Pipes, plug-ins, plumbing: VCs gung-ho about embedded finance startups, but a word of caution

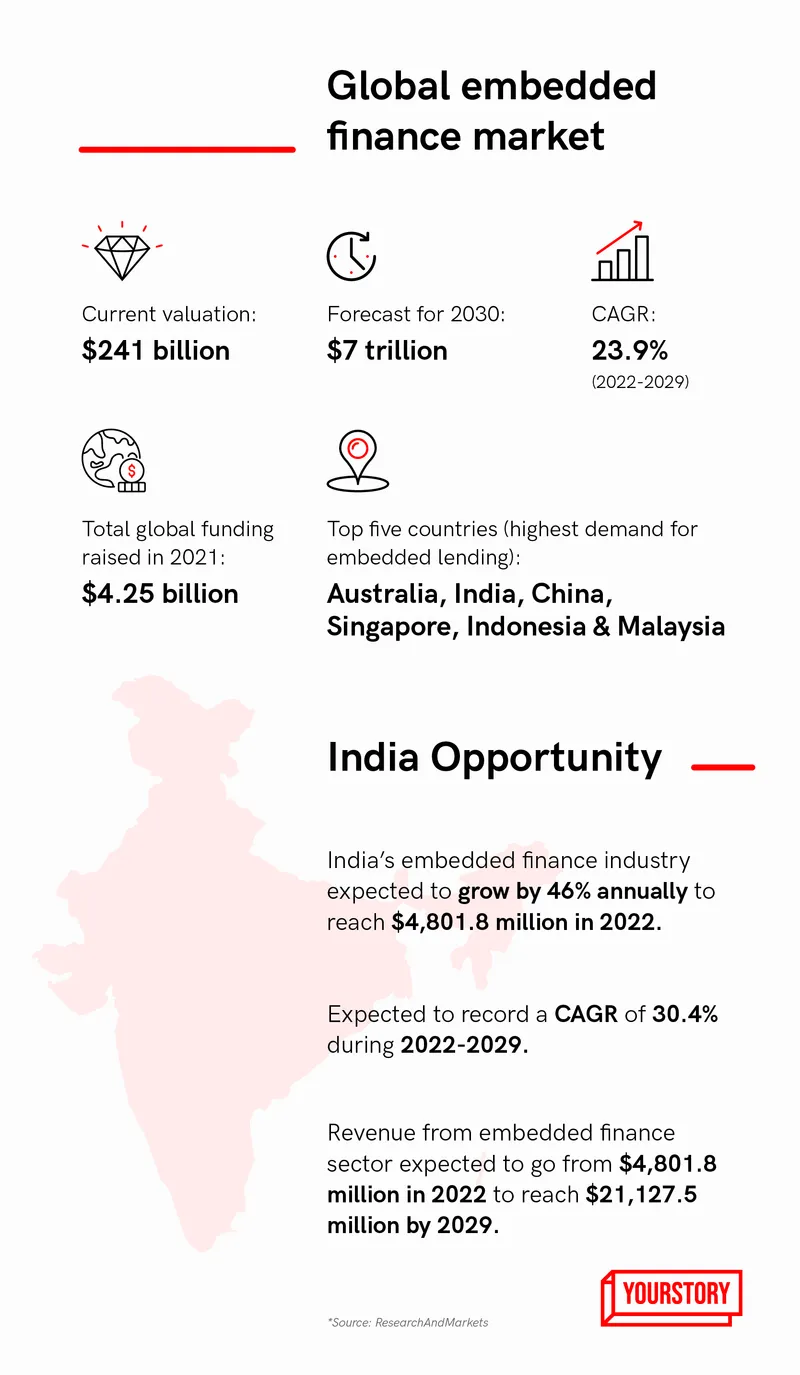

As money pours into the embedded finance sector, touted as the next big wave in fintech, YourStory speaks to top VCs in the space for their views on embedded finance infrastructure startups, also known as pipes, and the key future trends

It’s the age of digital banking, and anyone and everyone wants to be a fintech! From just-in-time loans, and buy-now-pay-later (BNPL) to new-age credit cards - one is spoilt for choice.

From offering small-ticket loans to its delivery partners, to electric car maker selling auto insurance to its customers, every non-financial company is a mere step away from offering financial products to its existing or potential customers.

And this is made possible thanks to the consortium of embedded finance infrastructure providers or enablers, popularly known as pipes. They work as an interface between financial institutions (banks/NBFCs) and digital platforms/businesses to help the latter offer financial products/services alongside their core offerings, a process known as plumbing.

