Startup news and updates: daily roundup (May 9, 2023)

YourStory presents the daily news roundup from the Indian startup ecosystem and beyond. Here's the roundup for Tuesday, May 9, 2023.

Funding

BlackSoil invests $4M in GenWorks Health

Alternative credit platform has invested $4 million in GenWorks Health Private Limited, a medical technology company based in India.

The investment is expected to support GenWorks Health's growth and development while contributing to the advancement of innovative healthcare solutions.

"Our investment in Genwork Healthcare is not only a testament to their potential for growth, but also to our belief in the transformative power of healthcare technology,” said Ankur Bansal, Co-founder of BlackSoil Capital. “By leveraging our expertise and resources, we are confident that together we can make a positive impact on the healthcare industry and improve the lives of countless individuals.”

GenWorks Health claims it has served over 40,000 customers in more than 700 districts across the country. Other investors in Genworks Health include Somerset Indus Capital Partners, Evolvence, and Morgan Stanley.

RACEnergy secures $3M in a pre-Series A round

Deeptech battery swapping company has raised $3 million in debt and equity in a Pre-Series A round led by growX Ventures. Investors like Micelio Mobility, Huddle, and other angel investors also participated in the round.

The new capital brings the total funds raised by the company to $6 million. RACEnergy noted that the funds will enable its expansion to new markets and further develop its swapping technology for two-and-three wheelers. It will also help scale its operations with a new facility in the pipeline, Co-founder Arun Sreyas, said.

“We are thoroughly impressed by RACEnergy's expertise in deeptech, its exceptional in-house battery pack and swapping station developments,” Sheetal Bahl, Partner at growX Ventures, said in a statement. “With the recent clearance of AIS-156 Phase 2 certification and their successful commercial pilot that recorded an impressive 3 million green km, we are optimistic about their potential for exponential growth.”

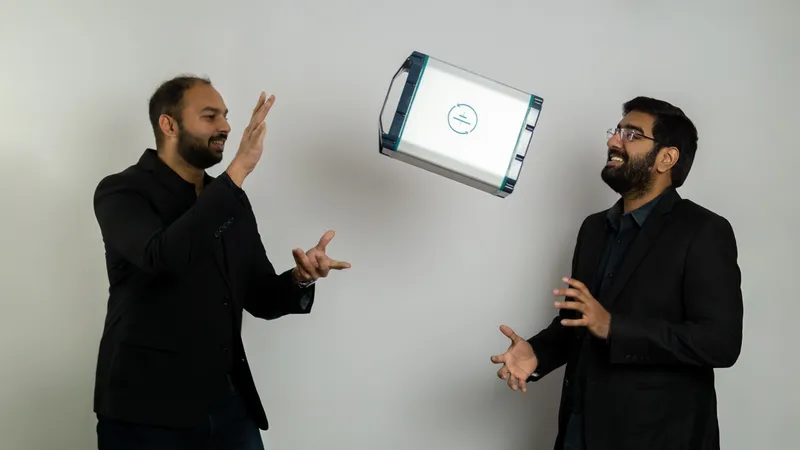

Founded in 2019 by Arun Sreyas and Gautham Maheswaran, RACEnergy is a deeptech electric vehicle infrastructure company. It is expanding its network of battery swap stations in the country through its strategic national and state-level partnerships, including HPCL and Hala Mobility.

RACEnergy founders. | Image credit: RACEnergy

Slick raises $1.6M in seed funding

Slick, a social networking platform for GenZ, has raised $1.6 in a seed funding round led by WEH Ventures. Other investors like iSeed, Titan Capital, All In VC, and a clutch of angel investors, including Sumit Gupta, participated in the round.

The funding will be used to enhance Slick's user experience, drive innovation, and develop

cutting-edge features to attract more users, the company said.

