Social trading apps—the new hunting ground for illicit stock tippers

Social trading apps are rampantly abused as avenues for luring unwitting traders, often with promises of hefty gains, as more people rush to dabble in the stock markets but have to contend with a dearth of SEBI-authorised advisers.

Key Takeaways

Social trading apps are often swarmed with stock recommendations from popular traders, including from several not licensed to do so.

India has merely 1,300 SEBI-registered investment advisers for an estimated trading population of 8 million.

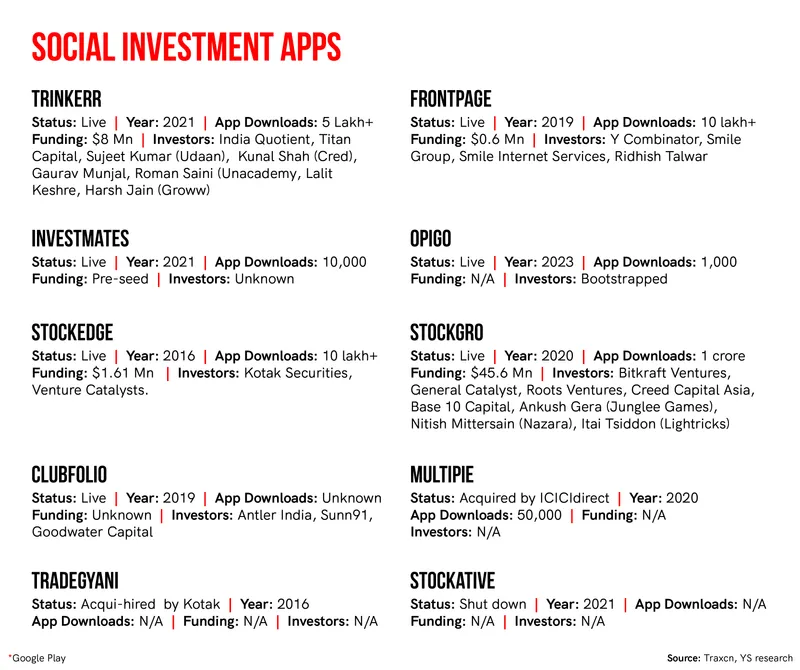

Platforms popular in the space include Trinkerr, FrontPage, InvestMates, OpiGo, StockEdge, and StockGro.

There are no specific laws or guidelines governing social trading apps, nor are there any legal requirements for them to obtain a SEBI registration.

Sameer, a 28-year-old marketing professional, had been curious about trying his hand at the stock markets and took a fancy to social trading apps. As on social networking apps, he could get a peek into what others were up to (on the stock markets, in this case), and, if he liked what he saw, take cues. The ‘others’ could be rookie traders like himself or more experienced ones flaunting their big wins.

So far, no harm. On these apps—such as , , —no one’s supposed to tell him what to do. What stock to buy or sell. In general, only qualified experts authorised by the capital market regulator, SEBI, can offer trading advice on any platform or media. (Platforms do engage such experts to offer trading advice, typically with the necessary disclaimers in place and with customers paying a fee for the access.)

For Sameer, who didn’t want to be identified by his real name (you will see why), social trading apps seemed like a safe window into the vast, mysterious trading market. These would allow him to ‘follow’ successful traders and, hopefully, gain a better understanding of the ways of the stock markets.

But it’s not been all so innocent. For several traders with huge followings on these apps—not all of them authorised experts—the money lies in luring rookies like Sameer to external platforms such as Telegram where they can charge for their expert stock calls—buy, hold or sell. Sameer ended up joining three such groups and soon ended up losing nearly Rs 1 lakh.

That’s not all. YourStory reviewed a few social trading apps in the course of this story, and found several afflicted with problems not unfamiliar to social networks—a lack of proper monitoring and regulation. While app operators say they moderate the content on their platforms, a basic probe tells a different story.

These apps are often swarmed with stock recommendations from popular traders—several of whom flex snapshots of stock market successes for their followers while also supplying web links to private channels for new followers.

In effect, social trading apps are outpacing platforms such as YouTube, Instagram, Facebook and Twitter as avenues for luring new traders to paid channels promising astronomical returns with direct stock recommendations (which is illegal unless from authorised experts). As more Indians take to the stock market—it’s still a tiny population with only about an estimated 8 million active traders as of March—this is a grave concern.