These pipes are tech enablers that take care of the entire backend, including integration of customised banking application programming interfaces (APIs), bank partnerships, compliance, security and so on, and even co-create products. As a result, financial products or services that regularly took over 18 months to launch in the past, can now be up and running in a matter of weeks for a fraction of the cost and complexity. That's the main value these pipes bring in.

There are four major use cases of embedded finance for a digital platform— payments (e-wallets, instant payments), lending (BNPL, EMI options, digital credit cards), insurance and investment.

‘Pipe’ing hot demand for enablers

Embedded finance is not a new concept, and has been in existence for many years now. Look around, and all the Big Techs are in finance now. Whether it’s an Apple credit card or an offering from Google, Facebook or Amazon, all the big tech companies have now supplemented their software and hardware offerings with extensive financial arms.

However, the momentum of embedding finance among digital platforms has only now started to gain traction, as they look to offer services beyond just wallets. By offering financial services, they can subtly lock in their users and bring them deeper into their respective ecosystems, besides adding new income streams.

Today, companies across industries like insurance, grocery, logistics, manufacturing, and ecommerce are looking to launch their customised embedded financial services, or maybe add a new business vertical altogether.

The 150-year-old Indian Postal Services, for instance, is undergoing a massive transformation to offer financial services that would serve almost 70 percent of its revenue. Recently, a popular Indian fitness app was rumoured to offer health insurance as one of its core products on its platform.

“Embedded finance will be the core around which a lot of new-age B2C customer interactions will happen. Non-fintechs will want to build stickiness with their customers and offer things beyond their core offerings. This will lead to a lot of transaction-specific financial products,” says Nakul Saxena, Head, Investor Relations at LetsVenture.

VC sentiment: A divided house

Given the infancy of the sector, there is a handful but a significant number of pipes in the space. However, this is likely to see an uptick in the next four to five years on the back of demand from non-financial companies to embed financial services.

Even with the few players around, the sector saw a significant amount of money being pumped by Venture Capitalists (VCs) in the last 12-14 months. (Refer table).

Several VCs, including Matrix Partners, Flourish Ventures, and QED Investors, have placed embedded finance as a top priority area for their investments. Others like Elevar Equity, Lets Venture and Innoven Capital, are upbeat, but remain discerning over the sustainability of their business models and efficiency, and hence, are selective-cum-cautious in their funding approach.

“This is a highly regulated sector, and you cannot afford to get your business model wrong. You need to have 99.99 percent efficiency. VCs will chase founders who have figured out four things—criticality of the financial product/service to the end-user, who is their customer, how they enable the complete financial flow (the most value-added thing), and how they monetise,” says Anuradha Ramachandran, Investments Director at Flourish Ventures.

This will eventually show up in two ways—money will get concentrated into fewer and fewer startups that are able to demonstrate this, and second, valuations of these startups will go up.

The firm has invested in Fintech (formerly YAP) and fintech platforms like Apnaklub, Aquaconnect and Credflow, and is looking at the embedded finance space from a platform, plugs and innovative products perspective.

“Financial infrastructure is one of our leading thematics this year, and I would expect 50-60 percent of our corpus to go in that direction,” Anuradha adds.

Amit Nawka, Partner, Deals & Startups Leader, PwC India, says, “Startups need to clearly define their role in the value chain. The business model has to be thought through, as even the regulators themselves understand the new models.”

Amit expects more money to flow into the segment at the back of their demand and the focus segment they choose.

Germany-headquartered VC firm, Picus Capital, which has invested in embedded finance startup Buildd in 2021, sees tremendous potential for investments in the Indian embedded finance ecosystem, but not without discernment.

“When it comes to dealing with a space like embedded finance, one must be mindful of where and whom the value will be accredited to. While the canvas is vast and opportunities are immense, investors will be discerning to identify such business models,” says Florian Reichert, Partner and Managing Director, Picus Capital.

VCs expect specialisation to take place in the segment, and hence pipes will need to choose their area of expertise eventually, instead of following suit and building copycat models. The area of expertise could be as per use case (lending, payment, insurance etc), sectoral (auto, travel, ecommerce etc) or target audience (kiranas, farmers, millennials, affluent class etc).

“Once unique and new use cases like agriculture-based financial products, and offerings for kiranas come up, we will eventually be seeing a growing appetite for these startups,” says Nakul of LetsVenture. The firm is sector or platform agnostic, and is still watching the pipes closely.

