In good times or bad, Stellaris Venture Partners has a steady startup investment strategy

Early-stage VC firm Stellaris Venture Partners remains focused on having a long-term investment commitment with its startup portfolio.

Venture capital firms often tend to restrict the flow of capital into startups during periods of downturns while pushing as many investments as possible during an upswing in economic activity. However, Stellaris Venture Partners believes in keeping a steady hand.

The Bengaluru-headquartered early-stage VC firm believes in doing a certain number of investments each year regardless of the external environment. This way, it ensures a long-term investment commitment with its portfolio of startups.

“Over the last seven years, we decided that every year we will do ‘x’ number of investments,” says Rahul Chowdhri, Co-founder and Investment Partner at Stellaris Venture Partners, in a conversation with YourStory.

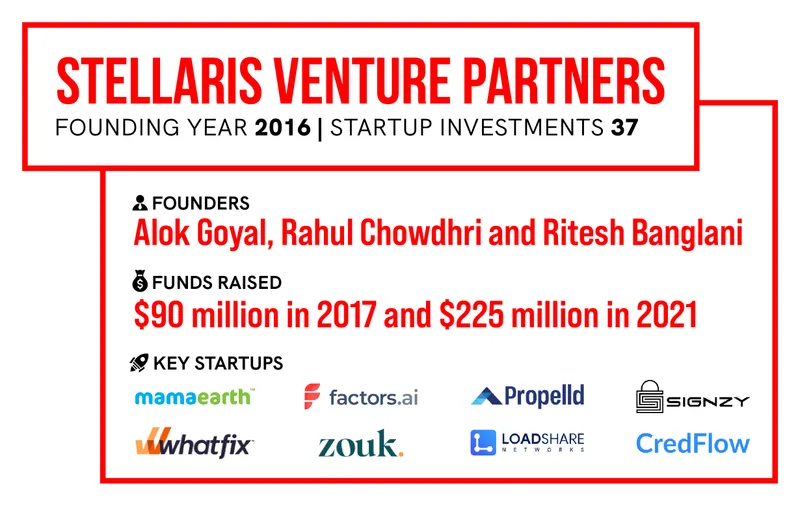

Founded in 2016 by Alok Goyal, Rahul Chowdhri and Ritesh Banglani, the VC firm has completed 37 startup investments cutting across multiple sectors. It has raised $315 million cumulatively across two funds—$90 million in 2017 and $225 million in 2021.

Stellaris, which counts , , , , and , in its startup portfolio, sticks to the discipline of not going overboard as its guiding principle. It typically does about 8-9 startup investments each year across the stage of seed and Series A funding rounds while a certain portion of its capital is reserved for the later stages.

Key principles

The Indian startup ecosystem is in the midst of a bleak funding winter with money drying up not just for late-stage startups but even young companies are finding it challenging to raise venture capital.

According to a PwC India report, funding into Indian startups fell by 36% in January-June 2023 to $3.8 billion compared to the second half of 2022. This was the lowest half-yearly capital inflow in the last four years.

In fact, venture funding on a weekly basis for the third week of August was in the single digit—the lowest ever recorded by the startup ecosystem.

Despite the uncertain environment, Stellaris believes in following its guiding principles of investment.

“Even when markets were going ballistic, we asked topline and bottomline questions to the founders,” Chowdhri asserts.

This year, Stellaris Venture Partners has investments in startups including , , , , and .

For Stellaris, there are two key stakeholders—investors or founding partners in their fund, and startup founders. To ensure both their interests are taken care of, the firm follows a top-to-down investment approach in sectors where they have a deep understanding and scouts for ventures or founders accordingly. Stellaris has invested in startups across B2B commerce, consumer tech, fintech, and SaaS sectors.

Here, the fund follows a diversified sector approach to have a more balanced portfolio and minimise risk. As Chowdhri candidly notes, “We cannot exactly predict which sector will do well.”

Secondly, it believes in providing the right support and empathy to these founders in their growth journey through mentorship, strategic inputs, and extending financial support.

Opportunities

Stellaris Venture Partners’ two big investment focuses are generative artificial intelligence (GenAI) and electric vehicles.

In the case of GenAI, Chowdhri ascertains there may not be many Indian startups building foundational technology models but Stellaris will focus on ventures which leverage these platforms to offer any service or product. Several of the firm’s existing portfolio startups like , , , and others are leveraging GenAI platforms.

Stellaris also backs tech-enabled businesses focused on consumers, supply chains, and global markets as the investment firm determines some sectors are still under-penetrated by technology and hold immense opportunity.

“The penetration of technology in various sectors will only go up and consumers expect better services at cheaper prices,” says Chowdhri.

In addition, Stellaris also sees opportunities for many Indian businesses, especially small- and mid-sized, to tap into global markets by leveraging technology.

Chowdhri says the firm has always focused on backing ventures building sustainable businesses in market segments which can offer high gross profit margins.

The early-stage VC firm invests anywhere between $0.5-3 million in seed-stage startups and $3-6 million at Series A round of funding. It has no plans of launching a third fund with enough capital left to deploy.

Being bullish

To fund startups, Chowdhri leans on his experience both as a fund manager—he was earlier associated with Helion Venture Partners—and also has experience working in companies such as Microsoft, BCG etc.

Over the last 15 years, he has seen the Indian startup ecosystem transform. He recounts the days when online travel and taxi operators relied on call centres for bookings despite being internet businesses.

“A large part of bookings were coming through telephones but smartphones changed the game,” he notes.

He is also of the strong belief that two key external factors are behind the change—the higher degree of technology penetration and increased purchasing power parity of Indian consumers.

“There is now a multi-decadal opportunity for India to thrive not just as an economy but also the tech economy,” says Chowdhri.

He remains very bullish on the prospects of the Indian startup ecosystem as he emphasises that for a country to rise economically, entrepreneurship needs to be at its core and technology will play a big role.

He has one piece of advice for all startup founders that regardless of the external environment, “make sure you do not run out of money.”

(The story was updated to reflect the correct Fund I size and GenAI startups portfolio.)

Edited by Kanishk Singh