A spokesperson for social trading app Trinkerr, founded in 2021 in the wake of the Covid-lockdown rush to stock trading, said the company moderates all feeds and removes posts that are not by registered advisers, and is developing a version that will “make moderation more efficient” and not allow posts by non-registered entities.

“Only registered advisors (who will be given a blue tick) will get post access. This version is currently under development and will be out soon,” the spokesperson said in an email response to queries. The spokesperson also said private promotions are strictly not allowed and that the company has an automated system to flag posts and comments bearing trading recommendations.

A spokesperson for Frontpage said that apart from moderators removing spam and promotional content, users “collectively decide the quality of the posts and the contributors” and that “community-driven moderation on Frontpage is likely a better solution to weed out bad actors.”

As for any unauthorised ‘buy and sell’ signals posted on the platform, the spokesperson said this was “similar to how it happens on YouTube, Twitter or any other social platform”, adding, “Not sure about regulations here. I guess SEBI is also figuring out how to stop influencers, even TV channels, (from manipulating) markets.”

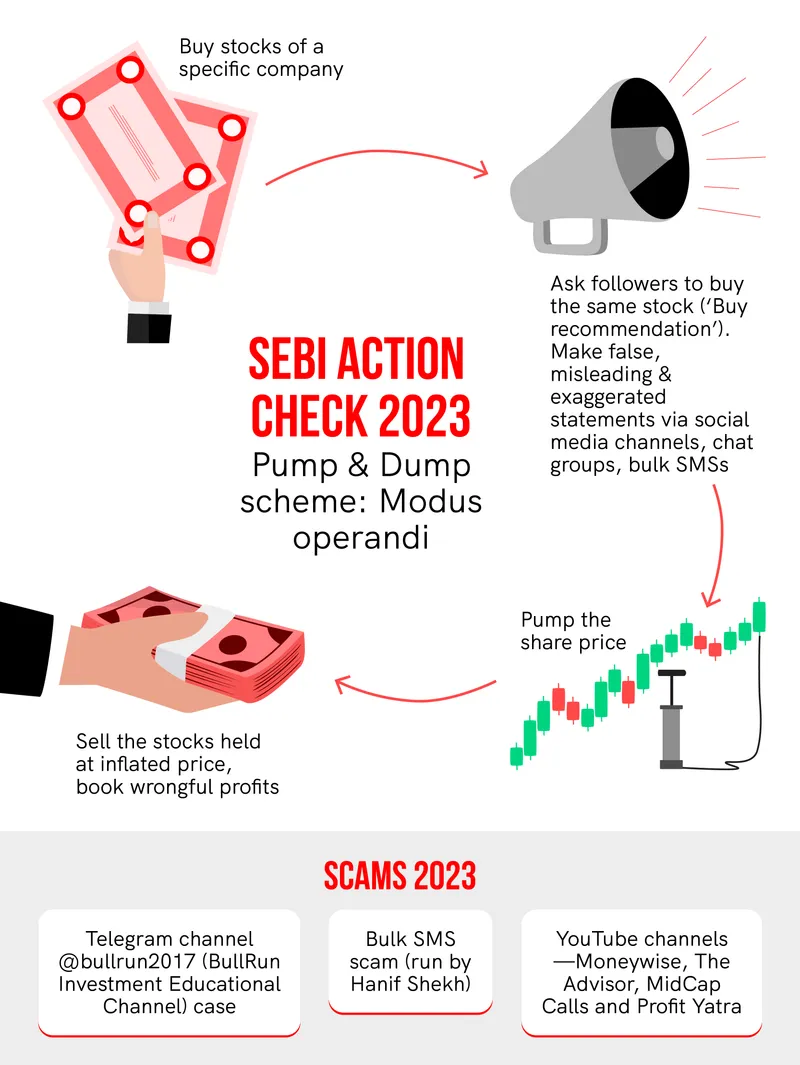

SEBI’s beef with social media tips

Social media stock tips have been a matter of concern for SEBI for some time now. The regulator time and again has cautioned investors of potentially fraudulent activities carried out through SMS, websites and social media, often advising users to deal with only its registered intermediaries.

But these intermediaries are too few. As per public data, there are a mere 1,300-SEBI registered investment advisers in India for an estimated trading population of about 8 million.

