[Techie Tuesday] From being a part of Windows 95 launch to building the first global BNPL product, meet ZestMoney’s Ashish Anantharaman

In this week’s Techie Tuesday, we feature Ashish Anantharaman, Co-founder and CTO of ZestMoney. With over 22 years of experience, Ashish is responsible for the technical growth and evolution of the Buy Now and Pay Later (BNPL) platform.

Ashish Anantharaman isn’t your quintessential techie from any of the IITs or even BITS Pilani. In fact, Ashish’s least favourite subject in school was mathematics.

And yet, Ashish, an engineer from Mumbai University, is today the co-founder and CTO of one of the fastest growing fintech startups, . With over 22 years of experience, Ashish firmly believes that, to grow as a techie, it is very important to keep evolving oneself.

Born in Mumbai, schooling was a tough period for Ashish as his father, who ran a business that wasn’t doing too well, had to give it up to work in a small company later.

“Academically, I was average, but then I had some passion towards computers. This was around 1991,” says Ashish. At the time, computers were just making their presence felt in India.

“Every time I would walk by computer institutes, I would be fascinated with those machines with large screens and keyboards. For me, it was a big thing as I hadn’t even seen a calculator,” adds Ashish, who was 16 then.

For Ashish, computers were about people sitting in an AC room and working away with a strong sense of purpose. “Before heading to school, I would stand near a tree outside the computer institute and simply observe everything around me,” recollects Ashish.

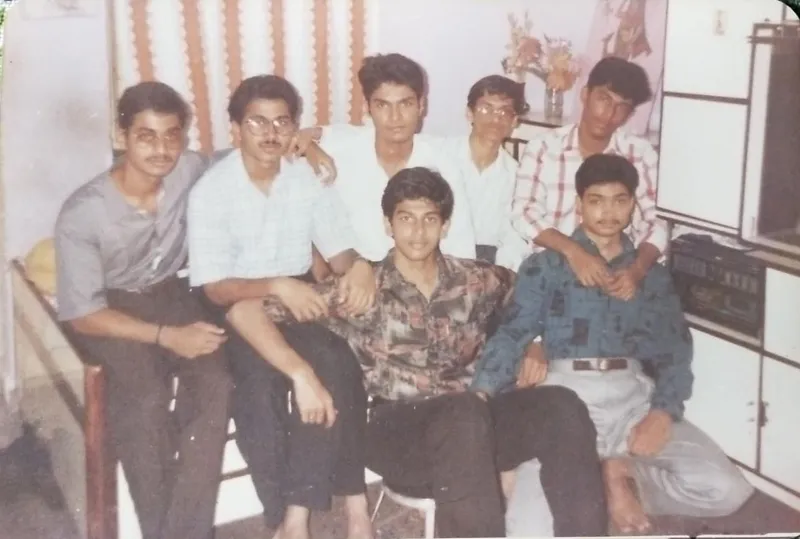

Ashish during his high school days

Knack for computers

Incidentally, someone from the institute noticed Ashish doing this every single day for a few months and invited him into the academy. Ashish was then given a quick introduction to computers. Talking about the early days, Ashish says,

“It was the first time I had touched a computer. But much to my own surprise and others at the institute, I was able to write a program within 45 minutes. I understood most things about software and hardware, I asked questions and everyone explained how it worked, and that’s how I just came up with the first program. It was about the Fibonacci series.”

While Ashish was asked to join the institute, he couldn’t afford to pay the tuition. However, the institute spoke to his father, and decided to give Ashish computer training free for the first month.

“I then managed to secure a student loan. Thinking back, I cannot say how I secured that loan, but secure it I did. And from there, I started my journey into computer science, and along with it, my confidence also grew. I was an average student, and here I was doing something that I seemed to be naturally good at,” adds Ashish.

This also led him to take up engineering from Mumbai University in 1993. Until 1996, Ashish also taught at the same institute where he learnt computers. He started by teaching computer languages FoxPro and DBS, while his first coding language was COBOL.

“For every small piece of instruction, I would write about 800 to 900 lines of code, which was condensed to 10 lines,” says Ashish. However, writing those programs in COBOL solidified his logic, which helped him when he moved to C++ programming.

Ashish during college days

Front row seat to Windows 95 and the internet

As he was good with programming, after finishing his engineering in 1995, Ashish secured his first job at Microsoft. It was the time Windows 95 was being built.

“Towards the end of Windows 95 launch, I was a part of the team that was into developing the operating system (OS). It was a great learning curve for me. It was the first time I was getting my hands dirty and building something from an operating system level of programming. It was a building block for everything I did later,” says Ashish.

In 1997, during the internet boom period, Ashish decided to join KPMG. Here, Ashish went on to build websites, shopping carts, proxy servers, and email servers.

“I built everything around the internet, and this gave me a strong overview of how the internet works,” adds Ashish. Knowing that there is more to learn and know in the new technology areas, Ashish decided to join Veritas, a data management company in 1999.

Veritas was then affiliated with a company in the Middle East and here, he learnt about data management, warehousing, storage, retrieval, backups etc. “This gave me an idea of how databases work and everything related to scale. Anything I built after that I owe it to those early days and the time I spent with the experts,” adds Ashish.

