VC funding in October crosses $1B mark; sees 11% annual decline

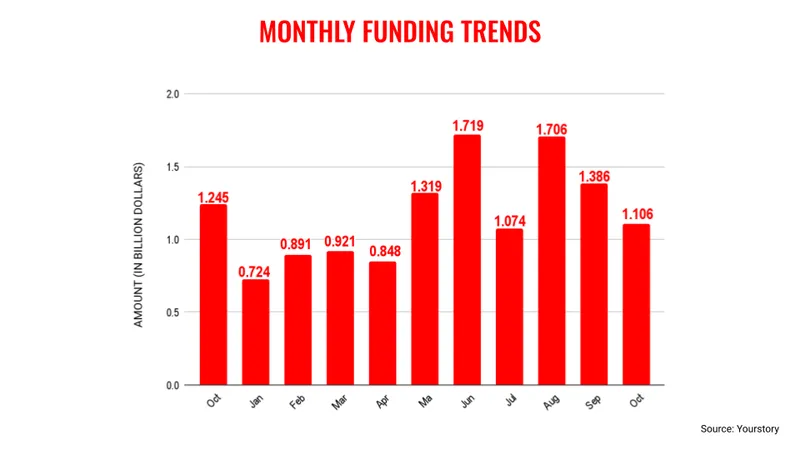

In October, startups raised $1.106 billion in funding cutting across 103 deals—a fall of 11% compared to the $1.245 billion raised in October last year.

Venture capital (VC) funding into Indian startups continued to stay at billion-dollar levels in October, the trend continuing for the last six consecutive months starting May this year

In October, startups raised $1.106 billion in funding cutting across 103 deals—a fall of 11% compared to the $1.245 billion raised in October last year. According to YS Research, it was a 20% decline compared to September 2024.

The table from left represents October 2023 followed by ten months of 2024

The positive aspect of VC funding this month was the total amount crossed the $1 billion mark again. The $1 billion is an important psychological threshold for the Indian startup ecosystem to signal that things are moving in the right direction.

At the same time, the total VC funding for the 10 months of 2024 touched $11.7 billion, overtaking the $10.8 billion recorded in the entire 2023.

However, October has seen a slowdown in terms of the quantum of money raised and the number of deals. The month saw 103 deals compared to 117 in September 2024.

Eruditus, Samunnati, and Finova Capital raised funds in the range of $100 million and above. Meanwhile, upGrad and Purplle secured funds within the $50 million-$100 million range. These funding deals show that higher VC inflow into the Indian startup ecosystem is largely dependent on high-value deals.

It was quite noticeable in October, when early-stage startups received $244 million from 80 deals and late-stage companies got $354 million from just four deals.

Early-stage startups are consistently receiving the largest volume of deals right through the year, although the deal values are low.

Interestingly, startups received the second-highest debt capital in October, highlighting how companies are opting for the debt funding route as the equity route is still challenging for many.

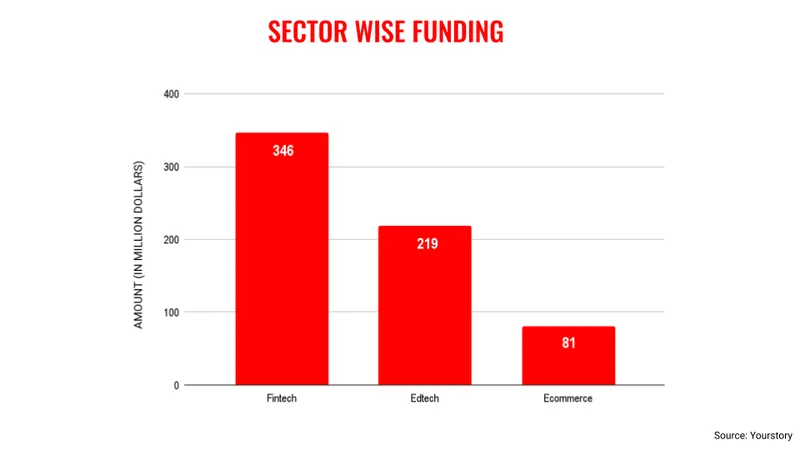

In terms of sectors, fintech raised the most funds, followed by edtech and ecommerce. The fintech segment has consistently maintained the number one position in receiving VC funding largely to scale business opportunities in this sector.

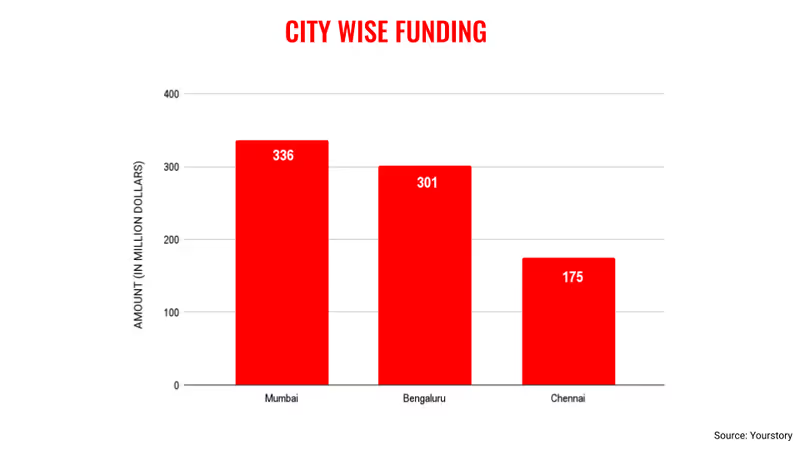

Mumbai emerged as the leading destination for VC funding in October at $336 million, followed by Bengaluru and Chennai. Surprisingly, Delhi-NCR, which is generally in the top three, just raised $93 million this month.

Overall, the VC inflow has been in the right direction for the Indian startup ecosystem, and in 2024, funding will rise at least 15% more than in 2023. It is expected that 2025 will be a better year for Indian startup funding.

Edited by Suman Singh