Why investment firm Faad Network believes there is a need for more early-stage funding in India

Launched in 2015, Gurugram-based Faad Network helps early-stage startups raise capital. In a conversation with YourStory, CEO Aditya Arora talks about why startups need more early-stage mentorship and funding guidance, and what the investment firm aims to do by 2020.

Most early-stage startups have one thing on top of their wish list: funding. Most startup founders and entrepreneurs tend to cold call and interact with different investors and investment firms, but often find it really tough to get that first cheque.

It was to change this that Dr Dinesh Singh, and Karan Verma decided to start Faad Network Private Ltd. The firm helps early-stage startups raise capital through its wide network of angel investors, HNIs, VC firms, family offices and debt funding professionals. Aditya Arora soon joined as the company's CEO.

As a mentor of change at Atal Innovation Mission, NITI Aayog, Aditya had interacted with multiple entrepreneurs and industry leaders. His conversations made him realise that startups needed different types of help, including funding.

Dinesh and Karan were colleagues, working with Synergy Environics in the field of mobile radiation chips. They met Aditya at an internship fair. Dinesh has expertise in identifying and capitalising on opportunities to build revenue, pre-openings, turnarounds, and rapid growth in a highly competitive market.

Karan brings his expertise in facilitating angel investments into seed and growth-stage ventures, helping startups validate their business plans, and offering mentoring and handholding.

In a conversation with YourStory, Aditya talks about why they started Faad, how they choose startups, the help they offer entrepreneurs, and the way ahead.