The “lack of specific regulation for these dedicated apps for the stock market, which are becoming popular among first-time traders, sans limited content moderation policies, may end up turning these apps as an indirect stage area for scammers,” said the founder of a wealth management advisory, speaking on condition of anonymity.

The moderation battle

With content being so varied and spread across different parts of these apps, the issue of moderating information takes primacy.

FrontPage and Trinkerr, as previously mentioned, say they have moderators to remove spam and promotional content. The latter is also working to disable posts by non-registered entities.

InvestMates takes a similar approach as these platforms. “We have community moderators who give feedback, besides the algorithm that highlights such chats," said Founder and CEO Prakash Nagarajan. "The content is instantly removed or users are suspended. Users are screened as per data privacy laws along with internal verification processing.”

For the most part, these apps outline basic guidelines such as asking users to stay on topic and act responsibly, besides restricting promotions. They also explicitly note that users are solely responsible for their interactions with other users, in the terms and conditions section.

In some cases, creators are allowed and charged by apps to share their social media links on their profile, including private channels promotions, an adviser who was approached by one such platform told YourStory on condition of anonymity.

Apps claim to take responsibility via verified ticks for SEBI-authorised advisers or reputation score, often leaving it up to users to act on their discretion. Top contenders on the app who are not verified by SEBI are given green ticks, which establishes the difference.

Newly launched app allows users to express only bullish or bearish sentiment of stocks, and get ‘scores’ on the basis of the gain made. These scores are indicative of how successful a user has been on the app–based on how accurate their bets have been.

“The idea of scoring is to have serious players and advisors build credibility to gain follower’s trust and then connect for advice,” says Devansh Mehta, Co-founder at Opigo.

On a similar note, Co-founder Vivek Bajaj shared how the company kept the community premium (paid) from the first day to separate wheat from the chaff.

“Once you pay money, you try to build a reputed community via credible data points and research rather than just talk about stock signals. We have more than 10,000 paid members who are paying Rs 12,000 per year to remain a part of this community,” he said.

Despite all the checks, it’s a ‘show, but no tell’ play as unqualified traders end up fluffing their profiles on some apps, and take the conversation to private chat rooms.

As per the unnamed adviser mentioned above, some apps work around algorithms to highlight creators based on their performance, but others charge an upfront fee for promotion of their private channels or courses.

“One of the reasons for the flurry of non-licensed experts on these platforms is the shortage of the licensed ones, of which the former is taking advantage of,” he said.

“These third-party apps cannot get enough RIAs (registered investment advisers) like us,” said Sujith Salunkhe, CEO at MoneyDhan, a SEBI-registered investment advisory. "We are always approached by them. But the compliance is backbreaking. Every advertisement we make must be approved from the BSE and SEBI portals. We have to pay Rs 6,000 as fee for each approval of PPT or advertisement we post."

