This startup is making bonds an attractive investment option for retail investors

Bonds India has created a tech platform for retail investors to easily participate in the bonds market, which did not have many takers, with the potential to generate higher returns when compared to fixed deposits.

The conventional investment avenues for a retail investor revolve around fixed deposits (FDs), mutual funds or stocks. But tech-enabled financial services startup is keen to show them another equally rewarding option - bonds.

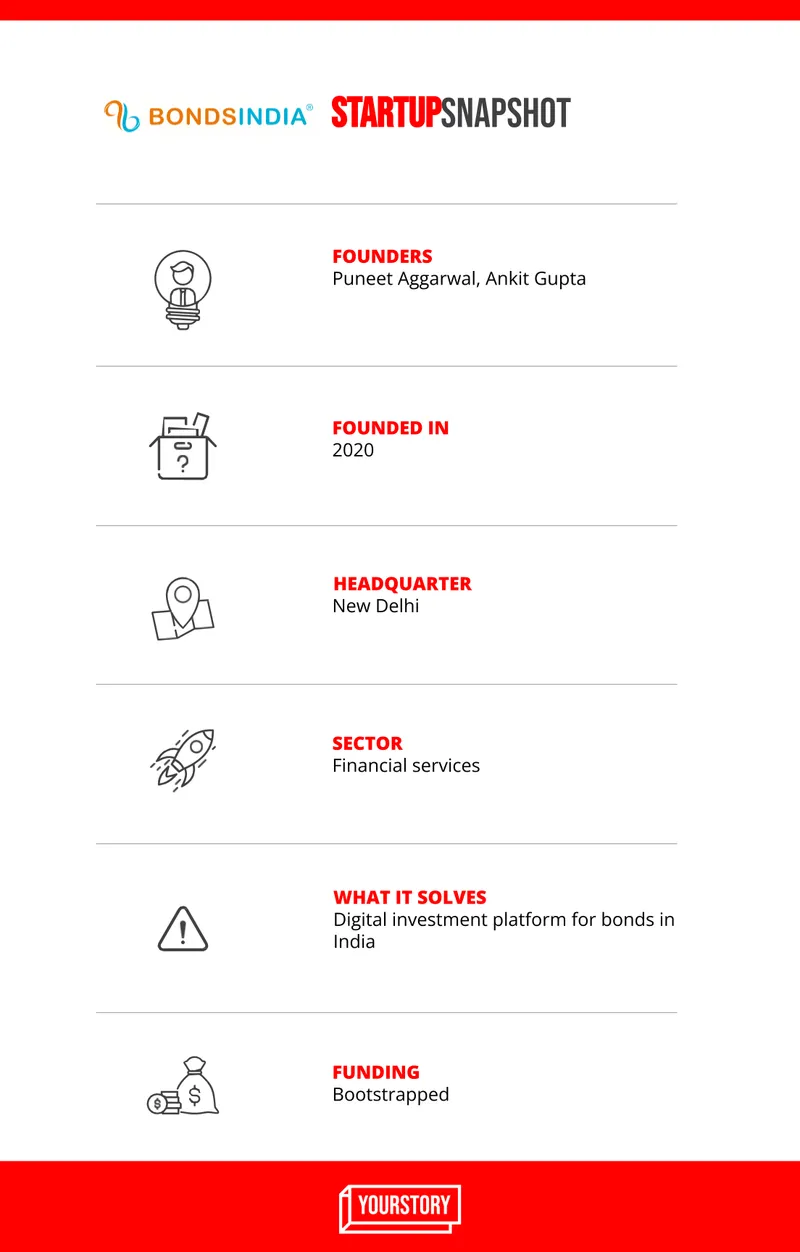

Founded by Ankit Gupta and Puneet Aggarwal in February 2020, the Delhi-based startup is keen to introduce retail investors to the world of bonds and show them how one can generate a higher return than a fixed deposit (FD).

Bonds come in various formats like government securities, public sector bonds, corporate bonds, etc. This market predominantly has investors who belong to the HNIs, corporates, and institution categories.

“Bonds are a better option when compared to FDs as it has advantages such as higher yield, better liquidity, and are safer also,” says Ankit.

However, the biggest challenge that both Ankit and Puneet saw was the lack of awareness of the bond market by retail investors.

As Puneet says, “A retail investor does not know where to buy or sell these bonds.”

The journey and challenges

The founders of Bonds India have been connected with the financial services industry for nearly two decades. Ankit is a chartered accountant and Puneet is an investment banking professional.

Realising that there is lack of awareness among investors on the entire bond markets, the founders started working on multiple fronts, which included interaction with the regulators, stock exchanges, creating a tech platform and disseminating information about this segment.

The key challenges that Bond India saw which was hindering higher participation of retail investors was the lack of accessibility as well as opaqueness of the market. The participants in the bond market were not focused much on the retail investors as they felt they would not be keen on investing their money.

On the other hand, bond instruments like government securities earn an income of 6.5 percent while those from the corporate segment can give you anything between 9 and 12 percent return. The returns are higher than the conventional FDs.

Puneet says, “The big challenge was to create a tech platform, which is similar to stock market trading where one could start investing sitting at their homes.”

The second challenge was that the investor could not get all the data related to bonds -- whether it is related to their price, the returns it will provide, or how these are performing from a single source.

Ankit says, “There is a perception among investors that stock market trading is easy while bonds are difficult.”

Lastly, there was also the challenge around the liquidity of the bond market as these instruments generally hold to maturity kind of products and retail investors were apprehensive whether they could get their money quickly like stock market trading.

Product offerings and revenue

Bonds India went about solving these problems in a systematic manner. It first created an artificial intelligence (AI) driven tech platform, which enabled easier onboarding of investors -- be it their KYC requirement, opening an account, or trading in these instruments. Secondly, it conducted numerous webinars to create awareness of the bond market.

“We kept tech at the centre of our operations, which could solve all the problems of the retail investors in real time,” says Puneet.

Bonds India also created a curated list of Bond products that an investor could purchase or trade and this is an ongoing process as it is a vast market.

Today, Bonds India offers all kinds of fixed income instruments of bonds like primary and secondary market, PSU issues, corporate FDs, and government securities.

The startup launched its offering in September 2021 and it has already got 20,000 registered users with a turnover of around Rs 1,000 crore.

According to Puneet, Bonds India provides the entire end-to-end services for the retail investor, and the platform is available 24/7.

Ankit says institutions are now realising that retail investors can be big participants in the market.

The market and business model

Bonds India generates revenue in three ways — one is the fees of the IPO bond issues; secondly, it holds certain bonds on its books where it earns on the interest spread; and lastly, it can source products which are not there on the platform where it earns a certain income.

The founders claim that it has been able to run its operations in a sustainable manner with steady organic growth of client additions.

The bond or debt market in India is quite sizable with the largest component being from the government which is of $1 trillion in size while the others are corporates, PSUs etc.

Bonds India is looking to add 2.5-3 lakh clients in the next 18 months and take the total business volume to in the range of Rs 2,000-2,500 crore.

On the competitive front, there are other players in the market who offer similar services like Goldenpi, the fixed income, but Bonds India claims that it stands out by providing the entire gamut of services for its customers.

According to Ankit, there are Rs 1.6 lakh crore FDs outstanding in the country, and even if a small portion of this sum comes into the bonds market, it would make a lot of difference.

“We are still in the nascent stage of the market, and it will take some time for retail investors to understand the bonds segment,” says Puneet.

Edited by Megha Reddy