Route Mobile's stock market debut: Founder Rajdip Gupta charts 'transformational' journey to IPO

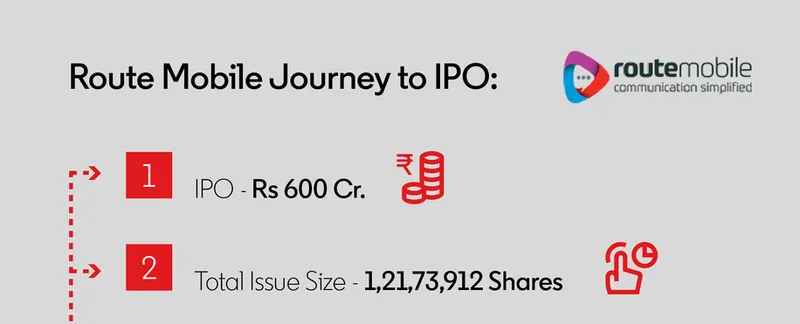

Route Mobile is expected to have a strong debut on the bourses on Monday. The company's Rs. 600-crore IPO was oversubscribed 74 times. Founder and CEO Rajdipkumar Gupta talks about the company's 'transformational journey' to achieving this milestone.

After a relatively muted initial public offering (IPO) market in the first half of 2020, there are signs India’s IPO market will pick up, thanks to a strong revival in stock market activity from the lows it hit in March 2020.

Last week, Bengaluru-based IT company Happiest Minds had a strong debut on the bourses, with its stock closing up more than 120 percent over its IPO price. Now, , a cloud communications service provider, is all set to have a stellar debut as it lists on the bourses today (Monday, September 21).

Route Mobile Founders - Rajdipkumar Gupta and Sandipkumar Gupta

Analysts expect Route Mobile to debut at a significant premium to its issue price of Rs. 350 per share, citing robust investor appetite given the company’s strong growth potential on account of its market leading position in the cloud-communications space.

Route Mobile said its Rs 600-crore public offer, which was priced in the range of Rs 345-350 per share and open for bidding on September 9-11, 2020, was oversubscribed 74 times.

The company received bids for over 89 crore shares as against the total issue size of 1.21 crore shares, according to data available with the NSE. The initial public offer comprises fresh issue of shares worth Rs 240 crore, and an offer for sale (OFS) of Rs 360 crore.

The ‘Route’ to IPO

Founded in 2004 by Rajdipkumar Gupta and Sandip Gupta, Route Mobile offers enterprise clients a cloud communications platform that can be deployed and integrated with existing business applications and systems.

The platform started by offering pure-play SMS and kept upgrading by adding newer features with the aim of helping customers in “simplifying communications”.

Rajdipkumar Gupta, Founder and CEO, Route Mobile

Founder and CEO Rajdip recalls,

“I started it as Route SMS Solution and later, we rebranded it Route Mobile Limited (RML). Since then, the company has grown from a bootstrapped venture with annual revenue of Rs 1.40 lakh to now over Rs 950 crore.”

“Our vision was and still is to connect the world through innovative digital technology, simplify cloud communications to enable enterprises to seamlessly connect, and customise their end-user experience to transform business outcomes,” he explains.

Still, the journey to Route Mobile’s eventual IPO has been “more of a transformational process than just a transactional” one, says Rajdip.

“We took a structured and planned approach for this critical milestone,” he adds.

As a niche player operating in an extremely dynamic, high-growth segment of the telecom-technology space and catering to the digital communication requirements of enterprises, Route Mobile has a limited number of competitors and no publicly listed rivals.

“This requires us to extensively evangelise the market segment that we operate in and pitch our core business model to potential investors,” says Rajdip.

The acceleration in digitisation initiatives by enterprises – driven in large part by the COVID-19 pandemic – created tailwinds for the company, he adds.

In fact, the company’s strong growth amidst the pandemic also helped heighten investor interest, says the founder.

