YourStory’s H1 2021 Funding Report: Indian startups on track to raise record amount this year

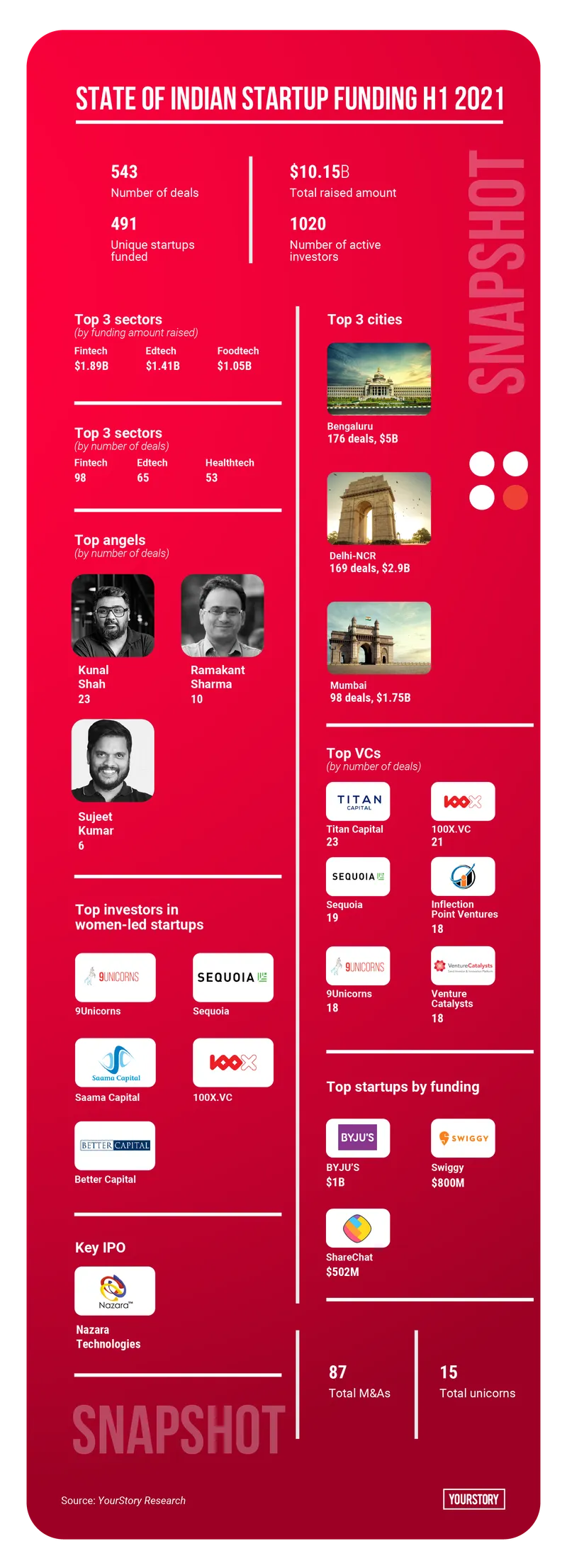

In the first six months of 2021, the Indian startup ecosystem raised $10.1 billion across 543 deals, and added 15 new unicorns. YourStory Research highlights key trends observed in H1 2021.

India may be faced with an uncertain economic environment after being ravaged by a deadly second wave of the COVID-19 pandemic, but that hasn’t deterred global and domestic investors from ramping up the pace and quantum of their investments into the Indian startup ecosystem.

In H1 2021, Indian startup funding touched $10.15 billion, already exceeding the $9.94 billion raised in the whole of last year. This was raised across 543 deals from around 1,020 active investors in the ecosystem.

Download YourStory Research's report on funding trends in the Indian startup ecosystem in H1 2021 here.

Going forward, Indian startup funding is expected to touch record levels this year, with startups likely to raise anywhere between $12 billion and $17 billion funding by the end of 2021, according to YourStory Research.

In the first six months of 2021, 15 startups attained the coveted unicorn status as well while Nazara launched its IPO.

Here are some key trends observed in H1 2021:

- Unique startup count in H1 2021 (491) has already been equivalent to more than 50 percent of total number of unique startups funded in 2020 (746)

- Number of non-outlier deals saw a 32.58 percent increase while the funding amount saw a 48 percent increase in comparison to H1 2020.

- Early-stage startups raised $1.1 billion across 405 deals, growth-stage startups raised $1.9 billion across 55 deals and late-stage startups raised $6.7 billion across 48 deals.

- In terms of amount of funding raised, B2B startups saw a 114 percent growth while B2C startups saw a growth of 107 percent in comparison to H1 2020

- Tier-I startups raised $9.8 billion funding across 493 deals, while Tier-II startups gained $64 million across 32 deals.

- Bengaluru startups secured $5 billion funding in H1 2021 across 171 deals, followed by Delhi-NCR ($2.8 billion across 164 deals), and Mumbai ($1.7 billion across 97 deals).

- Tier-II cities that received the most investor attention were Indore and Thiruvananthapuram

- Fintech and financial services sector topped the charts, raising $1.89 billion across 98 deals. This was followed by edtech ($1.42 billion across 65 deals), foodtech ($1.05 billion across 2 deals), ecommerce ($879 million across 38 deals) and healthtech ($700 million across 53 deals)

The report offers an in-depth view of the state of funding activity and key trends in the Indian startup ecosystem in January-June H1 2021, a comparison across H1 2015- H1 2021, and an outlook of what 2021 has in store for us in months ahead.

It also depicts the current landscape of active investors in India, Tier-I and Tier-II inclination, sectoral landscape, business model-wise distribution, sectoral landscape, and more.

Download YourStory Research's report on funding trends in the Indian startup ecosystem in H1 2021 here.

** Note: All figures based on publically disclosed deals.

Edited by Saheli Sen Gupta