How this startup is enabling Indian MSMEs to ship directly to consumers halfway across the world

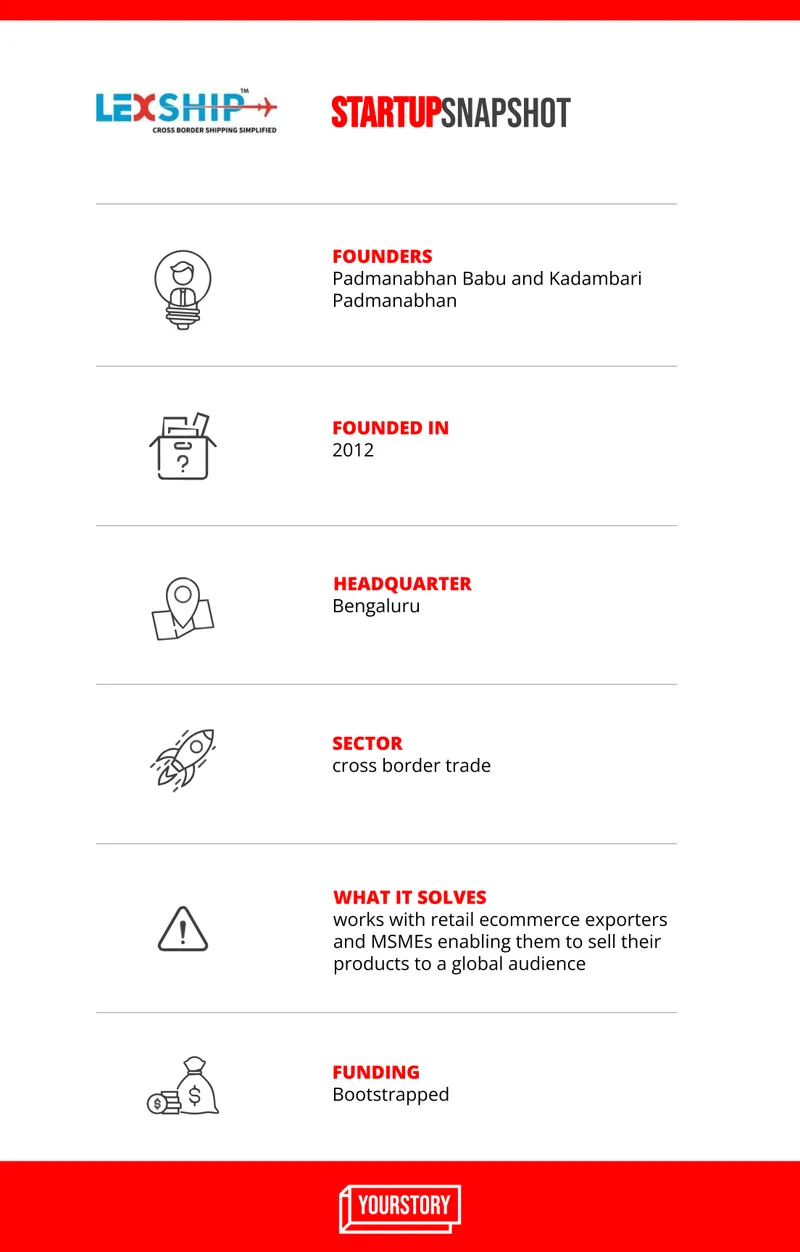

Launched in 2019, logistics startup LogiLink India’s LEXSHIP platform works with exporters and MSME’s to sell their products to a global audience by digitising and bringing transparency to the supply chain ecosystem.

India is home to more than 63 million micro, small and medium enterprises (MSMEs) across the country. They contribute nearly 40 percent to India’s overall exports, which is close to 6.11 percent of the country’s manufacturing GDP and 24.63 percent of the GDP from the services sector, according to the Government of India.

However, many of these MSMEs can’t directly sell to the customers and resort to taking the business-to-business (B2B) route, leading to mounting paperwork, delays in delivery, and opacity in conducting business.

This is where Bengaluru-based startup LogiLink India stepped in to bridge the gap and provide a viable solution to MSMEs through its Made in India brand .

The startup works with retail ecommerce exporters and MSMEs, enabling them to sell their products to a global audience.

How it started?

Founded in 2012 by husband-wife duo Padmanabhan Babu and Kadambari Padmanabhan, LogiLink India was a consulting company helping large companies build and run logistic solutions.

Padmanabhan, CEO of LogiLink India, has been working in the logistics sector for a little over a decade, and Kadambari, Director of the company, is a chartered accountant. In 2018, they were joined by Ravi Manhass, who is the Business Head - Sales and Marketing and has previously been a part of DHL Express and Bluedart, along with Bhuvnesh Raisinghani, who is Head Of Operations and previously worked with Genpact.

From 2014 to 2017, the team started exploring the transaction space, signing up with SMBs and managing their supply chains. In this phase, the company was clocking a revenue close to Rs 1 million monthly.

