[App Friday] Former Paytm Money CEO Pravin Jadhav’s Dhan is focused on long-term investors, traders

With live tracking of nine indexes, watchlists, and live historical data provided for most asset classes, Dhan is an app any new and existing trader could use.

The COVID-19 pandemic has been harrowing for many businesses across India. But the volatile stock market has been firing on all cylinders. After the initial slump, many bored at-home investors realised the market potential and started investing in the equity market.

This opened up a whole new gamut of first-time retail investors, which many startups are trying to capture. Investment platforms like , , and not just saw more people signing up, but their valuations also soared.

While bootstrapped fintech startup Zerodha attained the unicorn status in 2020, Bengaluru-based Groww raised $83 million in its Series D round led by Tiger Global early this year at a valuation of $1 billion, and joined India’s burgeoning unicorn club.

Dhan, an investment app, is also targeting a similar consumer base. Launched by former CEO Pravin Jadhav, the app is a platform for trading and investing in the stock market. Run by Jadhav’s Raise Financial, Dhan’s focus is on long-term investors and traders.

Rolled out in September this year, the app currently has over a thousand downloads, according to data available on the Google Play Store.

How does the app work?

Dhan is available for early access on the Google Play Store and the iOS app store. Once you download the app, you can log in with your mobile number or email id and you will have to set a six-digit passcode, verify your email address, and place a request for early access.

YourStory got access to the app almost immediately.

Once you log in, you will be asked to upload a copy of your PAN card to proceed with KYC (know your customer) procedure.

Dhan's KYC process has many steps but it is quick and efficient

After this, the app asks you to take a real-time selfie, upload an in-person verification video with an assigned KYC pin, do a digital signature, and fill a declaration form. This form is to ascertain your income levels, your profession, and trading experience. The app also asks for your bank account details and send Rs 1 to check if the account works.

All this process does not take more than 15 minutes, and only the verification process might take a bit longer.

The app has a super-fast KYC and onboarding process, and it also supports trading across all exchanges such as equity, exchange traded funds (ETFs), and derivatives (futures and options) across equities, commodities, and currencies.

There is also a one-time account opening fee of Rs 295 if you wish to start trading on Dhan.

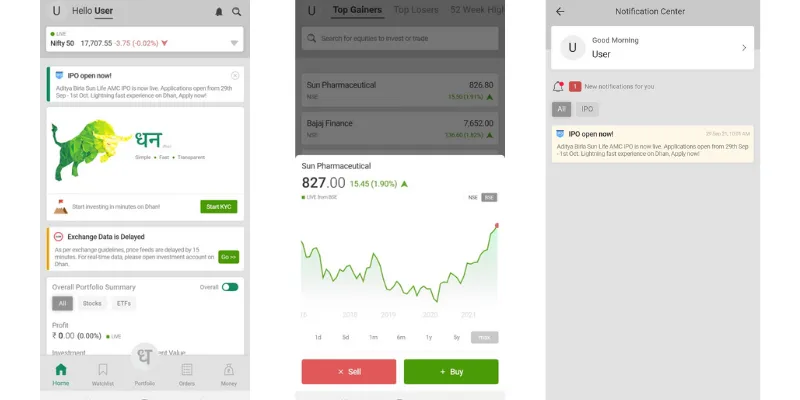

Once the account is open and your details are verified, you can start investing. The app has a green-and-white themed home page, where you can access your profile in the top-left corner. The notification bell on the right-hand corner gives you updates about your investment portfolios and also application timelines for any company’s initial public offerings (IPO).

You can use the magnifying glass icon, beside the bell icon, to search for any equity, ETFs, or currencies. There is also a bar just below these icons, which shows the spike and fall in Nifty 50, S&P BSE Sensex, Nifty, and S&P BSE’s mid and small cap, among other indexes.

Below the index bar, the app has added another bar showing information about IPO companies’ opening applications.

As you scroll down a bit, another bar shows a portfolio summary of your investments. How much profit you might be making on your investment, the current value of the total investment, and so on.

The app seems quite friendly for new retail investors. Below the portfolio summary bar there is a section, which has titles including equities, ETFs, futures, and currency. When a user clicks on these titles, in this case equities, for instance, a list pops up showing all the equities listed on the NSE (National Stock Exchange). The list is further classified into top gainers, top losers, 52-week high and low, by volume, and by value.

The app's layout encompasses most things a trader would need

If users click on one of these equities, they even get historical data to assess how the stock has performed over the last five years. According to Dhan, the data comes live from the NSE and BSE (Bombay Stock Exchange). The case is similar with other asset classes listed on this tab.

Users can also create a watchlist by clicking on the tab with the same name on the bottom-most bar. This list can be created by going through different stocks classified under auto, large caps, financial services, bank, and tech and IT.

Verdict

Overall, Dhan seems like an app focused on the trader and the new retail investor community. It is like a financial terminal in your phone.

The app could serve as a good starting platform for new investors, as they can analyse the market well without having to go through multiple other websites.

The graphs, which shows historical data sourced from the BSE and NSE, gives great insight to make any kind of investment decision. Users can also use the list curation feature to keep an eye on the market for some time before investing their money.

With this kind of intensive data, the investor community will not shy away from using the Dhan app.

YourStory’s flagship startup-tech and leadership conference will return virtually for its 13th edition on October 25-30, 2021. Sign up for updates on TechSparks or to express your interest in partnerships and speaker opportunities here.

For more on TechSparks 2021, click here.

Edited by Megha Reddy

![[App Friday] Former Paytm Money CEO Pravin Jadhav’s Dhan is focused on long-term investors, traders](https://images.yourstory.com/cs/2/d72b5ef09db411ebb4167b901dac470c/Image17ow-1633006314614.jpg?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)