[Year in Review 2021] Quick commerce fix: How India got hooked to grocery on the go

The quick commerce model is here to stay and will drive investments in the logistics sector servicing the need for dark stores, last mile delivery.

How long does it take to buy a packet of instant noodles and make it? If all conditions are favourable, probably a total of 12 minutes thanks to promises of 10-minute grocery delivery — a new high for consumers in India.

After COVID-19 lockdowns hit the supply chain in 2020 and people struggled to buy essentials on a regular basis, many switched to buying groceries and perishables online. Subsequently, 2021 saw online grocery and fresh produce delivery companies ramp up the ‘convenience factor’ with promises of 10-minute deliveries to keep consumers hooked.

Food delivery company , which rolled out grocery and essentials delivery service Instamart in August 2020, said that it was looking to invest $700 million in growing the business that serves 18 cities. The service, which currently delivers groceries in 30-45 minutes, is targeting 15-minute deliveries by early 2022.

Another incumbent in the space is Bengaluru-headquartered , which rolled out 19 minute delivery for consumables earlier this year, backed by capital from Google Ventures and Lightstone, and others who participated in the company’s Series E round in February 2021.

Grofers recently rebranded itself to Blinkit with capital from and announced that it will be shutting down all locations that it did not service within 10 minutes. The latest entrant in the quick commerce space, Zepto, managed to raise $160 million within six months of inception, doubling its valuation to $570 million within two months.

These developments clearly indicate that quick commerce is here to stay and continues to attract investor attention. But who really needs groceries in 10 minutes?

“Does the customer really need something in under 15 minutes? Not really. But should the need arise, it is available. Quick commerce delivers customer delight and this expectation will move on from groceries to other online purchases,” Pranay Jain, Director at Avendus Capital, tells YourStory.

The trend also follows global tailwinds, which has seen the success of New York-headquartered instant grocery delivery app JOKR and IPO-bound delivery startup GoPuff.

Doing things differently

The current quick commerce boom feels like a deja-vu of the 2015-16 cycle when Blinkit’s former avatar , ride-hailing app , and ecommerce giant , among others, tested out the less than two-hour grocery delivery model only to wind them up later. The time and the unit economics were too difficult to sustain.

However, the current cycle is different from the previous one as the players are looking to build a network of dark stores or hyperlocal fulfilment centres that make for better unit economics. This is due to better utilisation of space, low rentals, differentiated SKUs (stock-keeping units), and faster picking and packing compared to a store-front or buying from kirana stores directly.

“There are three parts to the delivery chain – Farmer Collection Centers, Dark Store Network, and Last-Mile Delivery. We control the process and technology across all three parts for better customer experience. We prioritise one touch delivery, which assures customers that the produce is as fresh as it can get and hasn’t gone through multiple hands,” says Atul Kumar, CEO and Co-founder at Fraazo, a green grocery player competing with a host of quick commerce players.

“For the fresh category, customer experience and product quality depend on the overall treatment of the produce and time taken from farm to fork. Only offering last-mile quick delivery doesn’t necessarily improve customer experience with online grocery shopping,” he adds.

Some of the larger players in the space, including Instamart, Dunzo, and Zepto started with the marketplace model of delivering products by purchasing them through the kirana stores. “This helped the players early on to understand where the customer density was, which SKUs to stock and to understand the market,” says Pranay of Avendus Capital.

However, better predictability has pushed these players to switch to the hyperlocal fulfilment centre or dark store model, where a single large warehouse in the city services multiple small dark stores which service orders from the locality.