Route Mobile IPO

Growth in the pandemic

According to Rajdip, Route Mobile processed more than 6.95 billion billable transactions through its cloud communications platform in the three months following the nationwide lockdown imposed in late March 2020 to contain the spread of coronavirus. In comparison, the platform managed more than 30.31 billion billable transactions in FY20.

“We have established direct relationships with mobile network operators (MNOs) that provide our clients with global connectivity. As of June 30, 2020, we had direct relationships with over 240 MNOs and four short messaging service centres hosted in various geographies across the globe, with access to more than 800 networks across the world,” says the founder.

So far, in Q1 FY21, Route Mobile has recorded Rs 3,096.14 million in revenue. This compares with revenue of Rs 5,049.48 million in FY18, Rs 8,446.68 million in FY19, and Rs 9,562.52 million in FY20.

To ensure the company continued to grow even during the pandemic, Route Mobile was quick to implement various measures to ensure uninterrupted operations and services amidst the lockdown.

The startup was able to maintain a robust VPN infrastructure, which enabled and equipped a seamless shift to work from home to ensure there was no disruptions to customers.

“We also deployed security systems to safeguard assets and customer data and issued detailed work from home protocols to enable secure usage,” says Rajdip.

He adds that the platform has been designed to handle any increase in traffic, and the servers, which are in Tier-III data centres, maintain excess capacity that can be scaled in real-time as well.

“Our swift and proactive response mitigated the impact of COVID-19 on our business and personnel thus far. With this, we have also accelerated the digital communication initiatives, driving strong growth of our business in Q1 FY2021, and recorded 37 percent growth y-o-y,” Rajdip says.

The way forward

With this IPO, Route Mobile has three clear focus areas:

a. Developing omnichannel digital communication offerings and providing innovative solutions

Route Mobile intends to focus on revenue expansion through cross-selling and up-selling a wider range of services and solutions to existing customers. The R&D team has augmented the CPaaS platform with several new channels of digital communication, which is expected to drive growth.

Rajdip explains that the differentiated offerings will also help initiate business engagement with potential customers who do not currently use their services.

"We have made significant investments in developing our communication services and solutions. These investments have enabled us to expand our product and service offerings to include major mobile communication channels, including messaging, email, OTT, and voice,” he says.

Route Mobile also intends to leverage its existing platform, diverse enterprise client base, and super network to capitalise on the growth opportunity in the cloud communications space, and endeavour to be a one-stop communications solution provider to such enterprise clients and MNOs.

b. Continue to focus on developer community programme

Route Mobile API Developer or RAPID network, an initiative to formally launch the developer community programme, aims to enable developers to leverage the capabilities of the CPaaS platform and seamlessly deploy communication features within their applications/software.

The programme would also help Route Mobile adopt a bi-modal go-to-market strategy. It will primarily focus on agility, enabling developers and their enterprises to experiment with Route Mobile’s APIs, and improve its digital communication solutions.

c. Enhance service offerings through inorganic growth opportunities

The company plans to expand into new markets and address the need for cloud-communications services in new industries.

“We intend to continue our strategic expansion plans through inorganic growth opportunities in new markets, allowing us to complement our existing operations,” adds Rajdip.

So far, Route Mobile has acquired 365squared, Call2Connect, Start Corp, and Cellent Technologies, through which it expanded to Europe, Middle East, Africa, and Asia-Pacific. These acquisitions also helped the startup supplement its product and service offerings to include SMS filtering, analytics, and monetisation.

In June 2020, Route Mobile entered a business transfer agreement to acquire certain technologies and related contracts from a Bengaluru-based company specialising in the development of telecom-related solutions.

What Route Mobile IPO means for startups?

Route Mobile’s oversubscribed IPO indicates good investor confidence in the company and hope for IPO exits for the startup ecosystem, say analysts.

One analyst adds, “Startups still have a long way to go before they can file for an IPO, but the steps that are being taken by several young companies is a positive sign.”

Edited by Saheli Sen Gupta and Kanishk Singh