PhonePe to acquire ZestMoney in $200M-$300M deal: source

A source close to the talks said the deal will close in two to three weeks, and was in the final stages of completion.

is in the final stages of acquiring BNPL player for $200 million to $300 million, a source close to the talks told YourStory.

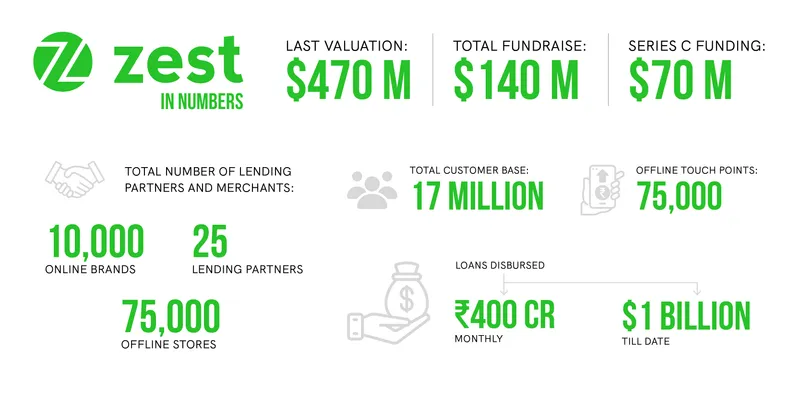

The buy-now-pay-later startup was last valued at $470 million after its latest funding round when it raised $70 million in its Series C in September last year.

BNPL companies such as ZestMoney and its peers , , , etc., have been grappling with a lot of uncertainty ever since the Reserve Bank of India (RBI) released guidelines around digital lending, essentially making it hard for fintech startups to extend personal credit lines via a card. While ZestMoney has been lending at checkout points, without a card, stringent guidelines have still affected the industry.

For PhonePe, ZestMoney gives it instant access to a readymade consumer credit base. It bolsters PhonePe's lending play--a space its rival, Paytm, has already cracked quite well.

The PhonePe-ZestMoney deal was first reported by The Economic Times.

The deal is expected to close in two to three weeks, the source said, adding it was "almost as good as done."

(Design credit: Nihar Apte)

TVS Motor-backed Ultraviolette launches new electric motorcycle at Rs 3.9L

ZestMoney will continue to function as a separate entity, under its own brand name, once the acquisition is completed, the source said.

People familiar with the development said ZestMoney could hit EBITDA profitability by the end of the calendar year, which may have sweetened the deal for PhonePe.

ZestMoney said the talks were "speculative", while PhonePe declined to comment on the deal.

PhonePe has been eying major acquisitions in the sector to boost its financial and tech platform play, as well as bolster its “super app” plans. The company has made seven acquisitions to date, including OSLabs, Zopper Retail, WealthDesk, and OpenQ. ZestMoney's will be PhonePe's most expensive acquisition yet.

Founded in 2015 by Priya Sharma, Ashish Anantharaman, and Lizzie Chapman, ZestMoney offers BNPL plans of ticket sizes Rs 50 to Rs 5 lakh payable over 30 days to 24 months. It has partnered with 25 banks and non-banking lenders, and works with large merchants such as Amazon, Flipkart, Google Pay, Apple, and Xiaomi to offer its BNPL services to customers.

In June, YourStory reported that ZestMoney had raised Rs 20 crore in debt by issuing non-convertible debentures (NCDs) through private placement to its existing investor Alteria Capital.

YourStory had earlier this week reported that Flipkart-owned digital payments platform PhonePe had received a fresh capital infusion of about Rs 742 crore from its Singapore-based parent, even as it reported a wider consolidated loss for the 2021-22 financial year.

This is the second major capital raise by the company from its parent this year. In March, the fintech company passed two separate resolutions to allot a total of 2.5 million equity shares to PhonePe Pvt. Ltd, Singapore, to raise $297 million (Rs 2,275 crore).

PhonePe also recently moved its headquarters from Singapore to India to bolster its position, and prepare for its initial public offering.

Edited by Megha Reddy