Here’s what founders need to keep in mind while launching a US startup from India

At a masterclass at TechSparks 2021, Stefan Nagey, Co-founder and CTO, Capbase, answered specific questions on how to incorporate in Delaware from India, raise funds in the US, hiring legalities, and much more.

“Find people who you trust and [who are] potential investors. Tell them you would like to talk about your idea and get their feedback on it. People are much more interested in talking about their experiences, professional journey, and give advice, than they are in thinking whether or not to give this person money,” said Stefan Nagey, Co-founder and CTO, , at a virtual masterclass, ‘How to launch a US startup from India’ at TechSparks 2021, Asia's largest and most influential startup-tech conference hosted by YourStory.

Why do Indian startups choose to incorporate in Delaware?

“Delaware has very known and well tested laws with the government. Delaware Corporations laws have been running for a long time… they’ve given you almost every scenario that you could run into as a founder or investor… so [there’s always] a clean and easy way to handle disputes,” said Stefan while listing reasons that investors, both in the US and internationally, strongly prefer investing in Delaware corporations.

“Without a Delaware C Corporation, you won’t get US investors,” he added.

Incorporate in Delaware, from India

Stefan shared quick steps to follow that included hiring a registered agent in Delaware so that Delaware knows where to find you, filing for corporation online, getting an employer identification number (EIN), and opening a US bank account.

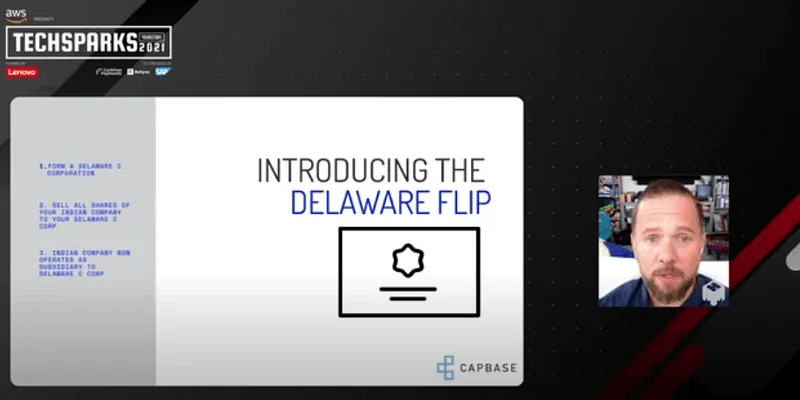

He also explained the process to follow in case a founder had already incorporated their company in India and wanted to form a US corporation.

Stefan spoke about ‘Delaware flip’ wherein a founder is required to form a new US company and make that US company buy their Indian company. The Indian company continues to operate as a subsidiary of the US company, but the US company can be the main financial entity. This company can take investments, pay people in the US, accept money in US dollars, etc.

Different ways to raise money

Explaining the definition and difference between preferred shares and participation shares, Stefan mentioned, “Currently, most deals in the US when you are selling preferred stock would be at a 1X non-participating multiple.”

Talking about the complexities of selling preferred shares, Stefan outlined the “big five documents” outlined by National Venture Capital Association, which include updated charter, investor rights agreement, voting rights agreement, management letter/agreement, and ROFR and co-sale agreement.

In addition to preferred and participating stocks, Stefan also explained processes such as convertible notes, valuation caps, and conversion discounts, and simple agreement for future equity (SAFE).

Hiring employees

“If you are hiring in the US, you have to worry about payroll taxes, does that payroll cause you to have a business nexus in that state? If yes, then do you need to file your corporation as a foreign corporation,” said Stefan while explaining the hiring process.

Additionally, Stefan also explained that the company would need to withhold taxes that employees owe to the US government. The company will also need to withhold 7.2 percent employer portion of social security tax.

“You’ll also need a confidential information and invention assignment agreement that says all the ideas that an employee develops while they are being paid by the company and using company equipment, belong to the company. This is how your startup is building its value in the early days via IP.”

Going the Capbase way to avoid complexities

“We help founders from the moment of formation, we help founders if they are already further along in their corporate journey, if they’ve incorporated in some other country… we can help them incorporate in Delaware, get them set up with their first cap table, get them to set up to issue equity and do business in the US, etc.,” said Stefan while explaining his platform, Capbase.

“Our job at Capbase is to take care of all the legal, compliance, and financial aspects of work so that you [an entrepreneur] can focus on just building your company,” Stefan said.

To log in to our virtual events platform and experience TechSparks 2021 with thousands of other startup-tech enthusiasts from around the world, join here. Don't forget to tag #TechSparks2021 when you share your experience, learnings and favourite moments from TechSparks 2021.

For a line-up of all the action-packed sessions at YourStory's flagship startup-tech conference, check out TechSparks 2021 website.

Edited by Teja Lele