers and merchants and create an intra and inter-city access for seemingly "local" brands. Today, LBB sells everything from clothing and shoes to beauty products, jewellery, bags and even snacks, tea and coffee.

Creating target audiences and communities

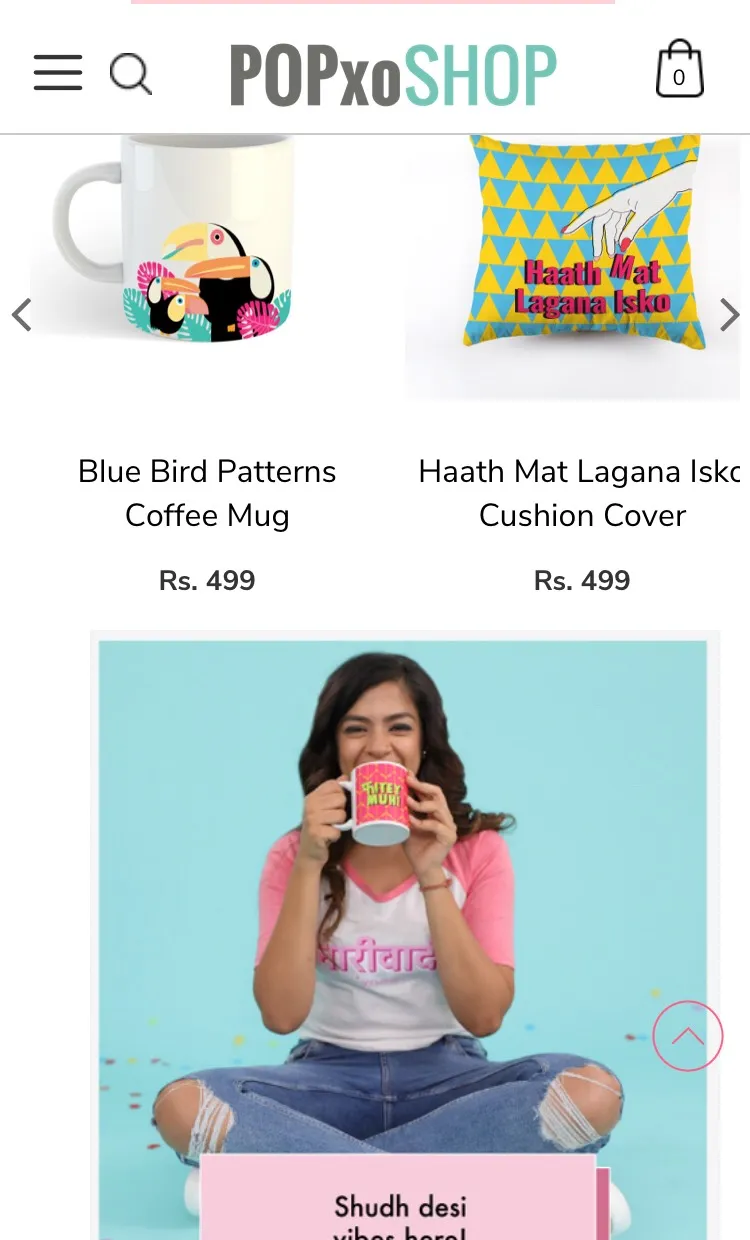

Another site, POPxo, has content tailored for young Indian women on its platform It’s natural then, that products on the platform also have the same focus.

Says Priyanka Gill, Co-founder of POPxo,

“We launched POPxo Shop in 2018 - a private label for millennial women. We realised that there was no strong female-focused millennial product brand in the market and decided to use the data we have to create a collection of products with a strong design language around it.”

She goes on to add that being a data-centric company, POPxo knows what appeals to women online. “Launching our private label was a natural extension.”

These platforms, Ujjwal adds, bring in a strong sense of community. Priyanka defines it as – ‘Content-Community-Commerce’, while Suchita says that with commerce, even the content part of the business has scaled up.

“We're able to find and identify great local brands with the help of our users. In enabling commerce, the flow from a user finding out about a great brand they may not have heard of before to actually being able to shop from them becomes effortless,” says Suchita.

