India’s agrifood startups close record-breaking $4.6B funding in FY22: Report

According to India AgriFood Startup Investment Report, India has overtaken China as Asia-Pacific's biggest funder of agrifoodtech innovation.

Despite the pandemic, economic slowdown, and impact of climate change, the decade-old Indian agrifoodtech sector has seen an increasing number of VCs betting on its tenacity and the immense scope of growth.

According to AgFunder and Omnivore’s fourth India AgriFood Startup Investment Report, India has overtaken China as Asia-Pacific's biggest funder of agrifoodtech innovation, attracting record levels of investment in the fiscal year April 2021 to March 2022.

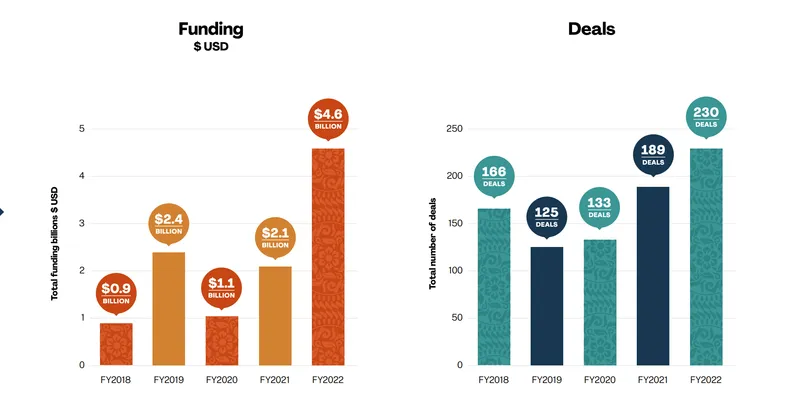

Alongside the increasing volume of deals, the average round sizes have also increased significantly across all funding stages, with the overall investment volume up by 119% to $4.6 billion in the fiscal year ending March 31, 2022. The number of deals increased to 234 in FY22, compared with 189 deals in the previous fiscal.

Michael Dean, Founding Partner, AgFunder, said, “India has always been a leading agrifoodtech ecosystem, ever since AgFunder and Omnivore started in the early 2010s but to see investment levels surpass all other countries in the Asia-Pacific region and compete on the global stage is indicative of the impressive range and depth of innovations coming from the country and potential to impact the agrifood industry as a whole.”

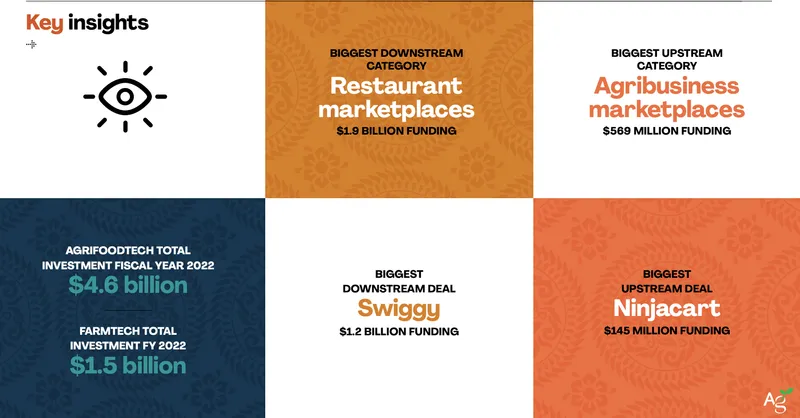

It was a breakout year for farmtech in India as startups in this category raised $1.5 billion across 140 deals—a 185% year-on-year increase.

Since 2018 overall investment in agrifoodtech in India has grown by over 400% due to participation from both domestic and global investors. Image Source: India 2022 AgriFood Startup Investment Report

According to the report, downstream startups raised $3.8 billion in FY2022—a 115% increase from $1.77 billion in FY2021. This significant growth is due to Swiggy, which raised $1.2 billion, accounting for 26% of total investment in the agrifoodtech space.

On the other hand, upstream investment leapt 300% to $1.2 billion up from $312 million. The participation of generalist VCs, bigger deal sizes, and higher deal count contributed to this increase, the report states.

Image credit - India 2022 AgriFood Startup Investment Report

It is also to be noted that upstream deals surpassed downstream deals in number for the second year in a row, with 121 upstream deals and 113 downstream deals closed in FY22.

Some of the other key insights from the report -

- Farmtech startups closed $1.5 billion in funding, a 185% increase on the $527 million raised in FY21.

- Restaurant marketplace and e-grocery were the most funded downstream categories, accounting for 84% of total downstream funding with e-grocery startups landing the highest number of late-stage deals.

- E-grocery startups raised $934 million across 42 deals, a 4X jump from $244 million across 25 deals in FY21.

- Investment in online restaurants and meal kits saw a remarkable recovery at $301 million in FY22, almost 4X more than $64 million in FY21.

- The premium branded food and restaurants category saw a marginal 9% increase in funding.

- Agribusiness marketplaces overtook midstream technologies to become the most funded upstream category in FY2022. The former raised $569 million in FY2022, a 7X jump from the $86 million raised in FY2021.

Mark Kahn, Managing Partner, Omnivore, said, “The investment trends are proof that the agrifoodtech space can no longer be called niche. It has caught the attention of generalist VCs the world over who understand that agrifoodtech is key to the transformation of India’s massive agricultural sector and rural economy.”

Edited by Saheli Sen Gupta