So is InnoVen Capital, which does not have a dedicated focus on similar startups, and may invest in one which is already established and has achieved scale.

Amol Warange, Director, Omidyar Network India, expects embedded finance models to emerge at scale in healthcare, agriculture and small businesses, with products that are customised to their use cases. Innoven and Lets Venture foresee high demand in auto, travel and tourism. Payments have already evolved, and BNPL will remain the hottest use case while products around insuretech and wealthtech will be the next in line.

For VC firm Elevar Equity, which has invested in embedded finance startup , a founder’s understanding of the whole financial space is important along with a strong tech game.

“Financial services cannot be underestimated. They may look simple on the outside but there's a lot that goes into scaling a lending business. Just providing tech is not enough. We are big believers in embedded finance, but are selective and will continue to screen for founders who understand financial services along with technology,” says Jyotsna Krishnan, Managing Partner at Elevar Equity.

What the VCs predict: Key future trends

Large rounds in a handful of startups

Experts predict a handful of focussed startups to remain in the space (plumbing), building for a particular market. These are startups that have established business models and monetisation channels, along with strong finance know-how.

“Companies that really understand regulations, compliance, and cross border trade, and can build trust with institutions, will be able to win. Going forward, only a few large players will emerge, due to regulations and challenges, and you will see significant rounds in those few startups,” says a VC on the condition of anonymity.

On the other hand, some believe it would not be a 'winner-takes-all market’ as the opportunity is vast.

Plugs becoming manufacturers

A startup in the embedded finance space could either continue to do plumbing, or go a step ahead and offer products to the end-users themselves. This could be done, for instance, by taking an NBFC/insurance licence or tying up with a third party for lending.

A good example of this would be digital insurance startup , which is both a pipe and a manufacturer (of financial products). The direct-to-consumer (D2C) auto insurance provider also services embedded insurance products like mobility and gadget insurance across large digital consumer platforms like Amazon, MakeMyTrip, Ola and Urban Company. Noida-based Zopper is another example.

However, for a pipe to manufacture and service financial products to the end-user is an altogether different ball game. It might provide the startup with high margins as they would be able to bring down the costs, but that could only happen after a certain growth stage, explains Aditya Kumar, Co-Founder and CEO at Niro.

“Most of the pipes won’t have the scale. Maybe a very large platform would be able to turn into manufacturing and offer financial products. Regulation is a challenge. Acko was one of the very few companies that got the license. Banks don’t like bundled products, and therefore, pipes would be better off by sticking to plumbing,” feels Ashish Sharma, Managing Partner at Innoven Capital.

Pipes versus In-house debate

Businesses looking to embed finance in their platforms have two options: go into partnership with a pipe or create and sell the service in-house. Interesting, has done this in-house (Ola Money), while Swiggy has decided to partner (Swiggy Money).

The question that arises here is that should VCs put money into Ola as a part of their overall tech story, or into Swiggy and the fintech that offers the embedded finance integration?

“These are two different stories, and it is yet to be established which one will be more successful,” says Anuradha from Flourish ventures. However, a partnership is a win-win for both as platforms can continue to focus on their main offering while the pipes take care of the entire backend chain and set up the finance layer.

Advice for digital platforms: ’Don’t fall for FOMO’

Right now, embedded finance is a bit like the “shiny object syndrome,” where everyone is seeing big numbers and wondering what they’re missing out on. But, experts advise that just because you can add embedded finance to your product offering doesn’t mean you should. Startups must lean into the platform economy first, and add features that will keep customers hooked to their platform.

The next technology stack

While the embedded finance trend is only just getting started in India, it is touted as the next big wave in fintech.

In the developing world, it has the potential to be much more disruptive and life-changing. Take for instance WeChat (Pay) in China or in Indonesia. WeChat started as a messaging app and Gojek started as a ride-hailing app. The platforms are today bringing bottom-up financial inclusion to the Chinese and Indonesian markets due to their reach and connect with customers across regions. Closer home, it remains to be seen if the Indian Postal Services will have a similar impact.

As far as pipes are concerned, these startups must look at going beyond just being a technology or infrastructure provider, and offer custom products to create a differentiator for themselves in the market.

Summing it up eloquently is Anubhav Jain, co-founder of embedded finance startup , which raised $25 million in Series A funding in January this year, “The money has come into the segment after a lot of wait and watch. Earlier, VCs were not sure as to what scale a particular enabler can reach. That was a big question. But now, they have identified one or two leaders in the space, and this might be a winner takes it all market in the long term.”

Edited by Anju Narayanan