How EarlySalary built a moat and hit Rs 160 crore in disbursals in a single month during the pandemic

EarlySalary, a Pune-based fintech startup, has disbursed over Rs 4,750 crore over the past four years. A combination of new product lines and changes in consumer behaviour post the pandemic has now created a perfect storm for the company.

In 2016, Akshay Mehrotra and Ashish Goyal, went on a meeting marathon, interacting with over 100 working professionals across IT parks, coffee shops, and cafeterias. They wanted to test a thesis they had personally faced — month-ends are usually a period of financial stress for people, even for employees with steady jobs and income.

Those meetings led to the birth of . Today, the consumer lending platform has significantly evolved and grown to reach over Rs 230 crore in monthly disbursals and over Rs 4,750 crore in cumulative disbursals. The startup has over 500,000 active customers.

New product lines, a change in consumer behaviour post the pandemic as well as larger changes in India’s financial ecosystem have fueled the Pune-based company’s growth over the past few months.

EarlySalary offers low-cost travel and shopping EMIs to customers.

In fact, EarlySalary added 100,000 new customers between January and August this year.

Also in August 2021, EarlySalary saw its highest disbursal of over Rs 160 crore in a month. Its new business line of Buy Now Pay Later (BNPL) clocked over Rs 25 crore, and the number of personal loans processed in a month hit above 5,000.

“Pre pandemic we were clocking close to Rs 20 crores of the monthly volume. We have built a balance sheet of let's say around 250 crores,” adds Akshay.

When the pandemic hit, traditional lenders were impacted by the RBI mandate on the moratorium.

However, while other lenders had close to 80 percent of its consumers opting for the moratorium, small-ticket platforms such as EarlySalary had 13 percent of its customers opting for the breather.

According to Akshay, EarlySalary focussed on quality customers from day 1, which helped the startup see fewer users opting for the relief by RBI.

The consumer base

“Most traditional lenders focussed on the quarters to end, and were focussed on just recovery and couldn’t add new customers. For us, in Q3 and Q4 we were able to incubate new channels and also realised that the customer was ready for new products. We were able to grow our topline and become PAC positive, at a holding company level,” says Akshay.

He explains this was also possible with a focus on building different product lines, which has helped open revenue lines.

The addition of the BNPL option for upskilling companies such as UpGrad and Scaler has also helped EarlySalary onboard new customers.

Using the BNPL scheme, customers can buy a skill program either at an upfront cost or pay for program with EMI that is powered by EarlySalary. This channel is hitting over Rs 10 crore in a month, the company claims.

“After edtech we opened up healthcare and insurance on EMI. There are over 5000 transactions that we are clocking in that segment,” says Akshay.

Differentiated offerings

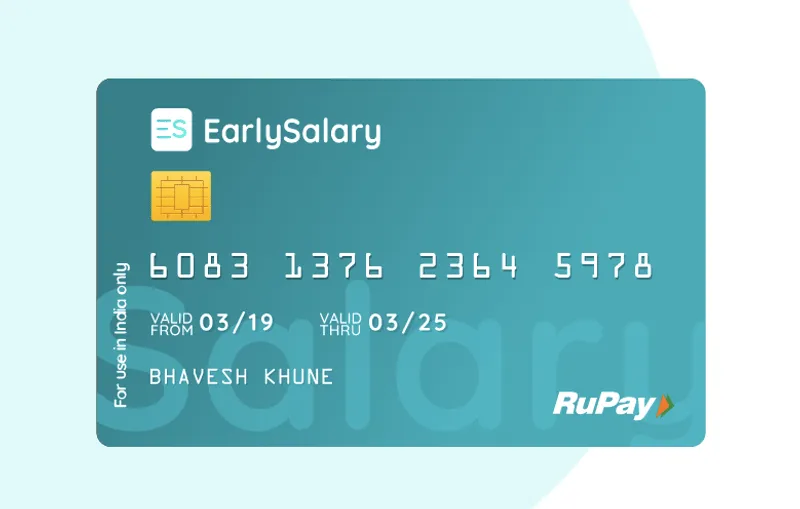

The team also launched a new card in October 2020 in partnership with the National Payments Corporation of India (NPCI). The product was launched in August 2021. Akshay says this builds out a combined effort. The first effort is offering customers credit to purchase a product, say a credit card. The card offered by NPCL then offers a 30-day interest-free credit period.

The card also gives automatic EMI options at different retailers. He explains within the first two weeks, the team had disbursed over 2000 cards.

The team is targeting an AUM (assets under management) of Rs 1,000 crore by March 2022. This means close to Rs 2,500 crore of disbursal this year.

“But this isn’t going to be easy. The market isn’t so kind. We cannot do everything on our balance sheet, so this means we have to introduce a multi-lender. We have both on our platform. When we are lending short term money, we do so from our NBFC, but if the customer is good, and if we want to expend the tenure of the loan, my NBFC’s cost of capital cannot justify it. This is where the bank comes into play,” says Akshay.

But the customer still gets a cheaper product. Akshay adds that this acts as a strong ramp up. The team does over Rs 80 crore off the balance sheet.

The changed consumer

In October 2020, the startup also raised $10 million in Series C funding. Product diversification was one of the reasons why Fidelity-backed investment company Eight Roads Ventures bet on the team.

Speaking about the investment, Shweta Bhatia, Partner, Eight Roads Ventures says, “We never invested in them as a payday lender. We saw that there is a massive segment of consumers in India who are new to credit, these are undiscovered and underserved. And EarlySalary gives them a tailored product offering and line. This gives different ticket sizes for different kinds of consumers.”

Akshay attributes their BNPL product’s popularity to the changing consumer behaviour.

“In a pre-pandemic world, a consumer earning Rs 60,000 a month wouldn’t hesitate to buy a phone of Rs 20,000 in a single payment, now the world is different. They are looking to extend their cash flows,” explains Akshay.

While banks currently want to cater to the high pedigree customers, there is a huge vacuum for solutions tailored for people earning in the Rs 25,000 to Rs 60,000 bracket.

The idea is to build a tech play using the MLS systems to process the risks faster. Akshay says that the team is looking at it more as an embedded finance system and not just a neobank.

“We are already putting a widget that allows you to let us do the transactions. Our technology and lending entity powers everything. That gives us the more power and responsibility of the entire process,” adds Akshay.

Segment and future

The COVID-19 pandemic has severely hit the consumer lending space. Challenges in the segment include issues with regard to lending rates, coercive methods in recovering loans, and non-consensual use of data.

In 2020, the Reserve Bank of India (RBI) issued notifications to Non-Banking Finance Corporations (NBFCs) and Banks mandating additional disclosures/compliances, and an advisory to borrowers warning them against fraud platforms.

The Digital Lenders Association of India (DLAI) has also issued guidelines, with a regulatory pipeline on this front as well. Players like EarlySalary continue to thrive due to compliance with RBI guidelines. Other startups in the segment include PayMe India and CashE.

Speaking of the differentiation, Shweta added the company has been looking at retaining customers from a first principles tech angle. Also, the management has a background in the space in finance and risk management.

In the near future, EarlySalary plans to focus on two areas: “Can we create an ecosystem that is similar to a bank? If we are moderately successful we have a large deposit taking NBFC that has a leverage to lend on a co-lending system. Another thing is can we do a million credit transactions a month, and can we achieve that in three years? That is our single point vision we are working towards.”

Edited by Affirunisa Kankudti

![[Product Roadmap] How EarlySalary tapped tech to grow loan disbursals to Rs 2,850 Cr in 4 years](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/akshay-mehotra-1607408988816.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)