Could 2021 turn out to be the year of the startup IPOs?

There are still four more months before we bid adieu to 2021, but the year has earned the tag of the second-best year ever for IPOs with a record raise of Rs 60,588 crore. And, the party is far from over.

It began with and . Soon, , , , , , and PB Fintech (which runs Policybazaar) joined the queue to file their draft red herring prospectus (DRHP) – the last step in the direction of tapping the primary market with their initial public offerings (IPOs).

The IPO market is so hot right now that the monetary authority has taken note, saying in its latest bulletin that "year 2021 could well turn out to be the year of IPOs for the country".

More and more Indian startups are filing for an IPO, and their timing seems just right - from the standpoint of the investment climate and investor sentiments in India.

The enthusiasm of IPO bidders is apparent - many IPOs have been oversubscribed, some getting subscribed over 100 times the offer. The words ‘loss-making’ are no more a deterrent for primary market aspirants as showcased by serial loss-making foodtech unicorn Zomato, which debuted on the bourses with a market capitalisation of Rs 1 lakh crore (and counting upwards).

And, the year 2021 seems on track to repeat 2017 - the best IPO year ever when Rs 67,147 crore were raised over 12 months through 36 issues.

The eight months of 2021 have seen the same number of issues, but a total of Rs 60,588 crore was raised until August. But with a number of IPO aspirants from the burgeoning startup universe joining the queue, experts believe that the total number may top the 100-mark in 2021.

The IPO rush

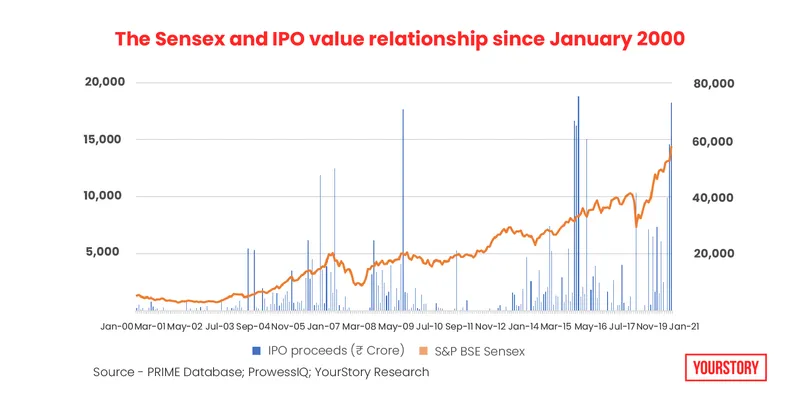

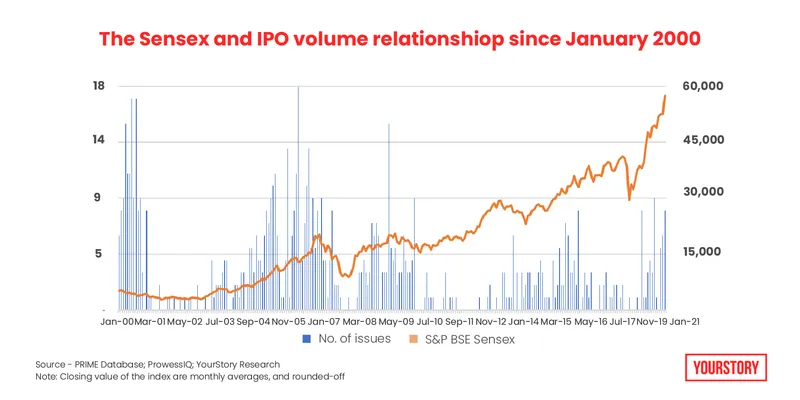

According to YourStory’s analysis of the S&P BSE Sensex and IPO issuances since January 2000, 2021 is not just following in the footsteps of 2017; it’s also tracing the path taken by 2007 and 2010.

In 2007, annual IPO proceeds worth Rs 34,179 crore were raised across 100 issues, which were 72 percent higher than the previous year’s Rs 19,852 crore raised through 73 issues.

In 2010, now the third best IPO year, Rs 37,535 crore were mopped up through 64 issues - a growth of 92 percent compared to Rs 19,544 crore raised from 20 issues in 2009.

In 2017, the Rs 67,147 crore raised was an increase of 153.4 percent compared to Rs 26,494 crore raised from 26 issues in 2016.

And in 2021, until August end, the Rs 60,588 crore mop-up is 127.7 percent higher than 2020's Rs 26,613 crore across 15 issues.

A few sceptics term 2020 – the year COVID-19 hit the world – as an exceptional year, but the fact is that the first wave severely hit the primary (IPO) market as much as the secondary market.

At the peak of the first wave, the S&P BSE Sensex had corrected over 39 percent in a matter of just 46 trading days – from 42,274 points on January 20, 2020, to 25,638.9 points on March 24, 2020.

The IPO market was inactive half the year, with no fundraise during January, February, April, May, June, and August. When activity picked up in September, 59.3 percent of the entire year’s proceeds were raised in the four months until December.

In 2021 too, the second wave’s reflection on the IPO market was visible – there was no activity during the month of May.

However, August saw maximum action with eight issues garnering Rs 18,242 crore – just Rs 582 crore short of overtaking November 2017 as the best IPO month ever when Rs 18,824 crore were raised from three issues.

Following a pattern

A close look at the monthly scorecard of IPOs, along with the monthly average closing of the S&P BSE Sensex, also helps to establish a unique 2017-like pattern in 2021.

Compared to the Sensex’s monthly average closing value of 26,626 points in December 2016, the 30-stock index had gained 19.2 percent on an absolute basis at 31,730 points in August 2017.

In 2021, at 57,522 points in August-end, the Sensex has gained by an absolute 20.5 percent compared to 47,751 points at the end of December last year.

Also, at the end of 2017, the Sensex had recorded an absolute increase of 23.1 percent compared to 7.1 percent absolute growth at the end of 2016.

In 2021, while the eight-month absolute increase in Sensex is 20.5 percent, the same for all of 2020 stood at 17.3 percent. When compared to March 2020, the absolute increase in December last year was 62 percent.

When seen from the lens of crisis, the global financial meltdown caused a major erosion in investment sentiments and the index. During that period, the IPO market was at a complete standstill; the bounce-back in the markets was quickly reflected in the increase in IPO proceeds and their numbers.

At the newest life-high of the Sensex on September 6, at 58,515.85 points, the recovery of 128.2 percent recovery from the March 2020 COVID-low is reflection of the bullish sentiments, which will aid the IPO market in times to come.

Looking at all this data, one thing is clear: abhi toh IPO party shuru hui hai!

YourStory’s flagship startup-tech and leadership conference will return virtually for its 13th edition on October 25-30, 2021. Sign up for updates on TechSparks or to express your interest in partnerships and speaker opportunities here.

For more on TechSparks 2021, click here.

Applications are now open for Tech30 2021, a list of 30 most promising tech startups from India. Apply or nominate an early-stage startup to become a Tech30 2021 startup here.

Edited by Teja Lele