Paytm's revenue jumps 32% in Jul-Sep quarter, net loss narrows to Rs 292 Cr

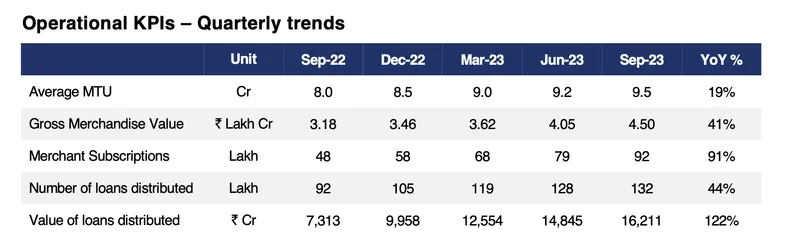

The growth was led by an increase in GMV, merchant subscription revenues, and more loans distributed through the platform, Paytm said.

Fintech firm recorded a 32% jump in revenue to Rs 2,519 crore in the July-September quarter (Q2 FY24) while narrowing down its losses to Rs 292 crore.

Its net loss in the year-ago period was Rs 571.5 crore.

“The growth was led by an increase in GMV, merchant subscription revenues, and growth of loans distributed through our platform. There are no UPI incentives booked during the quarter,” Paytm said in an exchange filing.

The company’s operational income or adjusted EBITDA (not accounting for ESOP expense) was up Rs 319 crore YoY to Rs 153 crore from a loss of Rs 166 crore in the corresponding quarter last fiscal.

It reported its first-ever adjusted EBITDA profitability in Q3 FY23.

Paytm revenue from the payments business surged 28% YoY to Rs 1,524 crore. As of September, there were about 92 lakh merchants paying subscriptions for its devices—an increase of 44 lakh YoY and 14 lakh QoQ.

“Net payment margin has gone up 60% YoY to Rs 707 crore due to an increase in payment processing margin and increase in merchant subscription revenues. Payment Processing Margin is at the higher end of 7-9bps range due to increase in GMV of non-UPI instruments, like postpaid, EMI and cards, and improvements in payment processing margin on these non-UPI instruments,” it said.

Meanwhile, its revenue from financial services, including loans, was up 64% YoY to Rs 571 crore. It managed to disburse Rs 16,211 crore worth of loans, of which Rs 9,010 crore came from Paytm Postpaid, Rs 3,927 crore personal loans, and Rs 3,275 crore merchant loans via its partner banks and NBFC—an increase of 122% YoY.

However, the value of personal loans disbursed came down QoQ as the company reduced shorter tenor loans (six months) on its platform, terming them as riskier. This resulted in a reduction in the value of loans, while the disbursal volumes have remained steady.

Currently, the fintech has partnered with nince NBFCs and banks for its credit card and loan distribution business.

The number of unique users who took loans through the Paytm platform reached 1.18 crore.

The total expenses were up by 14% to Rs 2,936.7 crore, of which employee benefit expenses and payment processing charges formed a major share. However, the firm managed to bring down its marketing and promotional expenses to Rs 258 crore from Rs 327.5 crore a year ago period.

On the RuPay credit card on UPI opportunity, Paytm said it is seeing good adoption by consumers. “We believe, over a longer period of time, this has a potential of becoming a decent revenue stream for UPI payments,” it added.

On Thursday, investment bank Jefferies initiated coverage on Paytm with a 'buy' rating and a target price of Rs 1,300. The bank is convinced that Paytm will become a profitable fintech globally in the next four quarters. It expects the listed firm to turn profitable by the third quarter of FY25 and generate sustained growth in accounting profits thereafter

Shares of Paytm ended 1.20% higher on Friday at Rs 980.05 apiece on NSE.

(More details to follow.)

Edited by Kanishk Singh