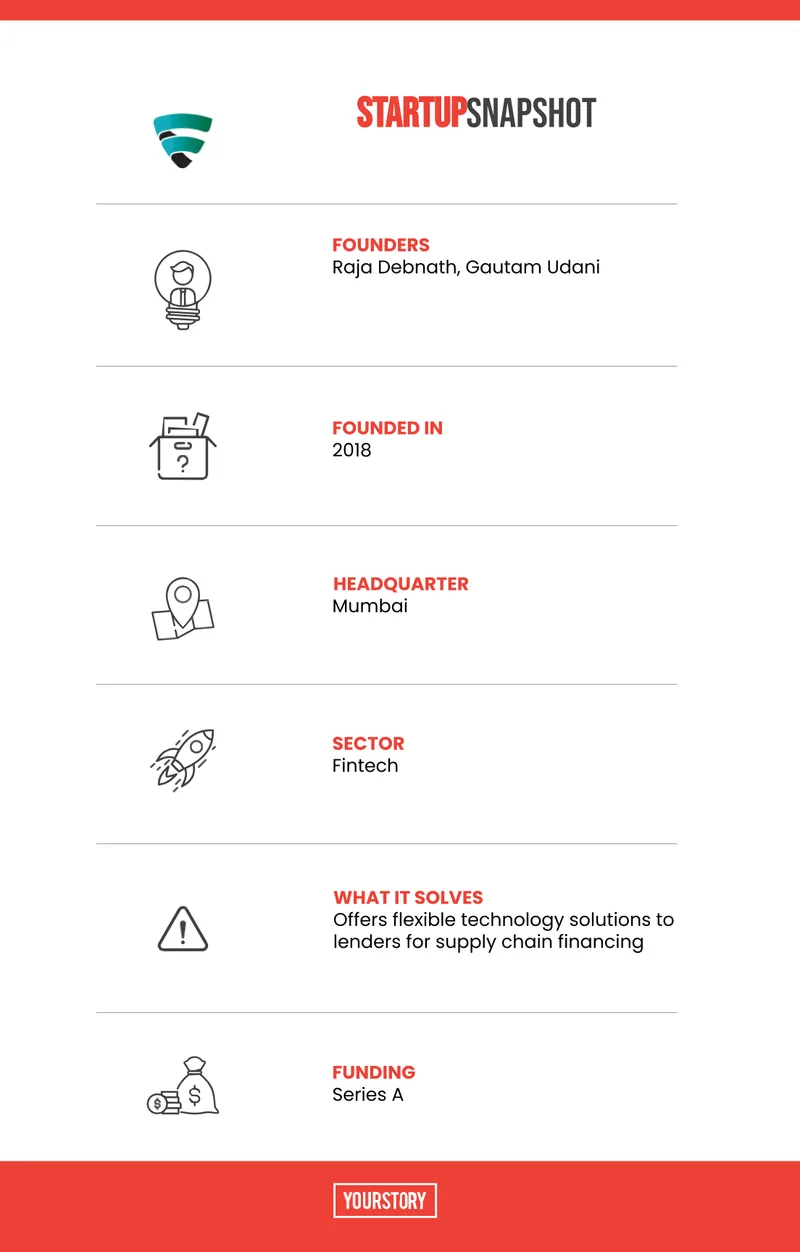

How this supply chain financing platform is helping banks finance SMEs

Mumbai-based Veefin, founded in 2018, is offering flexible technology solutions to lenders, with its end-to-end stack including onboarding, underwriting, loan origination, transaction and transaction management for SMEs.

While working with International Finance Corporation (IFC), a World Bank Group organisation, Raja Debnath noticed a gap in the supply chain financing platforms available in the market.

In supply chain financing, a third party facilitates an exchange by financing the supplier on the customer's behalf.

For Raja, who previously worked as the Global SME Banking Advisory Services Specialist of Asia at IFC, his work involved advising banks on supply chain financing as a part of IFC’s vision to encourage private sector development in less developed countries in Asia.

In the process, he realised that the available platforms did not provide end-to-end solutions for digital lending, and either had very few tech vendors with the products not in line or the ones that existed were very expensive.

Motivated to look for new solutions in the same space, in 2018, he started working with Gautam Udani to create enterprise technology solutions for lenders offering supply chain financing. This led to the launch of Veefin.