Underwriting and sports

In 2000, when Ashish got an opportunity to work with Swiss Re Group in the UK, he also moved to the country. Reinsurance company Swiss Re were building underwriting platforms for insurance companies in the US and Europe.

Ashish spent close to three years with them, and while slow paced, the work was technology intensive and helped him learn all about architecture. It was during this time that Ashish decided to go back to one of his older loves - sports. In 2007, Ashish joined Sportingbet, a UK-based company that was into online sports betting. Ashish went on to build different types of engines- betting engines, casino engines, and poker engines, that are still being used to this day.

“As I had internet related knowledge, I was able to build the first of its kind in sports betting. I worked on newer concepts like play betting and live streaming betting for sports that were not televised. This was quite fascinating, as I had a natural mix of sports, creativity, and technology,” says Ashish.

The world of fintech

While Ashish had assumed he would spend most of his days and time only in the world of online sports, he entered the world of fintech when he was headhunted by Wonga. It was one of the most successful fintech companies in the world in 2013. It was here that he had the first exposure to Buy Now Pay Later (BNPL). As the Head of Software Development, Ashish was to build Wonga’s BNPL product.

“I built and deployed the product in five countries in Europe. I also went on to lead the SME lending product at UK, Everline, and the payday loan product of Wonga. I had touched upon the consumer and SME lending side. I had built everything from scratch and deployed it across regions,” says Ashish.

It was during this time that Ashish worked with Lizzie Chapman and Priya Sharma, his co-founders at ZestMoney.

“Lizzie and Priya were already in India building Wonga out of India. But they had decided to do something of their own, and that is how ZestMoney was born,” says Ashish.

Ashish during the Wonga Days

Building ZestMoney

Having built a BNPL product in 2012, Ashish understood the impact such a product could have in a market like India. “I saw how lives were being upgraded. And it was something I felt I could make a difference in,” adds Ashish. He also wanted to come back to India and give back to the community and the country. In 2014, when the trio had decided to start ZestMoney, India was going through a digital revolution.

“When we started ZestMoney in 2015, BNPL was already prevalent in the market with players like Bajaj Finserv, but they were offline. We were bringing the concept of BNPL online. While a big opportunity, it also was a big challenge - being a new concept,” explains Ashish.

“People were just getting started and were getting used to a digital mode of payment. And the uptake towards the digital journey had started with QR code payments slowly starting to come in. Also, what we brought to the table didn't exist, so that meant we had to make way for an education and learning curve. We had to introduce the concept and even educate the consumer,” says Ashish.

Today, ZestMoney is available at the checkout of leading merchants like Myntra, Nykaa, Amazon, Flipkart, Myntra, MakeMyTrip, Yatra, and Nykaa. They are also present at physical stores like Apple, Reliance Digital, Chroma, Sangeetha Mobiles across the country.

The fintech company has a registered base of over 13 million customers, and is available at the checkout of 10,000 online and 75,000 physical stores across the country. The company has several offers including a ‘Pay in 3’ no cost option for all purchases on the platform.

Today while hiring, Ashish looks for a good software engineer. He goes on to explain how a developer and software engineer play different roles - while a developer is given a set of instructions and works based on that, a software engineer just needs a problem statement. “They look at different options and technologies and come back with a solution and work on it, until it fits completely,” adds Ashish.

Advice for techies

On what he looks for in techies, he points to strong foundations in software development, holistic thinking, a technology-agnostic approach and good problem solving skills.

“And you get all of this only when you spend hours on end building products, writing code and building software,” says Ashish. The idea is to find the person who is patient enough to find the right solution.

Advising techies he says, “Be prepared to work hard and hone the right skills. Do not have an affinity to just one technology, come out of your comfort zone to look at new technologies and experiment with different solutions.”

He also advises techies to never stop evolving, saying it is important to learn new trades and new skills. “The fundamental part of any technologist is to remain relevant with technology.” He says while it is important to want to grow up the corporate ladder, it is also important that the basic thing and core job is to be able to write code.

“Having spent over 20 years as a technologist, I still code in my free time and spend two hours a week learning new things. Many people want to move into management within two or five years, which is fine, but that doesn't mean you stop learning and coding. Never stop coding. If you chase excellence, rewards will follow,” signs off Ashish.

Edited by Anju Narayanan

![[Techie Tuesday] From being a part of Windows 95 launch to building the first global BNPL product, meet ZestMoney’s Ashish Anantharaman](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/TTAshishAnantharaman-1641817578030.jpeg?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)

![[Techie Tuesday] From working on oil fields to building an AI startup that was acquired by a Valley unicorn: Deepti Yenireddy’s journey](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/TT-1621247423240.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Techie Tuesday] Zynga co-founder and startup investor Justin Waldron's game plan with PlayCo](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/Techie-Tuesday-1615827917111.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Techie Tuesday] Meet Saiman Shetty, who went from a small town near Udupi to building powertrain systems at Tesla](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/TechietuesdaySaimanShetty-01-1613389288802.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)