One year since IPO: Zomato’s choppy ride

A lot was riding on Zomato when it became India's first startup unicorn to go public. But in the year since the foodtech company opened its initial public offering for investors, its market value has corrected by more than half.

On July 14, 2021, the Rs 9,375-crore initial public offering (IPO) of —the foodtech unicorn—opened for subscription at a price band of Rs 72-76 a share, against a face value of Rs 1 apiece. The much-hyped IPO from the Indian startup ecosystem had closed on July 16 with an oversubscription of 35 times.

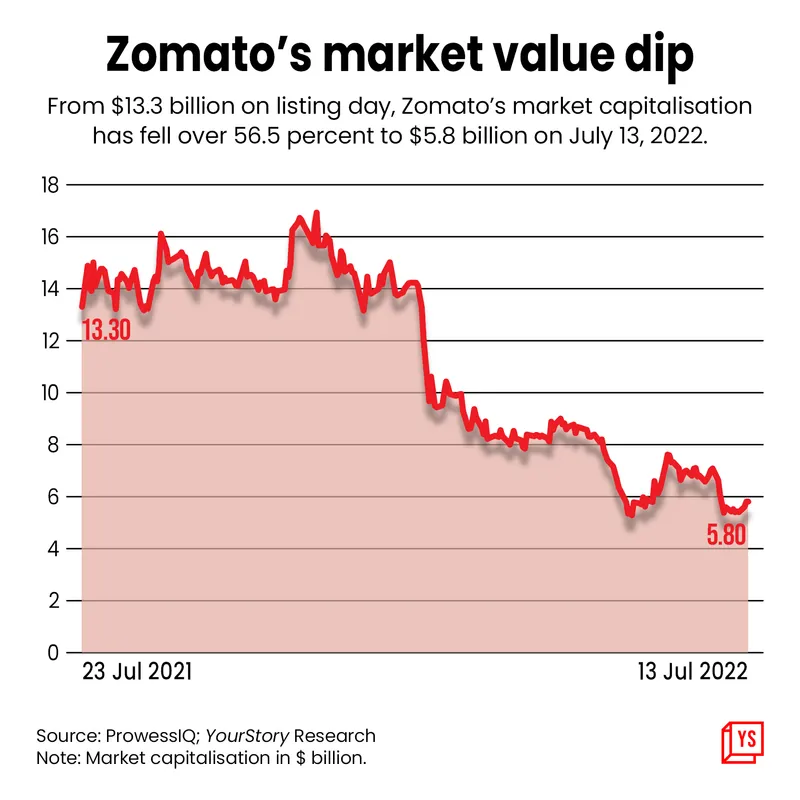

Zomato got listed on July 23, at a valuation of over $13.3 billion, with an issue price of Rs 76 apiece.

Before Zomato went public, YourStory Research conducted a detailed analysis of Zomato’s draft red herring prospectus (DRHP), especially its balance sheets, which had interesting frugality lessons for startup founders.

In the IPO, Zomato received an overwhelming response from investors. With the first startup unicorn going public, investors got the first taste of an entirely new and emerging sector of India’s economy.

On November 16, 2021, Zomato’s share price touched an all-time high of Rs 169.10 apiece on the Bombay Stock Exchange.