Let’s take this to Telegram

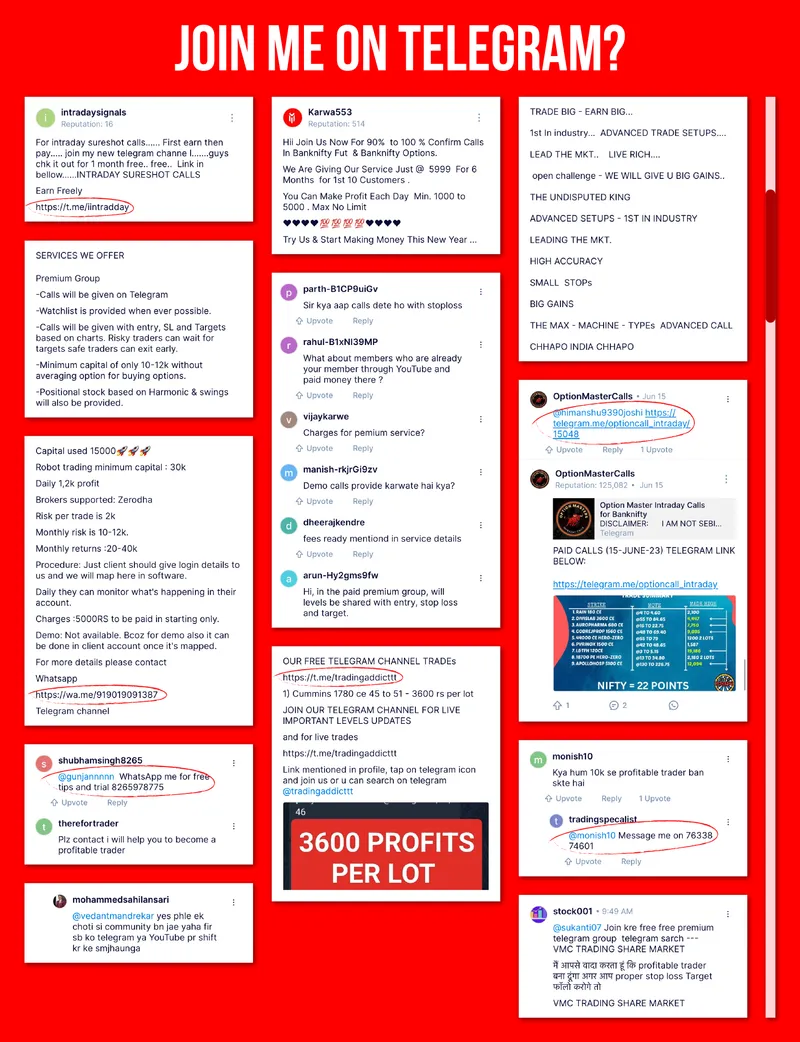

YourStory scanned through some stock trading apps and found several users posting links to their Telegram channels on their profiles and chats, using terms such as “join premium for stock tips”; “daily live trades”; “join for 4X-5X returns”; “we will give you big gains, small stops”; and “We give calls with entry, SL, targets, minimum capital 10K”.

Several even offered “robot trading” via Telegram/WhatsApp groups, asking users to pay a fee of Rs 5,000, to invest a minimum capital of Rs 30,000, and promising a daily profit of Rs 12,000.

“A lot of these self-proclaimed experts are giving advice on penny stocks and derivatives that are highly complex, risky and manipulative," said a stock market trader, also speaking on condition of anonymity. "For a first-time investor, it’s highly luring to fall prey to these shady traders, who charge no upfront fee but earn via broker affiliation and premium channels."

Operating in a sea of gray

At the moment, there are no specific laws or guidelines when it comes to social trading apps, nor are there any legal requirements for them to gain a SEBI registration.

Experts say the onus of the content shared lies on users and so does the responsibility to not fall prey to unsolicited investment tips.

“There is no law against sharing portfolios or trading patterns," said another investment adviser.

"SEBI won’t do anything about this because it comes under the education or knowledge category, which puts things under grey, and makes it worse when people with some influence start misusing it. This has been the problem with finfluencers, and now with everyone with such open-ended apps.”

Many have argued on the theory of no law for giving opinions or sharing trades, if no exchange of fee is involved and necessary disclaimers are put out by self-proclaimed experts.

However, in absence of content moderation policies, traders looking to sheen up profiles lure newbie investors to their private channels.

“There are very limited SEBI registered apps. Most of them are based around just giving stock tips and getting more creators on their platforms and have users trade via their broker/affiliate links. This is what the non-registered experts and platforms are taking advantage of,” said the founder of a licensed social trading app mentioned earlier.

Owing to the limited scale of such apps as of now, the regulatory spotlight is yet to fall on them, he added.

“There are two types of platforms at present. One which is run by experienced advisors who have been around and know the law, and other by techies. This domain has seen a lot of VC interest but no one understands the product and regulation well,” said the founder of a SEBI licence social investment app.

A securities market lawyer says the regulator is aware of all these apps and may soon come up with a self regulation policy for them as well.

Recently, SEBI came up with a framework for 'Execution Only Platforms' for direct plans of mutual fund schemes in a bid to protect the investors dealing in such schemes.

“A platform provider will have to do some self regulation. You cannot equate yourself with Twitter or Facebook. They don’t offer any execution service or specifically cater to stock market which is sensitive to scams,” said Karthick Jonagadla, Founder and CEO at .

On the contrary, Moin Ladha, Partner, Khaitan & Co, opined that there are different types of laws already established by the regulator and having a new special policy for ‘intermediaries’ may not be needed.

They, however, must cooperate with the authorities in sharing information.

“The nature of these apps is that anyone can come and post. They can’t filter each and everything but only have some measures at place. The same can happen on Reddit, Quora or Youtube. It really depends on the ‘intent’ of the user who, if misuses the platform, will proceed under the already laid down laws,” he said.

Edited by Akanksha Sarma