Zomato records first-time profit in Q1 FY24; revenue up 71% YoY

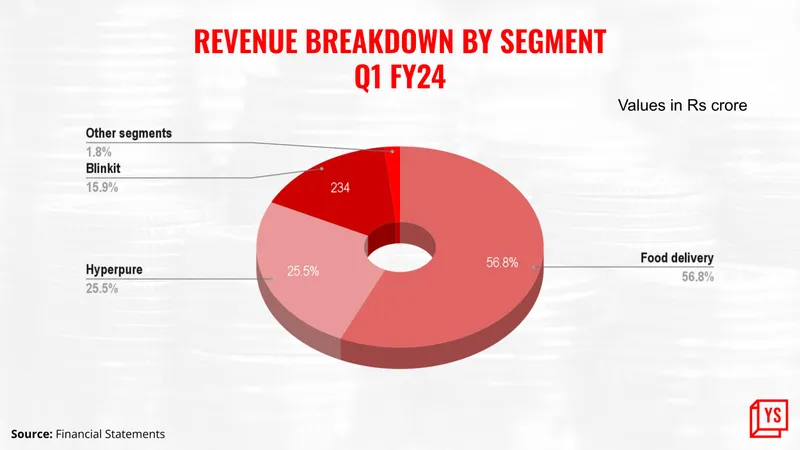

The Deepinder Goyal-led firm posted a 71% rise in operating revenue to Rs 2416 crore compared to last year. Revenue from Hyperpure, the company's B2B supplies vertical, grew 126% from last year.

Food delivery firm recorded a first-time profit of Rs 2 crore in the first quarter of FY24, from a loss of Rs 186 crore in the same quarter last year. The Deepinder Goyal-led firm reached profitability much earlier than its previous guidance where it said it expects to hit the milestone by Q2 FY24.

Operating revenue rose 71% to Rs 2,416 crore from Rs 1,414 crore in Q1 last year, helped by massive growth in Hyperpure.

“Realistically speaking, we were expecting to hit this milestone in the September quarter (Q2FY24), and we were being conservative in our earlier guidance. However, some critical parts of the team across our businesses out-executed our expectations/plans, and some of our initiatives delivered better outcomes than we had expected,” Akshant Goyal, Chief Financial Officer of Zomato, said.

Hyperpure—Zomato's business-to-business supplies vertical—rose 126% to Rs 617 crore from Rs 273 crore last year. This was primarily due to an increase in the minimum order value which led to a rise in average order value, the company said.

The firm's total expenses rose 48% to Rs 2,612 crore from Rs 1,768 crore last year, with delivery and related charges up 42%.

The company now aims to hit Adjusted EBITDA breakeven for Blinkit in the next four quarters, according to a statement to shareholders.

Zomato defines adjusted EBITDA as EBITDA plus share-based payment expense minus rental paid for the period as per IAS 116.

Food delivery

Gross order value (GOV) in the food delivery business in Q1 grew 14% to Rs 7,318 crore from Rs 6,425 crore, while average monthly transacting customers stood at 17.5 million. Growth in food delivery GOV was driven by robust growth in the number of orders as well as a modest uptick in average order value, Rakesh Ranjan, CEO of the food delivery business, said.

Ranjan–earlier the head of Hyperpure–was appointed as the head of food delivery last quarter. Rinshul Chandra was made the COO of food delivery while Rishi Arora was appointed as the head of Hyperpure.

Ranjan added that the growing adoption of Zomato Gold membership programme, demand recovery, and “great execution by the team” helped in boosting GOV.

Revenue from food delivery grew only marginally QoQ, indicating that food delivery growth continues to slow. The company re-introduced the Gold loyalty programme in January as one of its pioneering efforts to achieve profitability. The move is said to have helped reclaim market share from rival Swiggy, according to HSBC.

Blinkit’s performance

Zomato's quick commerce segment Blinkit posted a revenue of Rs 384 crore. The Deepinder Goyal-led firm acquired the grocery delivery company for Rs 4,447 crore in June last year.

While Blinkit saw a marginal rise in Q1 compared to last year, order volume fell 6% from last quarter, mainly due to a temporary business disruption in April, Albinder Dhindsa, CEO of Blinkit, said. Several delivery executives went on strike in April following some changes in their payout structure, resulting in the temporary closure of dark stores in certain parts of the country including Delhi-NCR.

“While the operations were back on within a few days, we faced a challenging period of around 45 days where the overall gig workers available to work in our system were 15-20% lower than normal. This was due to the above disruption as well as the heat and incessant rains. For us, this started to normalise in early June and we have seen healthy growth since then,” Dhindsa added.

The quick commerce segment expects to see 60%+ GOV growth YoY with improvement in unit economics. Dhindsa noted that Blinkit saw its highest-ever GOV and transacting customers in June and July.

Blinkit's GOV is very close to Zomato's GOV in some large cities and Blinkit is likely to drive more value than Zomato in the next 10 years, according to CEO Deepinder Goyal.

Zomato's shares on Thursday ended 1.65% higher at Rs 86.45 apiece.

(The story was updated with additional information and an infographic)

Edited by Akanksha Sarma

![[Book Review] The Idea Hunter: How to Find the Best Ideas and Make them Happen](https://images.yourstory.com/cs/wordpress/2012/12/IdeaHunterCover-424x620.jpg?mode=crop&crop=faces&ar=1%3A1&format=auto&w=1920&q=75)