Interestingly, Gautam Udani had founded , formerly known as Infini Systems, in 2010. Until 2018, the company specialised in digital transformation with data processing offerings.

It was in 2018, that he pivoted when he saw an opportunity in solving supply chain financing technology problems. Raja Debnath joined him as co-founder in 2019.

Led by Gautam, in 2018, Veefin’s team started to work on technology suites that it offers today for the banking, financial services and insurance (BFSI) industry.

Raja, who joined Veefin in 2019, started heading product and business development for the Mumbai-based company.

Veefin’s offerings

Veefin's main target customers are lenders including banks and non-banking financial companies (NBFCs).

With the onset of the COVID-19 pandemic, the last couple of years saw the spotlight firmly on the problems that small and medium enterprises (SMEs) face due to the unorganised nature of the sector. Financing is one area where they encounter challenges, and while a lot of fintech platforms in the country are addressing this need directly through their SME-focussed solutions, Veefin aims to help solve this problem through financing.

Banks and other financial institutions, due to lack of availability of data, find it riskier to approve loans for SMEs as compared to large corporations.

According to Raja, this risk profile comes down with SMEs that deal in supply chain with large corporations, and this has brought a lot more banks into the gamut of supply chain financing over the last few years.

This, in turn, compelled lenders to be equipped with better technology platforms that have multiple offerings rather than just one or two functions.

Veefin’s offerings - a wider range of products with end-to-end stack including onboarding, underwriting, loan origination, transaction and transaction management modules with all the necessary integrations for eKYC and authentication, promises to address this.

According to Raja, the platform is flexible with omni-channel boarding and enables financial institutions to design and change workflows and processes as per their unique requirements. “We would like to offer our platform to banks and lenders of all sizes,” Raja says, adding, “We offer modules depending on our client requirements and the market they serve in.”

Veefin’s software works for both on-premise and cloud-based models. With the use of data and analytics, the company also allows smart credit decisioning, which promises faster implementation than traditional technology platforms.

On pricing, which it has adopted keeping in mind the size and businesses of non-banking financial corporations (NBFCs), that may or may not necessarily be able to pay a high one-time fee,

Raja says, “Our pricing models are very different from normal pricing models.”

Veefin offers a subscription model for its platform, where banks can use the software on either a monthly pay-as-you-go basis depending on the volume of transactions, or a one-time licence basis with an annual maintenance fee.

This flexibility and the revenue model is what makes Veefin differentiate itself from large global players such as PrimeRevenue, Demica, and Finastra among others, says Raja.

Market

With Raja having spent a few years in Bangladesh, Veefin started by focussing on the banks in the country, with its market growing rapidly in the last few years.

Raja, speaking from his experience, network, and understanding of the market, says the country does not have many options when it comes to supply chain financing technology. In December 2021, the startup partnered with a Bangladesh-based firm to launch an integrated digital invoice auction platform in the local market, based on the recently issued Bangladesh Bank guidelines on local factoring.

Presently, the company has customers across India, Bangladesh, Saudi Arabia, and Vietnam, with clients such as Adani Capital, Hero FinCorp, IndusInd Bank, BRAC Bank, City Bank, Eastern Bank Ltd., Mintfi, KafLah, VP Bank .

Raja says the company has plans to expand across the globe and further domestically.

Growth and journey ahead

While the supply chain financing industry struggled for the first few months during the pandemic, it has grown in the last one year. Raja says. “In retrospect, the pandemic helped, as the banks figured they had to go digital.”

He claims in the last year alone, the company grew its orderbook by over 2.5 times.

“Even now, our pipeline is strong. We have a waiting period for clients now,” Raja says.

Earlier in December 2021, the company raised $3 million in funding from Dubai-based high networth individual (HNI), Rajesh Rajendran. It plans to use the funds “to build the company’s product and engineering teams.”

The startup also expects to double its team size in the next five months to 180 employees.

At the time of funding, Rajesh Rajendran, said, “Financial institutions have lately been focussing on SME lending and by virtue of that, there is tremendous interest in SCF (supply chain financing). Veefin is one of the few names globally that is putting supply chain financing under the microscope and providing relevant and smart solutions to lenders. I am glad to support this razor focused agenda of simplifying the SCF journey for corporates and lenders”.

Edited by Anju Narayanan