Here’s what tech startups must keep in mind as they work towards IPOs

IPO markets faltered in Q12020 due to COVID-19. But a recovery in June led to 480 IPOs through the year. As many as 15 startups, including Zomato, Delhivery, Freshworks, and BYJU’s, are readying to debut on the bourses in 2021. Here’s what they need to keep in mind before ringing the bell.

May the odds be ever in your favour!

They seem to be - for India’s startup ecosystem.

If 2020 was the year of unicorns despite COVID-19, 2021 may well go down as the year of tech IPOs.

India is now home to one of the largest and fastest-growing startup ecosystems in the world. Startups in the country have come a long way since 2012, when Inmobi became the country's first unicorn, to 2020, which saw the birth of 11 new unicorns despite businesses being upended by the pandemic.

The coronavirus-led recession also did not adversely affect investor confidence, with $9.9 billion being raised in 2020 as compared to $11.9 billion in 2019.

Despite the many individual success stories, IPOs – seen as a badge of honour for startups - remain a pipe dream for many.

But, change is afoot.

Last year, the SEBI proposed nine changes to its Innovators Growth Platform (IGP) framework. It recommended reducing the “hold period” before listing from two years to one year. A shorter holding period – the amount of time the investment is held by an investor – could attract investors seeking an early listing. . These new rules are likely to encourage more startups to go for IPOs.

Meanwhile, the Companies (Amendment) Act, 2020 empowers the government to allow certain classes of public companies to list classes of securities (as prescribed) in foreign jurisdictions.

Will all these moves give startups the confidence to tap public markets and translate into a flood of IPOs in 2021?

According to a survey conducted by RBI between April and November, 57.7 percent startups plan to go public over five years.

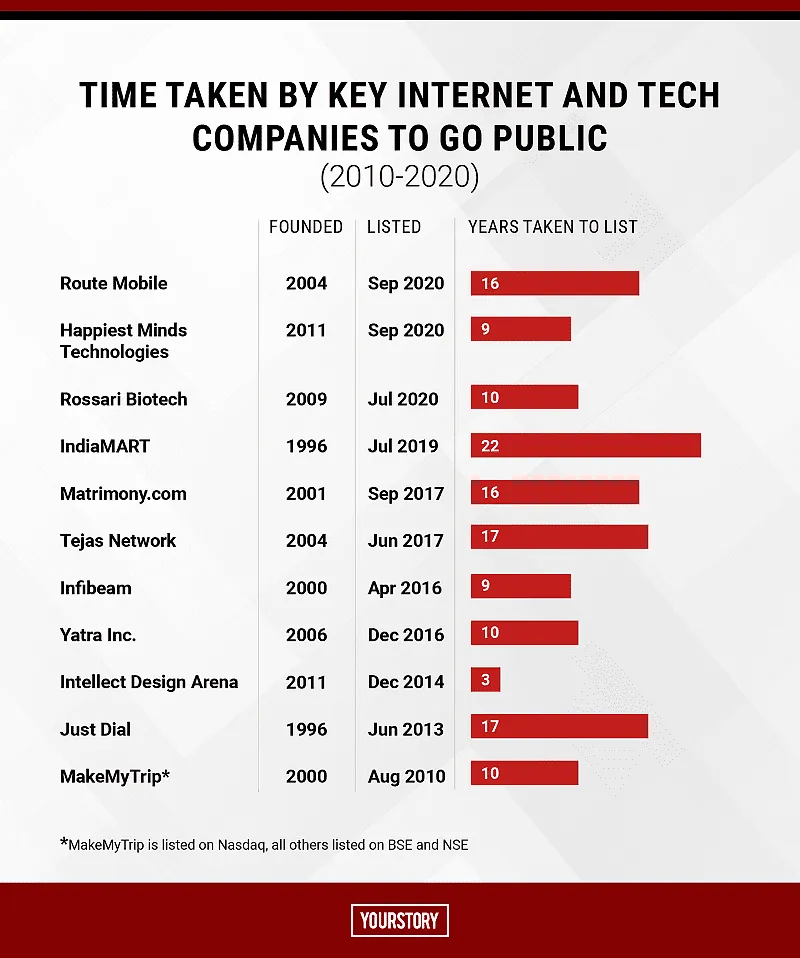

The key tech IPOs in 2020 were the likes of Happiest Mind Technologies and Route Mobile, among others, which saw stellar debuts on the Indian stock exchange. Of the 22 companies that listed in 2020, three were internet and tech firms—up from just one in 2010, when made its market debut.

At least 15 IPOs seem to be in the pipeline in 2021 with the likes of , , , , , , , and waiting to make their debut on the bourses. With benchmark indexes hitting record highs in India of late, and a spate of oversubscriptions last year, startups are hopeful of strong debuts.

YourStory Research shows that the time taken to file an IPO has come down - as compared to earlier, when companies took 20 years, the time to file has now narrowed to just three to five years.

Indian startups take IPO route

Several factors are coming together to take Indian startups on the IPO route.

Industries have matured, after being crushed and then bouncing back in the new normal. The stock markets have also been performing well lately. Budget 2021 created a buzz, with the Sensex surging over 1,500 points on February 1.

