Raids at Eazebuzz, Razorpay, Cashfree, Paytm: ED freezes over Rs 46 cr in payment gateway accounts

The ED had carried out search operations in connection with its probe into the Chinese loan apps fraud case.

The Enforcement Directorate (ED) on Friday said it has frozen Rs 46.67 crore worth funds kept in payment gateways (PGs) , , and after it carried out raids this week against Chinese-controlled loan apps and investment tokens. The funds have been frozen under the anti-money laundering law.

The ED has carried out search operations at multiple premises of the accused in Delhi, Ghaziabad, Mumbai, Lucknow, Gaya and 16 other premises of financial entities in Delhi, Gurugram, Mumbai, Pune, Chennai, Hyderabad, Jaipur, Jodhpur and Bangalore in connection with an investigation related to the app-based token named HPZ and its related entities, it said in a statement.

What is HPZ token?

The HPZ Token was an app-based service, promising users a large gain against their investments once they mine the token in machines. This includes Bitcoin and other cryptocurrencies. The creators of this app, lure victims into investments on the pretext of doubling their investment through the app HPZ Token.

Users received these payments through UPIs and other various payment gateways/nodal accounts/individuals. A part of this amount was given to investors and remaining amount was diverted to various individual and company accounts through various PGs/banks. From here it was partly it was siphoned off in digital/virtual currencies. After that, the fraudsters stopped the payments and the website became inaccessible, ED said.

“During the search, various incriminating documents have been recovered and seized. Huge balances were found to be maintained in the virtual accounts of the involved entities with payment aggregators. Rs 33.36 Crore was found with Easebuzz Private Limited, Pune, Rs 8.21 Crore with Razorpay Software Private Limited, Bangalore, Rs 1.28 Crore with Cashfree Payments India Private Limited, Bangalore and Rs 1.11 Crore with Paytm Payments Services Limited, New Delhi,” the federal agency said.

Companies issue clarification

Clarifying on the same, an Easebuzz spokesperson said, "We, at Easebuzz, would like to clarify that none of the parties mentioned in the ED’s statement belonged to our merchant base. The mentioned entities by authorities were only the counterparties of the merchant, who was using our payment gateway and this merchant had been proactively identified and blocked by us much before the investigation had started, as per our internal risk and compliance process."

Cashfree also issued a statement saying, “We continue to extend our diligent co-operation to the ED operations. We were able to provide the required and necessary information within a few hours on the day of

enquiry," Cashfree said in a statement. The company also mentioned that its operations and onboarding processes are compliant with existing regulations.

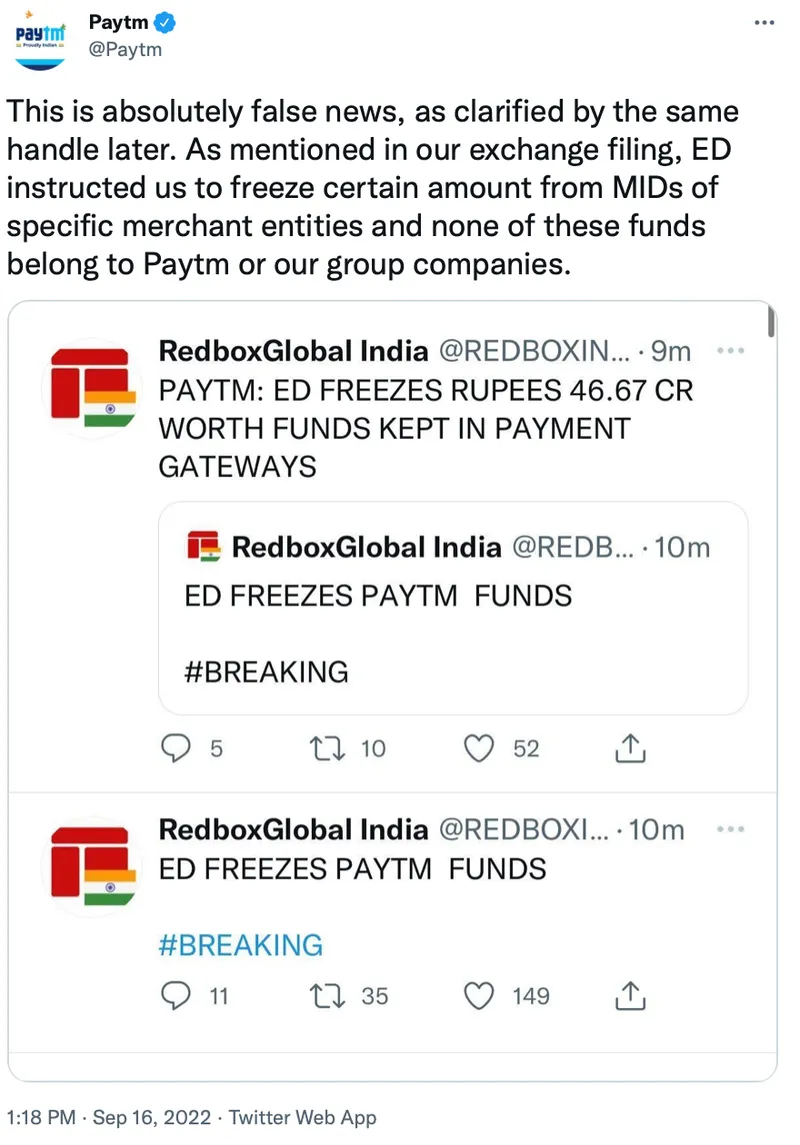

Meanwhile, Paytm denied freezing of funds and called it ""absolutely false news”. “As mentioned in our exchange filing, ED instructed us to freeze certain amount from MIDs of specific merchant entities and none of these funds belong to Paytm or our group companies,” it said.

Meanwhile, ED said further investigation is under progress.

(With inputs from PTI)