“There’s still a strong innate need to keep in touch with people and that’s why we believe this is the right time to build new social products, where the paradigm for monetisation could be very

different from when Snap/Facebook started,” Rohit Krishna, General Partner at WEH Ventures, said in a statement.

Since launching in December, with a team of 15 members, Slick claims to have amassed over one million users. Last year, Slick raised $500k in a pre-seed round led by Unacademy's founders and other angel investors like Kunal Shah, Sujeet Kumar, and early-stage VCs, Titan Capital, and Blume Founders Fund.

Mom’s Belief receives $685,000 investment from LEGO Foundation

, an organisation dedicated to empowering families of neurodivergent children, has received an investment amount of $685,000 from the LEGO Foundation as the duo entered into a global partnership.

This investment will be used to enhance and co-brand Mom's Belief's existing products, starting with India, the USA, and Dubai, it said.

“Families are uniquely placed to provide their children with playful learning opportunities that support their unique strengths and needs. We are excited to be partnering with Mom's Belief and supporting their work to nurture and uplift children’s potential,” Christina Witcomb, Director, The LEGO Foundation, said in a statement.

The primary goal of the partnership is to empower parents and families of neurodivergent children through integrated co-branded products and to build a community.

Through this collaboration of The LEGO Foundation's Learning Through Play (LTP) principles with Mom's Belief Family Support Program (FSP), the plan is to support 10,000 families in phase 1 and eventually roll out globally to serve another million families, the duo noted.

ixamBee raises Rs 11 Cr in pre-Series A round

Edtech startup has secured equity funding of Rs 11 crore in a pre-Series A funding round from investors, including S Chand & Company, Inflection Point Venture, Mukesh Sharma Family Trust, Keiretsu Forum, SAN Angles, Mumbai Angels, and Keyur Joshi.

This funding round also involved a secondary transaction of Rs 3 Crore. The edtech firm said the newly secured funds will be utilised to drive growth by launching additional learning programs and investing in content development, marketing, and technology.

“The emphasis on providing quality and affordable learning to students in semi‐urban and rural areas aligns perfectly with S Chand's vision,” Himanshu Gupta, Managing Director, S Chand Group, said in a statement. “We identify several synergies with ixamBee in terms of content development, marketing, and meeting the aspirations of the country's future workforce.”

Founded in 2016 by Chandraprakash Joshi, Arunima Sinha, and Sandeep Singh, ixamBee focuses on job preparation for small-town students. The platform operates on a freemium business model, offering free mock tests for over 100 exams. It claims to have reached over 12 million students.

ixamBee founding team.

Innovapptive raises undisclosed Series B funding

, a SaaS-based connected worker platform, has raised undisclosed Series B funding led by . Existing investor also participated in the round.

The Hyderabad-headquartered firm said it will use the investment to accelerate product innovation and reach new regional markets.

“Innovapptive is a high-growth, emerging leader in the connected worker software category. Its mission-critical solutions satisfy the growing demand from asset-intensive industries to connect front-line and back-office data sources for enhanced business operations, well positioning the company for long-term growth and success,” said Rachel Arnold, Co-Head of Vista’s Endeavor Fund and Senior Managing Director.

The investment in Innovapptive was made by Vista’s Endeavor Fund, which provides growth capital and strategic support to market-leading, high-growth enterprise software, data and technology-enabled companies that have achieved at least $10 million in recurring revenue.

Ben Benson, Senior Vice President at Vista, will join Innovapptive’s Board of Directors effective immediately.

Other news

ZebPay partners with TaxNodes

Crypto asset exchange has partnered with TaxNodes, an ITR filing platform, to simplify tax filing for virtual digital assets in India.

TaxNodes will provide assistance to ZebPay's user community to ensure precise tax calculations and compliance, and to keep them updated with recent tax-related developments in the virtual digital asset industry.

“We are committed to creating a regulatory-compliant ecosystem that fosters the mainstream adoption of crypto in India. This partnership is a significant step towards achieving that goal and enabling greater collaboration between stakeholders in the crypto ecosystem,” Rahul Pagidipati, CEO of ZebPay, said in a statement.