“In 2017, we started working with retail ecommerce because we saw that it was a fast-growing business and had a lot of scope. Retail exporters came into the fray and people were selling directly to customers, so we thought there's a large opportunity here,” LogiLink India Founder and CEO, Padmanabhan Babu tells YourStory.

The problem statement

“For a retail ecommerce exporter, there are no viable solutions available in the market,” says Padmanabhan, explaining that the existing service providers are all built for B2B and not business-to-consumer (B2C) operations. Every service provider – the marketplace, payment service providers, and logistic service providers – were working in silos.

However, with the world economy and businesses methods evolving globally, the team realised it is not about multi-echelon supply chain networks but rather selling directly to customers.

They also realised that the biggest problems in huge paperwork, working capital getting stuck, and lack of transparency.

“The buyer and the seller did not know each other, so the market was very grey. We wanted to streamline the entire process,” Padmanabhan adds.

Giving an example, he explains that if an exporter had to sign up to send shipments to an international buyer, the average lead time would be anywhere between 15 to 20 days before the shipping account got approved. Then they would have to file papers for customs clearance. Multinational companies would also ask for a large amount as deposit from a shipper in India.

“So we changed that; we targeted that within 24 hours, you will be online and your KYC will be digital. You can make digital payments, you can pay only for what you ship, and will have no blockage of working capital. All the documents and the statutory compliances that are associated with international ships are all managed through our software,” says Padmanbhan.

What the startup does?

The startup primarily focuses on digitising the entire shipping ecosystem and bringing transparency, accountability, and efficiency in the supply chain ecosystem that is filled with regulations and paperwork.

Its customer base comprises close to 4,000 exporters and MSMEs, with close to 25 percent of them being women entrepreneurs. They are spread across India, with close to 60 percent of them hailing from Tier-II and III cities.

Launched in November 2019 – just a few months before the onset of the pandemic, LEXSHIP claims to have transported goods to over 19,000 pin codes across India and delivered close to nearly every country across the globe. They are the major logistic partners of eBay and Amazon users around the country.

While it raked in Rs 20,000 in revenue in November 2019, a year later, in September 2020, it recorded huge revenue growth, clocking Rs 25 lakh as 600 merchants had started using the service.

USP and competition

Some of the other startups in the space include international firms such as DHL Ecommerce and FedEx.

Unlike them, the startup maintains an asset-light model and deals in the B2C segment. It provides for end-to-end delivery service and ensures pick-up and drop by partnering with delivery partners in other countries.

Unlike other shipping companies such as FedEx, the startup differentiates with its price factor and no deposit. It charges in the range of $6-7 per shipment weighing 100-150 grams.

“Now, people all over the world want to buy goods from different countries, which can be cheaper, or unique. This paradigm shifts in the way the business is being done cannot be serviced based on a certain set that was built for a different business model,” Padmanabhan explains, adding that products of specific geographical importance such as handicraft, health products, beauty products, jewellery, etc., are seeing a rising demand.

“We have gone on to create a market that we are supporting because there are three things that need to flow in tandem - information, finance and physical products. This is where we find the information, break the data flow, be compliant, bring transparency, and make shipping economical,” he adds.

Challenges and raising capital

The biggest challenge the team faced was the lack of awareness even in a growing segment.

“We largely see investors making strategies according to the concept that ‘what sells in West, sells in the East’. Explaining the market to a potential investor is a challenge because it’s new and growing, and probably in three years, it will be fancy to be in the modern ecommerce space,” he shares.

The company initially operated in a very frugal manner using personal equity. The team consists of 15 members, with three of them working in technology.

“Every time we invested our money into the business, it showed our belief in the business. We went from Rs 20,000 business revenue in 2019 to Rs 1 crore in December 2021,” says Padmanabhan.

Because they were building a platform that had a limited profile, the founders decided not to raise capital early on. They decided not to use capital on acquiring customers and instead, their go-to-market (GTM) strategy was to “work for the marketplaces, offer real solutions, and solve real problems”.

A startup in this sector is measured in terms of sellers added per exporter, shipment volumes, and revenue per consignment. It has carried goods worth over $10 million in the last two years, moving 100-150 shipments per day.

The startup is looking to raise capital in 2022, which would be used to expand its technology team and their product. It also has a plan to expand geographies to South Asia, Europe, and the US.

While the startup plans to replicate its model in South Asia, in the US and Europe, it plans to set up a warehousing facility and more.

Cross-border trade market

One of the stimulating drivers in enabling an economic recovery is cross-border trade.

PayPal’s Cross Border Trade (CBT) 2021 Report values India’s total export market at $526 billion. Of this, close to 60 percent are goods which represents a market worth $313 billion for India’s local artisans of tribal products, handicrafts or small exporters of gems and jewellery, and with nearly $213 billion (40 percent) of exports in services.

The advantage that the small business stands to gain from leveraging the global B2C demand is catering to a large audience as the adoption of online shopping has shown a new market for purchasing custom-made goods from anywhere in the world.

Edited by Kanishk Singh