Startups around the world can help solve the most intractable problems, says author Alex Lazarow

This author-investor shares global insights on the startup movement, emerging business models, and the innovation supply chain.

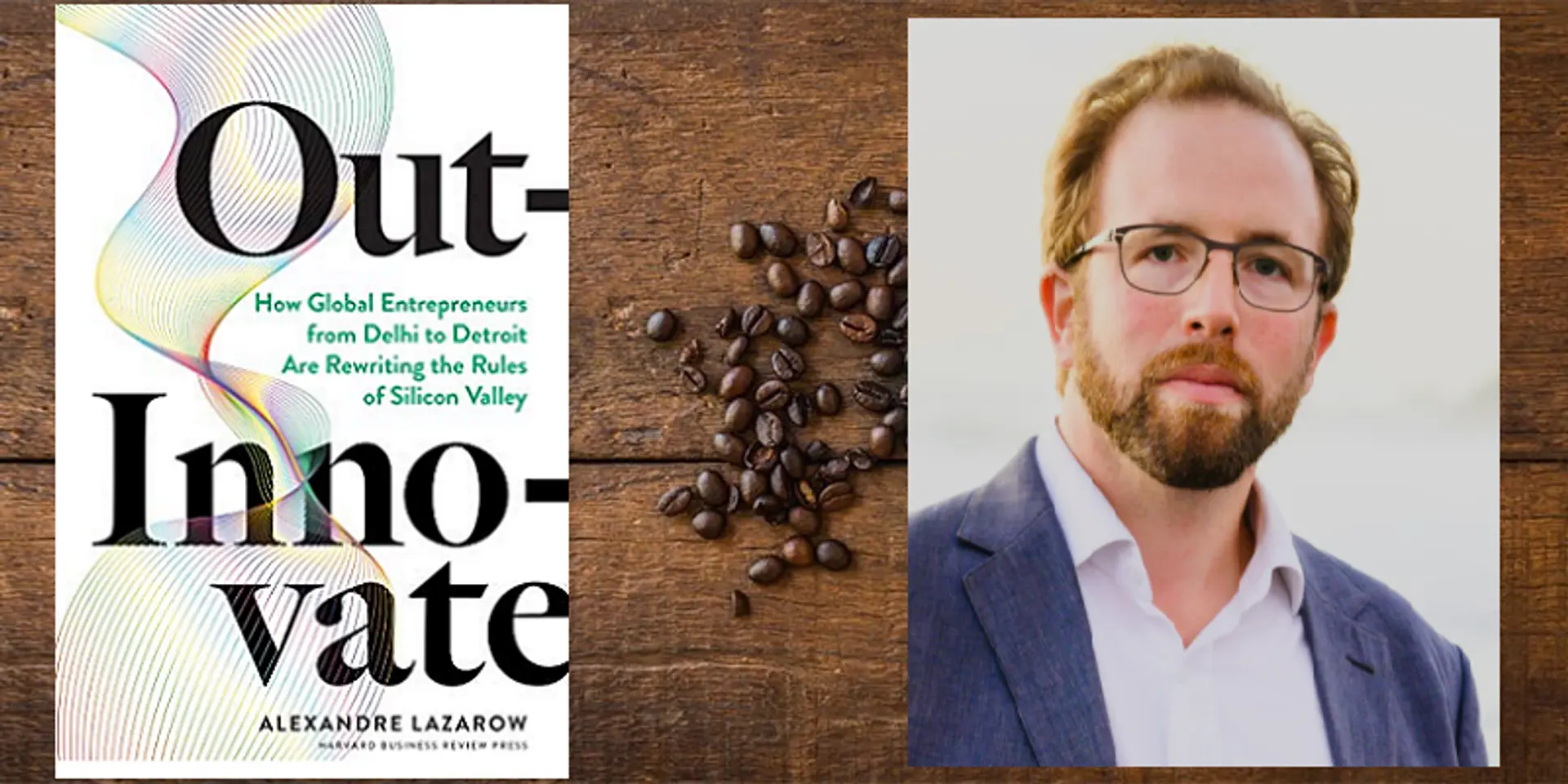

Alexandre Lazarow is the author of Out-Innovate: How Global Entrepreneurs – from Delhi to Detroit – are Rewriting the Rules of Silicon Valley. The global canvas of the book shares fresh insights on startup successes from Asia, Africa, and Latin America (see my book review here). The book is in YourStory’s pick of Top 10 Books of 2020 for Entrepreneurs.

Alexandre (Alex) Lazarow is a venture capitalist with Cathay Innovation and was previously with Omidyar Network, McKinsey, and Bank of Canada. Originally from Canada, he is a Kauffman Fellow and an adjunct professor at the Middlebury Institute of International Studies, Monterey. He is a graduate of Harvard Business School and the University of Manitoba.

See also YourStory’s Book Review section with reviews of over 280 titles on creativity, entrepreneurship, innovation, social enterprise, and digital transformation.

Alex joins YourStory in this chat on pandemic resilience, VC trends, and founder tips.

Edited excerpts from the interview:

YourStory [YS]: How has the COVID-19 pandemic affected the findings of your book?