The shop segment on Little Black Book

Also read: POPxo raises Rs 37 crore in funding led by Neoplux and OPPO

Ecommerce in a box

Priyanka says POPxo has created its own products and designs based on what the platform thinks its audience will associate with. “The designs are made in-house, while we work on a contract manufacturing model. We identified the right manufacturing partner, and a credible company who could take care of the logistics. In this fast-paced changing trend cycle, the frequency chart needed to be maintained,” she says.

Ujjwal believes the products on offer will depend on the audience the content platform is targeting. “Here, it isn’t about quantity, it is about the type and kind of product,” he says.

Investors certainly believe the model adds value. POPxo has so far raised $12.4 million in funding from Neoplux, GREE Ventures, Kalaari Capital, Chiratae Ventures (previously known as IDG) and a few others. LBB too has raised a total of $3 million in funding from Blume Ventures, Chiratae Ventures and a few others. The Better India, raised $3.5 million from Elevar Equity, the Rise Fund and TPG Growth earlier this year to focus on developing its ecommerce capabilities.

Sajith Pai, Director at Blume Ventures, adds that today, the friction to adding an ecommerce setup doesn’t exist as it once did. “There are platforms like Shopify, payment options, and great logistics partners that make setting up ecommerce easier,” he says, adding,

“These platforms are in no way competing with the larger ecommerce players. The focus is more on niche and curated items. While ecommerce and content are tough businesses in themselves, the commerce becomes easier when it is in-line with your content and you don’t fulfil last-mile delivery.”

The popXO Shop

An online solution for new brands

Content platforms’ ecommerce ventures primarily follow the model of Refinery29 in the US and Little Red Book in China, where the focus is on showcasing niche products. When Refinery29 started in 2005, the New-York based publisher wanted to combine content and retailing. The Little Red Book is a review-based platform that lets consumers buy foreign products and brands.

Interestingly, despite its relative success, news publication Digiday explained the irony of the model - while publishers focus on time spent by a user on a platform, commerce is about getting the user to checkout as fast as possible!

Little Red Book and Refinery29 have been able to crack the middle ground with affiliate marketing,. Refinery29 launched its commerce vertical in 2005, while Little Red Book is widely acknowledged as having set the gold standard for digital strategy in China.

US based Refinery29

Suchita says there is a difference between shopping and buying. One is focussed on need or convenience, and the other on desire. Traditional ecommerce platforms have mainly solved for convenience, but most have not really been able to bring in the ‘fun’ element.

“This, we believe, flows stupendously well into a model that brings together relevant, contextual information, and the ability to make quick choices through on-platform commerce,” says Suchita.

And this makes more sense now than ever. The organised retail market in India is currently pegged at $20 billion, and according to a Deloitte India and Retail Association of India report, the Indian ecommerce market is poised to touch $84 billion by 2021.

In India, ecommerce is dominated by Flipkart and Amazon, and content platforms admit there is no comparison. Amazon and Flipkart are mostly about commoditised, mass-produced and branded products, while these websites offer niche products. In that sense, they compete with other niche product companies such as Happily Unmarried, Qtrove and others.

The target audience is mostly in the age group of 18-40 years, and as Ujjwal explains are mostly urban Indians who are willing to try new and different things.

A way to reach the target audience

“In our worldview, the biggest struggle up and coming brands have is not collecting payments - it's being discovered and finding new customers. Algorithms and search engines have been cued to show us brands and businesses that are 'most popular'. Most popular doesn't mean best suited to you or your taste and preferences,” says Suchita.

She adds that there are over 10 million local businesses and typically commerce platforms skew traffic heavily to the top one percent. “That's what we want to change with LBB.”

“The kind of brands you'll find on LBB are up and coming- they're either established independent retailers, brands specifically known within a city or locality, or brands that are starting out. That we've been able to build highly differentiated supply of 1000+ merchants, and over 15,000 products in four to five months is what's really exciting,” she adds.

POPxo currently retails notebooks, phone covers, laptop sleeves, coffee mugs and cushion covers, among others. The average basket size is Rs 650. Most content commerce platforms have a basket size of Rs 500- Rs 1,000.

It doesn’t always work out, thought. For every Refinery29 and BuzzFeed, there is also a ScoopWhoop. The media platform started with selling notebooks and stationery items but eventually closed it down. Only time can tell how the rest of the players fare in highly lucrative yet highly competitive landscape.