Startup funding: Indian startups raise $3.76B in Q1 2021; early and late-stage firms shine

In Q1’21, the Indian startup ecosystem saw a year-on-year increase of over 17 percent in funding deals. Read YourStory Research’s detailed report to find out more about the investment trends, patterns, top sectors, and more.

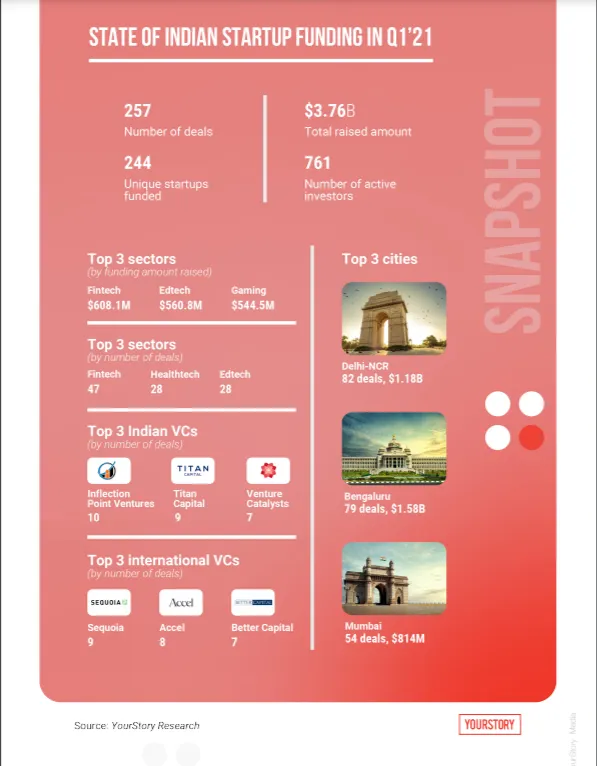

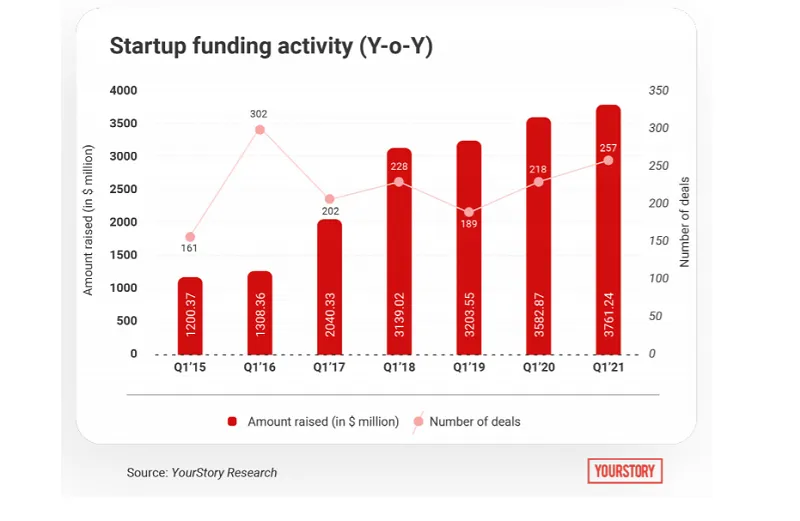

Overall funding activity in the Indian startup ecosystem was positive in the first three months of 2021, with startups raising $3.76 billion in funding across 257 deals, publicly available data analysed by YourStory Research showed.

In the first quarter, the total deal value rose 5 percent to $3.76 billion from $3.5 billion a year earlier, a period that can largely be considered pre-pandemic.

The number of deals in Q1 rose to 257, up about 18 percent from 218 deals in Q1 2020 and up 70 percent on a sequential basis from Q4 2020 levels.

According to YourStory Research, the amount of funding raised and the number of deals seen in Q1 2021 was the highest across the past five consecutive quarters.

Data also shows that early and late-stage deals recorded robust activity, even as the number of growth-stage deals in Q1 fell 10 percent compared to a year ago.

Here’s a look at the five key trends observed in Q1’21

- Rise in number of deals of more than $100 million: In Q1’21, there were 10 deals valued at more than $100 million and amounting to $2.12 billion. In Q1’20, this number was 8.

- Thrissur becomes the newest Tier-II entrant into top 10 charts: In Q1’21, healthtech startup Zaara Biotech, with only one deal of $10 million, secured a place for this Tier-II city in the top 10 cities (by funding value) in Q1’21. Overall, the Tier-I trio — Delhi-NCR, Mumbai, and Bengaluru — continued to lead the charts in terms of the amount raised and number of deals.

- Gaming re-entered top charts: With Dream11’s $400-million funding, Nazara Technologies IPO listing, and MPL expected to enter the unicorn club this year, the gaming segment garnered investor attention, raising $544.52 million across 10 deals.

- The IPO gold rush: In Q1’21, Nazara Technologies made a strong debut on the Indian public markets. It was subscribed four times on the first day as retail investors latched on to India’s first gaming IPO. Several of India’s category-defining unicorns and soonicorns — Flipkart, Zomato, Ola, Delhivery, Policybazaar, Freshworks, Nykaa — are also looking to go public in 2021.

- Edtech sector’s consolidation: In Q1’21, India’s largest edtech startup BYJU’S completed the acquisition of coaching centre chain Aakash Educational Services reportedly for $1 billion. Also, Vedantu acquired Instasolv while Unacademy acquired Tapchief and Handa Ka Funda.

- Unicorn count rising at a fast pace: Three startups entered the unicorn club between January and March 2021. This included Digit Insurance, Innovaccer, and Five Star Finance. Also, moving towards Q2’21, the total has already reached 10, taking the total unicorn count to nearly 50.

Download YourStory Research's report on funding trends in the Indian startup ecosystem in Q1 2021

Edited by Tenzin Pema