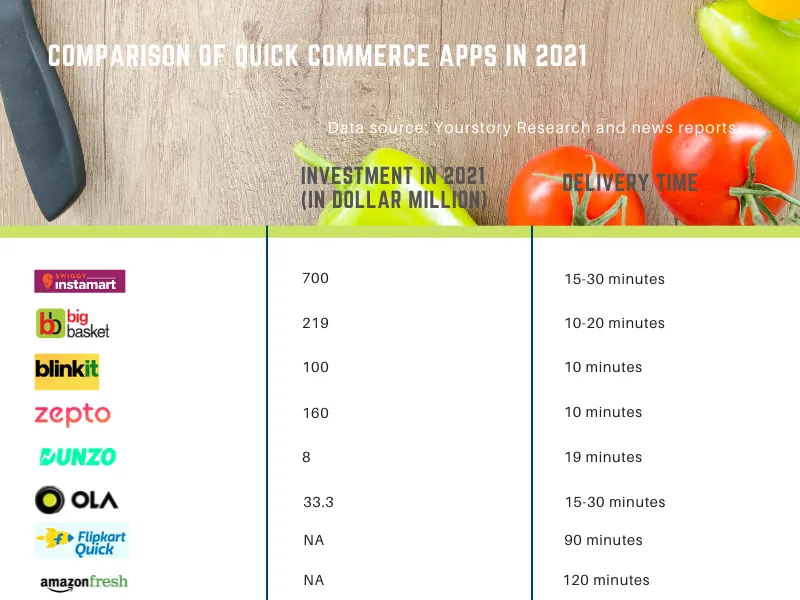

Comparison of Quick Commerce apps in India

Building the network

Owning, planning, and operating multiple fulfilment centres is a capex heavy proposition and one which can slow down expansion for a lot of players as they look to capture more cities.

From owning dark stores or partnering with local kiranas that would serve as a captive store for picking orders and delivering them, quick commerce companies are looking at seasoned logistics players to build out capabilities in warehousing, dark stores, and last-mile delivery play.

“Multiple players in the space started out with the model of building their own network in partnership with merchants who will bring in the real estate. However, storing inventory is a risk, and picking and delivery takes time. The model is moving towards a blend of company-run and third party managed dark stores,” Rahul Dogar, Co-founder and Director - Strategy and Business Development at Holisol Logistics, tells YourStory.

has built a network of over 100 dark stores for the quick commerce players it works with. The time taken for the company to set up an operational dark store is a week, as compared to three to four weeks taken by the companies themselves.

The model has also seen private equity backed end-to-end logistics solutions provider getting into the business. The company has been setting up city-level large warehouses, as well as smaller, hyperlocal warehouses to service the segment.

“Third-party players help quick commerce companies launch new cities faster. The potential for the sector is huge as the online players serve only one percent of the market,” says S Lakshmanan, Vice President and Head of Fulfilment Services at Ecom Express.

Spill-over to other sectors

The convenience factor is now spilling over from grocery to other sectors such as ecommerce and direct-to-consumer and FMCG brands.

With its new round of capital from Zomato, Lightrock, and Temasek, ecommerce enablement company plans to scale its network of warehouses to target same-day delivery for its partner brands.

“Our main categories are beauty, personal care, home interior, electronics, fashion, footwear, costume jewellery, and others. When you promise a three to six hour delivery for brands in the space, the chances of customers ordering it go up significantly,” Saahil Goel, CEO and Co-founder of Shiprocket, tells YourStory.

He adds that for these categories, customer expectation for same-day delivery is being pushed by the quick commerce model for groceries. Shiprocket has been growing its network of master warehouses or city-level warehouses to store select SKUs from partner brands for faster deliveries and has been piloting hyperlocal fulfilment centres for brands from the first quarter of FY 2021-22.

Abhishek Bansal, Co-founder and CEO of business-to-business last mile delivery company , says that the company processed nearly 60 percent orders in the food and grocery segment, while the remaining 40 percent orders came from ecommerce. Shadowfax has sharpened its focus on last-mile delivery after closing down other lines of business including less-than-truckload (LTL) delivery, big box warehousing, and cloud kitchen services over the last 18 months.

“Our focus is now on serving the 30 minute delivery space as it is only going to grow, driven by demand for grocery and pharma. We are looking at delivery partners as our customers and our strategy is to provide them with an app for work,” says Abhishek.

The moment of truth

Quick commerce is a space to watch out for logistics and online grocery players but the expectations are likely to settle in at a sweet spot of 30 minute or so. Industry players believe that the 10-minute model will see rationalisation over time.

“Anything that can be delivered in 30 minutes will fall into the lap of the logistics players and they will be ready to execute. Some of them will also look at creating micro-apps within the app where brands can sell directly to the consumer,” observes Pranay of Avendus Capital.

With the funding frenzy in the quick commerce space, the trickle-down to logistics players and adjacencies will be a space to watch in the year ahead.

Edited by Saheli Sen Gupta

![[Year in Review 2021] Quick commerce fix: How India got hooked to grocery on the go](https://images.yourstory.com/cs/2/a09f22505c6411ea9c48a10bad99c62f/Image710m-1640525645603.jpg?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)

![[Year in Review 2021] Despite stellar Nykaa IPO, most women entrepreneurs were asked one question: business or hobby?](https://images.yourstory.com/cs/4/211ccaf00e6d11e997fe8f165dce9bb1/WomenEntrepreneurship2021-03-1640259996436.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)