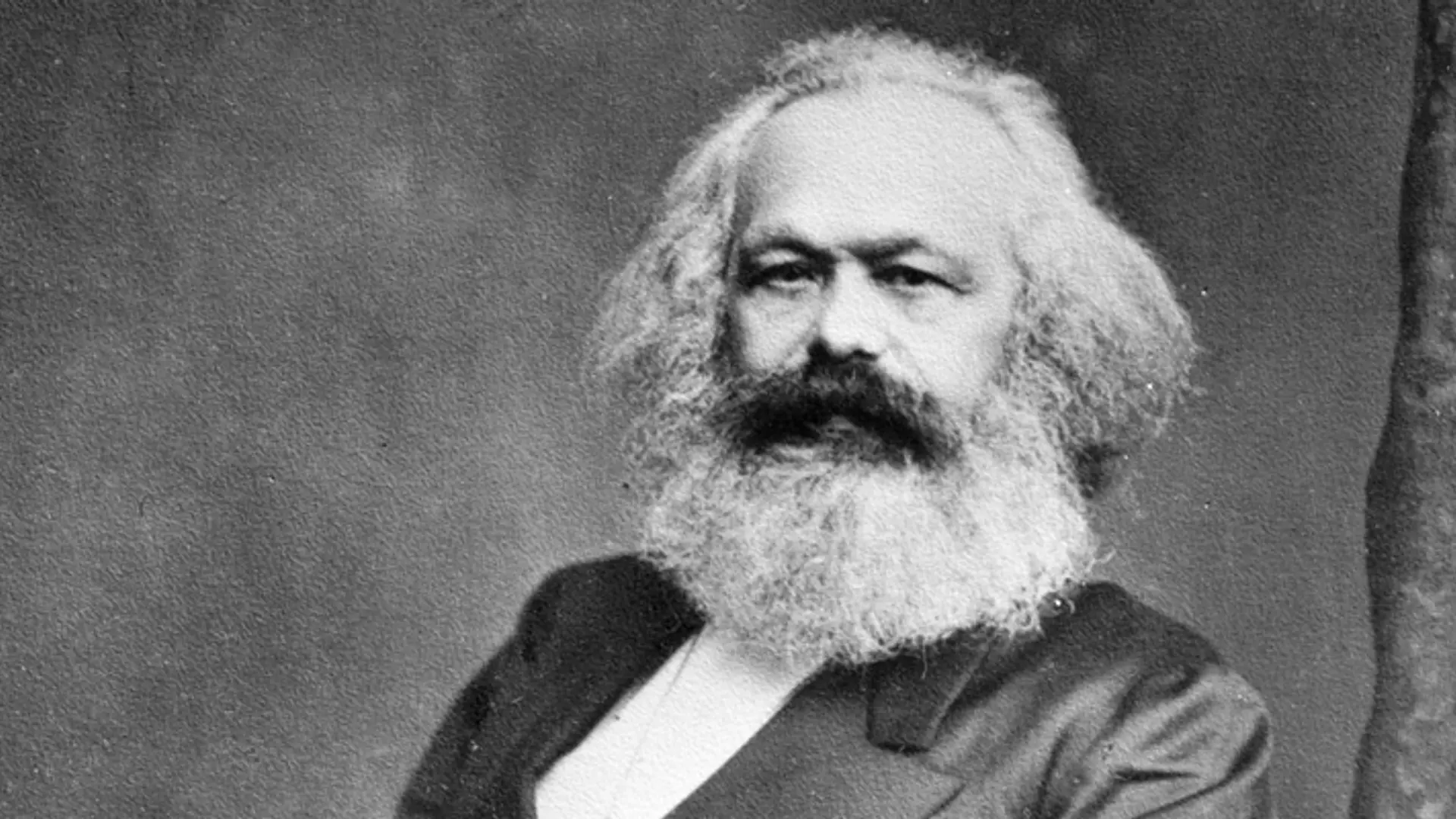

Faad founders Karan, Aditya, and Dinesh started Faad Network to help early-stage startups raise capital

Edited excerpts of the interview:

YourStory: Tell us, what exactly does Faad do?

Aditya Arora: Faad assists early-stage startups in raising capital through a network of angel investors, HNIs, VC firms, family offices, and debt funding professionals. Our approach is fundamentally sector-agnostic, supporting enterprises in the ticket sizes of $50,000 to approximately $1 million.

Our philosophy has always been to add value to businesses in conjunction with maximising monetary returns. Hence, we work with companies and entrepreneurs with clearly defined competitive advantages for long-term growth with mutual synergies and collaborative value.

YS: What are the challenges of building a firm like this?

AA: The initial challenge was that none of our team members had a VC background. Our core management team comprised a doctor, an engineer, and a finance professional. Building the network of investors from the ground up was our biggest challenge. However, we overcame this challenge by meeting people and learning more about the industry. Working in the space and mentorship opportunities also helped.

YS: What companies have you backed and how did you build your investor network?

AA: In two years, we have backed seven companies. Some of our successful deals include budget eyewear brand Cleardekho, coworking space aggregator Stylework, organic DIY brand Nature’s Tattva, and feedback and analytics app Fellafeeds.

We have deployed almost $50,000 million through our network in these companies. We have a network of over 400+ investors across the country at present. We conduct closed-room pitching events, popularly known as “The Faad Pitch”, on a bi-monthly basis and have successfully completed eight such events.

We are adding a couple of more deals through recent pitching sessions. Our key clients include all early-stage firms looking to raise seed/angel capital. We also assist startups aspiring to make the perfect pitch, a sound business plan, or financial projections.

YS: What are the parameters for startups when you make your choice?

AA: We identify companies from multiple sources and conduct a pre-screening session. After this, we sign a working mandate and start working with immediate effect to close the deal for a period of three to six months. We already have some commitments from investors for our future growth, and our plans to expand and reach Tier II and III cities (and help even more entrepreneurs).

YS: Is Faad also going to invest in startups soon?

AA: We are still in the advance discussions of the fund – the category and GP discussions. We will apply for a SEBI registration shortly. Our vision for the fund is that it will give Faad autonomy to directly start investing in startups.

Our selection and curation of startups is our core strength so we want to use this leverage in our existing and new portfolios as well. Also, working with these startups as fund investors would give us more bandwidth to work with founders and help them to raise further rounds and grow their business.

However, the challenges for the fund would be to get the lock-in of the capital done smoothly and quickly by investors we have identified. We have spoken to private angels, HNIs, individual business owners and some first level (friends and family) connections.

YS: What can we expect from Faad in the near future?

AA: Currently, we are in the advanced stages of setting up an early-stage investment fund. We plan to directly invest in our companies through this route and take our portfolio to 20 companies by March 2020.

(Edited by Teja Lele Desai)

![[Startup Bharat] Giving space isn’t enough, startups also need money: Anupam Jalote of iCreate](https://images.yourstory.com/cs/2/3fb20ae0-2dc9-11e9-af58-c17e6cc3d915/feature_image1561441412886.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)