Graphic: Chetan Singh

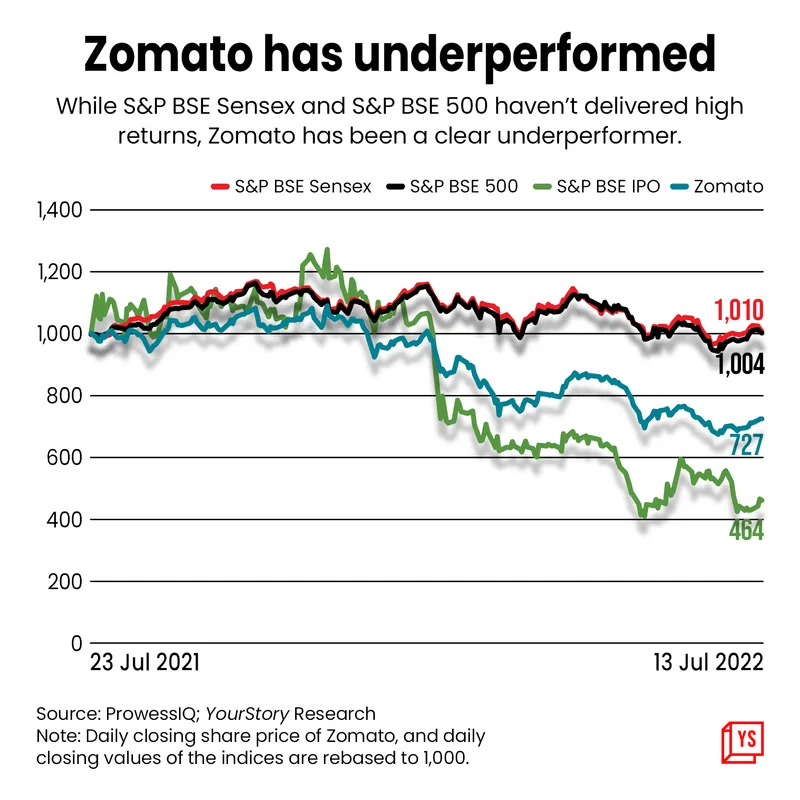

But following that, the stock price saw a gradual decline, closing at Rs 137.45 a share at the end of 2021. From there the shares have continued to decline, and touched their all-time low of Rs 50.35 on May 11 this year. In comparison to the S&P BSE Sensex, S&P BSE 500, and the S&P BSE IPO index, Zomato's share price performance has been a dampener.

Graphic: Chetan Singh

From $13.3 billion on July 23—Zomato’s listing day—the market capitalisation saw an absolute decline of over 60 percent to touch $5.3 million on May 12. At the close of the day’s trade on July 13, the foodtech unicorn’s market value of $5.8 billion has reduced by $7.5 billion, or by 56.5 percent, compared with its closing value on listing day.

Since listing, the aggregate ownership of institutions had risen from 16.3 percent in July 2021 to 18.6 percent in the quarter ended (QE) September 2021, and to 18.65 percent in QE December 2021. However, in QE March this year the ownership saw a decline to 16.4 percent.

Foreign portfolio investors (FPIs) account for the maximum proportion of institutional holding, and that saw a substantial increase from 7.69 percent at the time of IPO to 10.17 percent in QE March 2022. While the June quarter shareholding details are not public, it is noteworthy that FPI holding in QE December last year was marginally higher at 11.04 percent.

Graphic: Chetan Singh

Mutual funds’ ownership in Zomato has seen a decline in QE March 2022 at 2.82 percent, compared to 3.01 percent in July last year, and 4.4 percent and 3.88 percent in QE September 2021 and December 2021 respectively.

A large chunk of the decline in institutional ownership has been absorbed by individual shareholders. From 8.51 percent in July last year, their respective shareholding changed to 6.73 percent, 7.06 percent, and 9.07 percent during QE September 2021, December 2021, and March 2022 respectively.

During FY 2022, Zomato made minority investments in over half a dozen startups; including $60 million in social rewards startup , $75 million in logistics startup , and $50 million in healthcare startup Curefit.

Ahead of its IPO, on June 29 last year, Zomato had signed a deal with BlinkIt (erstwhile Grofers) to invest about $150 million in the firm by acquiring a 9.3 percent stake. On June 24 this year, Zomato announced a share-swap deal to acquire Blinkit for Rs 4,478.48 croee ($568 million) by issuing over 628.53 million shares priced at Rs 70.76 apiece.

Founded as FoodieBay in 2008 by Deepinder Goyal and Pankaj Chaddah, it was renamed as Zomato in 2010. The company has raised total fundings of $2.1 billion before going public till date.

Currently available in 21 countries, in addition to India, Zomato's food delivery services are restricted to India and the UAE. The company has shut its operations in countries including Singapore, the US, the UK, Canada, Lebanon, South Africa, and Hungary.

Zomato’s network has approximately 1.4 million listed restaurants, and it says it has delivered 535 million orders. It has 180,000 average monthly active restaurant partners and 285,000 average monthly active delivery partners.

Edited by Rajiv Bhuva