Indian startups to see lower valuations as capital inflow gets tighter

A combination of macroeconomic factors, including falling tech valuations, tech crackdown in China, the Russia-Ukraine war, etc., have reduced capital flow globally, bringing a sense of rationality to startup valuations.

“Winter is here,” Sanjay Mehta, Founder of , told YourStory after reported historic losses of $13 billion for the fiscal year ended March 31, 2022.

In the earnings call that followed the Japanese conglomerate’s results, Founder and Chairman Masayoshi Son said he liked to be on the offensive but it was now time to play defence. “When it rains, you open an umbrella,” he explained.

A combination of macroeconomic factors—falling tech valuations, supply chain bottlenecks, higher inflation pushing interest rates upwards, rising crude oil prices, the Russia-Ukraine war, and a tech crackdown in China—seem to have spooked the global markets and the effects are showing in the funding raised by the Indian startup ecosystem as well.

Investors are clear about one thing—an element of caution is starting to creep into the ecosystem.

While 2021 witnessed a record inflow of capital into Indian startups with ever-rising valuations, VCs are now looking for some rationality in their investments, mainly profitability rather than just scale.

At a recent startup event, Nithin Kamath, Co-founder and CEO of Zerodha, spoke about the likely correction in the Indian startup ecosystem in about six to nine months’ time as the country generally mirrors what is happening in the US.

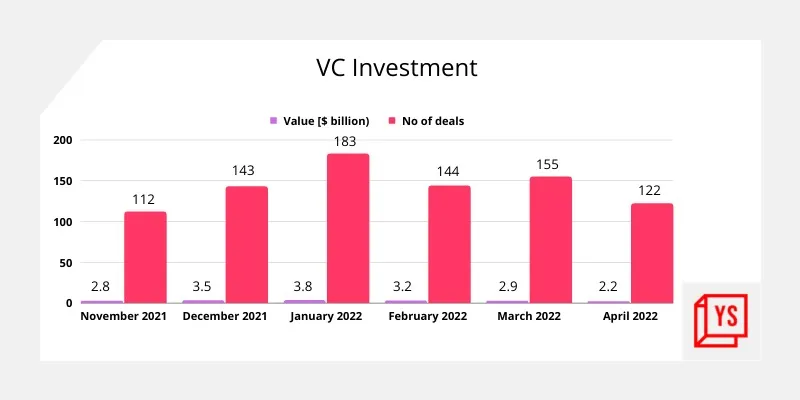

Flow of funding in the Indian startup ecosystem

There has been a steep correction in stock prices of technology companies in the US as the Federal Reserve increased interest rates to combat the growing inflation.

The situation is similar for new-age companies in India. Except for Nykaa, all other startups that went public last year—Paytm, Zomato, Freshworks, and PolicyBazaar—are now trading below their listing prices.

V Balakrishnan, Chairman, Exfinity Venture Partners, says, “There is much more reasonableness in terms of valuation...The exuberance of 2021 is gone.”

Who gets the cheque?

Indian startups, it seems, can no longer command the valuation game.

Siddarth Pai, Founding Partner at 3one4 Capital, says, “The slowdown in venture funding is fairly evident and there is now a lowering of valuation.”

For instance, no single unicorn emerged in April this year while startups achieving a billion-dollar valuation were seen almost every month last year.

To be fair, India saw 15 new unicorns this year until May. In fact, Open marked the country’s 100th entrant to the billion-dollar club. In contrast, 2021 was an exceptional year for unicorns with 44 startups entering the coveted club.

A venture capitalist of a leading early-stage firm on condition of anonymity said, “There is likely to be some separation now in terms of who is going to get funded, and only the good startups are likely to get the capital.”

As an investor wryly puts it, “Once the secondary market starts correcting itself, the impact is felt on the primary market and private lending space.”

Steady decline

The early trends are quite visible if one looks at the quantum of funding raised by Indian startups on a monthly basis, according to YourStory Research. In December 2021, the total funding raised was $3.5 billion and it rose to $3.8 billion in January 2022.

However, there has been a steady decline since, with February seeing funding at $3.2 billion, followed by $2.9 billion in March and $2.2 billion in April.

These changes are likely to be felt across the ecosystem, especially among startups looking to raise growth capital in the valuation range of $200-700 million. This would mean B2C startups are likely to find it more challenging to raise capital.

According to 3one4's Siddarth, “Most investors are in the wait-and-watch mode and are waiting to see how the situation will unfold.”

Falling tech valuations are one of the reasons for a fall in VC funding

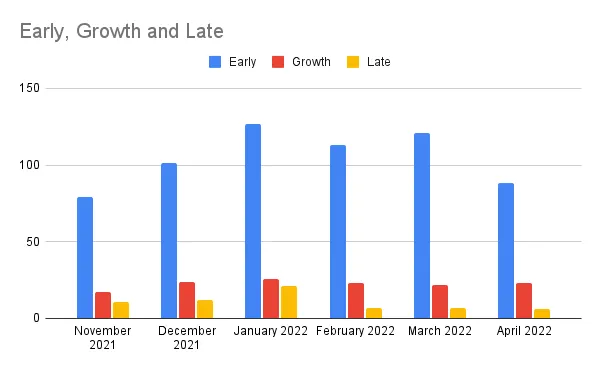

However, this does not mean it is all doom and gloom as early-stage startups continue to find favour among investors. This is one segment which has remained steady, despite the changes in the capital inflow.

In fact, Tiger Global—known for its large growth rounds—has started to look at early-stage startups as well, with Mumbai-based startup Shopflo becoming the first in India to raise seed funding from the US-based VC.

Incidentally, Tiger Global reported a loss of $17 billion in 2022—one of the biggest declines for a hedge fund in history.

Hemant Mohapatra of Lightspeed India recently tweeted: “There is too much talk of a downturn. Best founders emerge from these air pockets. There is no .com bust. Tech has permeated everything. We wrote 3 seed/A checks in last seven days. Lightspeed India-SEA is open for business for those committed to build generational cos.”

Impact in H2 2022

The effect of the slowdown will only be truly visible by the third or fourth quarter of the year. This is primarily because most venture funds have already raised capital and are now in the deployment mode. Also, many of the deals being announced now are the ones completed some time ago.

Stage-wise deals

Now, the focus has shifted back to the fundamentals of the business, where metrics such as unit economics and profitability are back in vogue. It is not that these were not there in the past, but given the latitude of capital, these were pushed to the background.

“This is the new reality,” says 3one4’s Siddarth. “It will be difficult for investors to underwrite large cheques.”

Startups that are leaders in a particular segment might not find it challenging to raise capital but this may not be the case for ones who fall into the third or fourth market positions.

“Good companies with good ideas will be able to raise capital, but the valuation has to be reasonable,” says Exfinity’s Balakrishnan.

Edited by Megha Reddy and Saheli Sen Gupta