The focus on infrastructure and healthcare reforms, and improving ease of doing business in India are other factors which will be key to boosting the IPO market in 2021.

In such a scenario, it becomes imperative to understand how realistic it is to go public in 2021 for Indian companies and to check if they are ready for an IPO. Stakeholders of the Indian startup ecosystem got together to discuss this and more at the Resurgence TiEcon Delhi-NCR recently.

According to them, here are eight things a startup should look out for before going for an IPO.

Ask why you want to go for an IPO

It is really important for the founder(s) to be clear on the purpose behind the IPO. Is it to create liquidity, raise funds, exit, or create value for your investors? Because, for investors, an IPO can be a liquidity event; as a founder, it could be another 20-year journey.

“This is like marriage. You cannot walk away. It will keep biting you all the way till your grandchildren as they will be called promoters of that company,” Dinesh Agarwal, Managing Director, IndiaMART InterMESH said.

On the other hand, Anuj Khanna Sohum, Chairman, MD and CEO, Affle India Ltd, said a IPO was like a parenting journey for a founder. It was about “lifelong value creation” and required a life-long commitment.

Also, if you look holistically, delisting is very hard in India, which does not offer an exit option to a public company. This makes it more feasible to be a part of another public company rather than directly go for listing, said Piyush Gupta, MD, Strategic Development, Sequoia India.

Financial readiness is a must

This is a combination of three factors - revenue scale, growth rate, and profitability (or at least near to profitability). This means closing your quarters or months on a hard close basis without being forced for adjustments.

“Public markets are still old school when it comes to businesses. They should be able to drive profits and cash flows. An IPO is a non-tribunal process, and the Indian ecosystem is still young,” Piyush said.

Preparing for an IPO is tough

Dinesh said getting ready for an IPO is equivalent to false labour pains – a fact that founders must accept. There are many things involved that are not done on a daily basis. Also, India lacks experienced advisors as most domestic VCs still don’t have many companies that have gone public.

“Making a PPT is fine, but writing a 100-page document is different. You don’t want to over-commit something or miss anything,” he added.

Set a realistic timeline

Gearing up for an IPO may take anywhere between nine months and one year. Getting the processes in place, streamlining revenues, setting up the right team, getting KPIs measured, and building consistency in the overall work process need to be taken care of. From there on, it could be as early as six to nine months and as late as three years, depending on document approval, market window, valuation, or the founders’ willingness to go forward.

Focus on building the right culture

Building the organisational culture is crucial for founders if they are aiming for an IPO anytime in the future. The founder must lay the right foundation for the company – a culture that is built to last and encourages sustainable long-term and consistent innovation, and is backed up with values of governance, capital-efficient cash flows, and profitability.

“This is so that it grows into a fantastic corporate citizen when it leaves the comfort of being a private company and enters the real world of the public market. Here, as a company you are exposed to greater accountability and greater governance. It’s a little more unforgiving than when you are a private company,” Anuj said.

Start celebrating the right matrix

Everything boils down to founders’ mindset when it comes to value creation. Is the team focused on a new funding round or product launch, investor meetings or customer success, discounts as a strategy or continuous innovation -- things like these define the inherent culture of the startup.

“If you start celebrating the right matrix, you will build a great organisation that sees an IPO as a very interesting process. When going in for an IPO, the actual day when you ring the bell is the most glamourous part of the event. But the actual preparation, the journey, irrespective of whether you ring the bell or not, is actually deeply value-adding,” Anuj said.

Find good anchor investors

There are investors, great quality global institutional investors, and Indian institutional investors who behave exactly the same way as they would have done in a private round of funding. They would want to meet your customers, see how you work, analyse your business model, and do a deep amount of research on your company.

What founders need to do is find those great quality anchor investors, do the hard work to put their credibility behind their IPO. Then, many others would follow because it's like “a chain reaction of trust”.

Dinesh, of IndiaMART InterMESH, added that there are plenty of public market investors and all are super-smart people. “A 45-minute conversation with them will lead to questions that may irritate you…these will tell you more about your startup than you might have known,” he said.

Decide carefully where to list

As of today, Indian companies are required to list in India first - so this is not really a choice for most companies. But even if there’s freedom, startups would choose to list in their home market because there are benefits to brand building, and paybacks from understanding the local market, regulations, and linearity.

An international listing can give companies with international ambitions access to an international currency, which domestic listing does not. Further, domestic valuations in India are as good as many international markets. It is important how well investors understand your business.

“So, if I am a founder of a software business, and most of my customers are in the US, then a US listing can be more beneficial for me. It is similar to why companies like Infosys and Wipro get listed in the US,” Piyush said.

Anuj, however, said that apart from the financial metrics or market challenges, an emotional element is also attached to the IPO listing.

“There are some moments where you want to come back home. I would call upon all Indian entrepreneurs, no matter what your challenges are, please do consider and come list in India; you will never regret it. It is also your duty to help grow the Indian startup ecosystem…we are talking about Aatmanirbhar Bharat here,” Anuj said.

The speakers were part of keynote sessions and panel discussions during the virtual inaugural event of the Resurgence TiEcon Delhi-NCR conclave held from January 27-30, 2021.

Edited by Teja Lele