Alex Lazarow [AL]: COVID-19 has made the lessons in the book more relevant than ever. All of a sudden, entrepreneurs everywhere were looking for role models to manage the crisis.

Silicon Valley has great answers when it comes to building startups in ideal conditions – where capital and people are abundant and the business climate is stable. At the Frontier, the nascent startup ecosystems around the world offer examples on how to thrive in tough conditions. Their lessons now apply to all of us.

YS: What is your current field of research in entrepreneurship and investment?

AL: The rise of innovation around the world, and what it takes to succeed.

YS: How was your book received? What were some of the responses and reactions you got?

AL: In my work as a global venture capitalist and as an adjunct professor in entrepreneurship, I have always been struck by the radical differences between Silicon Valley and the emerging frontier of startup entrepreneurship around the world. This book was a reaction to this challenge and to start a conversation about what it takes to survive, scale and succeed around the world.

Yet, the world changed during COVID. All of a sudden, the whole innovation world was looking for answers on how to manage the crisis, including Silicon Valley.

Unfortunately, Silicon Valley did not have great examples on how to survive challenging macroeconomic environments, or manage a distributed team. Outside, these approaches are common practice.

Entrepreneurs build sustainability and resilience into companies from day one. They choose to build distributed teams to take advantage of talent anywhere, when not available locally.

In short, these global entrepreneurs have lessons for all of us. The lessons of Out-Innovate are now more relevant than ever for everyone.

YS: In the time since your book was published, what are some notable new startups you have come across?

AL: My most recent investment as a venture capitalist is bullseye on the themes in the book: ZenBusiness. It is an Austin-based leading platform for startups to manage their entire business online, including incorporating, setting up a company, managing their billings and finances, creating business documents, and so on (see more details here).

YS: As we come to a New Year, what trends do you see in venture capital investments in emerging economies?

AL: In the book, I explore some green shoots in global venture capital. First, new players are entering the market. This includes corporate investors and impact investors who are building the funding landscape and seeding the market.

Second, funds are becoming global. The startup movement has internationalised, and unsurprisingly, venture capital is too.

Third, new decision approaches are emerging. Notably, quantitative decision making is becoming more important.

Lastly, new products are being tried. Venture capital takes its inspiration from the whaling industry. Other inspirations like the mining industry are giving rise to alternate products like revenue shares (see here for more details).

YS: What are some ways in which startups in different countries can cooperate and collaborate?

AL: Innovation globally follows what I call the innovation supply chain. The best ideas increasingly come from everywhere, and get improved as they scale around the world.

Global startups have an opportunity to better learn from each other and draw inspiration from business models, adapted to their local contexts. This will increase the pace of innovation and business model evolution.

One example I cover in the book is ride sharing around the world. The model emanated in the US with Uber and Lyft. Yet, as it scaled globally, it adapted. In Indonesia, Gojek for instance became the top ridesharing company but leveraged a different model. They built a super-app, leaning on lessons from China. Gojek offers a range of services including food delivery and payments.

And today, these same product lines have influenced the original. Food delivery is one of Uber’s fastest growing segments.

YS: From your journeys across the world, what do you see as India’s innovation strengths and gaps?

AL: India is becoming an innovation powerhouse globally.

What I think is most exciting are the novel business models coming out from India from inspiring founders. For instance, companies like Udaan, a B2B enabler, are inspiring a swathe of other players in emerging markets around the world.

I also am excited about some of the novel startup infrastructure getting built. Notably, India Stack atop the Aadhaar platform promises infrastructure that can inspire altogether new models.

Yet, there are still gaps to fill: growing internet adoption and financial inclusion will help with digital onboarding, for instance.

YS: Looking back at your investments, what have been some surprises and disappointments along the way?

AL: I have found most professional success, but more importantly fulfilment – investing in businesses whose impact was deep and could scale, and supporting founders who are values-aligned. These are the businesses where the opportunity is large and the entrepreneurs’ passion is deepest.

YS: What are three success factors for a healthy relationship between investors and founders?

AL: First and foremost, it is values and mission alignment. I often joke that the average venture relationship is longer than the average American marriage. It is critical investors and entrepreneurs are aligned for the long-term.

Second, trust and transparency are critical on both sides and set the basis of a strong relationship.

Third is incentive alignment. I’m a big believer in structuring investments and relationships with incentives that make sense for everyone.

YS: What is your advice for those out there who want to become angel investors themselves, or start an investment firm/fund?

AL: Just start! Start building relationships with founders and explore ways to support them. Invest small amounts (including through platforms like Angel List).

YS: What is your next book going to be about?

AL: Stay tuned!

YS: What is your parting message to startups and aspiring entrepreneurs in our audience?

AL: There has never been a better time to start a company. There is growing business infrastructure like cloud, so you don’t need your servers, or Shopify to launch ecommerce. Startup culture is globalising and access to capital is democratising.

More importantly, startup innovation has the potential to solve some of the world’s most intractable problems in healthcare, education, and agriculture, among others.

Edited by Megha Reddy

![[Podcast] Alexandre Lazarow on looking beyond Silicon Valley for global innovation](https://images.yourstory.com/cs/2/a09f22505c6411ea9c48a10bad99c62f/Podcast-51-ConvertImage-1592484265209.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)