Grene Robotics acquires deeptech defence IP from Apogee C4I

has acquired the C4ISRT platform from Apogee C4I, an indigenous defence technology company.

This acquisition is expected to significantly strengthen the company's capabilities in the defence sector and contribute to the advancement of larger implementations on a national and international level.

In 2021, Grene Robotics introduced its comprehensive Autonomous Drone Security System–Indrajaal, which according to the company, has the ability to cover vast areas of up to 4000 sq. km per system and provide a comprehensive framework to defend against all classifications and all levels of autonomous drones.

“With the integration of Apogee’s advanced deep tech platform, we aim to bolster Indrajaal’s anti-drone capabilities further,” Kiran Raju, Founder and CEO of Grene Robotics said.

Hyderabad-based Grene Robotics is a deep-tech research and development company specialising in providing innovative solutions in artificial intelligence and robotics.

(From LtoR): Vamsi Vellanki, Wng Cdr (Retd) MVN Sai and Kiran Raju.

Meta launches #MadeOnReels initiative

parent Meta on Tuesday launched #MadeonReels, a programme designed to enable brands to boost business results through entertaining storytelling on Reels.

The social media company noted that selected brands will receive creative support, programme support, and the opportunity to work with three creators each on Reels campaigns around their specific marketing objectives.

“Our goal at Meta is to help businesses build for the evolving consumer behaviour and create a strong ecosystem for the future of digital advertising in the country. #MadeOnReels does precisely that,” Arun Srinivas, Director and Head of Ads Business for Meta in India, said in a statement.

Meta also announced the India findings of Global Consumer Short-Form Video Survey by Factworks commissioned by Meta. 82% of people surveyed in India said that they have followed a business after watching Reels, 74% said they have messaged a business after seeing their Reels, and 77% said they have purchased a product or service after watching Reels, the findings showed.

Absolute appoints Vinit Mishra as Head of Treasury, Finance, and Insurance

Absolute, a global bioscience company, has appointed Vinit Mishra as the Head of Treasury, Finance, and Insurance, for its global trade finance, Silkroute.

Vinit will assist in supervising all aspects of the company's global trade finance operations, drive business growth, and lead the team towards achieving strategic goals, Absolute noted.

“As an accomplished financial strategist, Vinit brings invaluable experience and expertise to our organisation. I am confident that his exceptional problem-solving skills, strategic thinking, and ability to cultivate strong relationships with both internal and external stakeholders will be instrumental in strengthening Absolute’s network across the globe,” Neeraj Choudhary, Group Head Finance, Absolute, said in a statement.

Prior to joining Absolute, Vinit was Head Treasury and Trade Finance at Louis Dreyfus Company India Private Limited.

Avendus appoints Anshul Gupta as MD, Head of Healthcare Investment Banking

Institutional financial services firm Avendus has appointed Anshul Gupta as Managing Director and Head of its Healthcare Investment Banking business.

“He (Gupta) is a strong leader with deep sector and M&A expertise. His approach aligns with our focus on thought leadership and scaling up our practice. We look forward to working with a large set of innovative entrepreneurs and sponsors to drive value creation in the sector,” Gaurav Deepak, Co-founder and CEO of Avendus Capital, said in a statement.

Anshul spent the last 15 years of his career in various leadership roles at Citigroup Investment Banking. He is also an expert in capital markets, having led IPOs for Gland Pharma, Laurus Labs and Eris Lifesciences; QIPs for Max Health and Piramal; financing for Intas’ acquisition of Actavis and bond issuances for Glenmark and Jubilant Pharma, among others.

Established in 1999 in Mumbai, India, Avendus has a presence in the areas of investment banking, institutional equities, wealth management, credit solutions, and asset management.

(The copy will be updated throughout the day with the latest news.)

Edited by Megha Reddy