Why your Refunds take time?

1557495172729.jpg?fm=png&auto=format)

If you shop online then you might have faced the following situations,

- You return an item and the money was promised to be credited within 5-10 working days.

- The amount is debited from your account but the order is not placed.

You expect the refund to be reflected into your account immediately, then why does it take so long?

Well, this blogs explains what exactly happens behind the scenes and what you should be doing as a customer to get your refund. The two cases mentioned above are the instances when a refund request is created. Let’s discuss these instances one by one.

1. Customer raises refund request to online business for returned goods.

1557495074460.jpg?fm=png&auto=format)

Customer purchases certain goods online which he/she then returns for some reason like poor quality of goods. Customer raises a refund.

What happens next is a return request is made by online business via their payment gateway. The payment gateway then transfers the information to the acquired bank via API. The acquiring bank (bank associated with the online business ) communicates with the issuing bank (bank associated with the customer with which payment was made) and raise refund request. Further, the request is accepted, filed and processed by the issuing bank and after the process is completed the refund is reflected into customers account.

Though the process seems simple on paper, it is a complicated process as the information exchange takes place between 4-5 different parties and there are many such refund requests raised, thus it takes 5-10 days for the return to reflect into customers account. Sometimes it can take more than 10 days if the return request get dropped due to System/Network failure and the request needs to be initiated again.

2. The amount is debited from account but the order is not placed.

The customer makes an online payment for certain goods and services, he successfully checks out making the payment through a payment gateway for desired goods and services. But the order is not placed and the amount is debited from customers account. The customer claims for the refund.

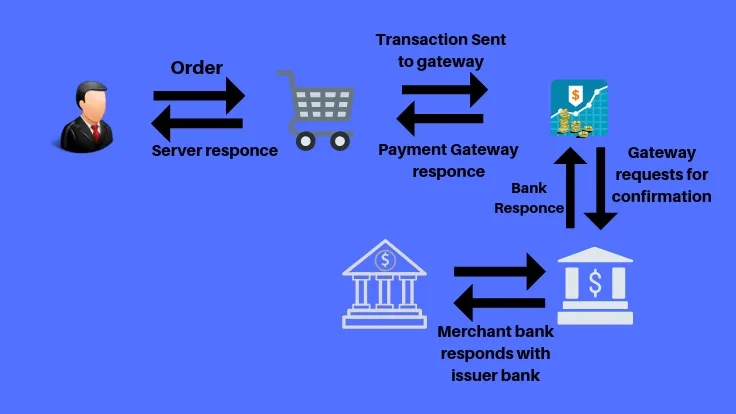

How does the payment process work?

There are several steps and parties involved in the entire online payment process,

- A website from where the customer makes payment.

- Payment Gateway using which customer will make payment.

- Acquire a bank (bank associated with online businesses).

- Issuing bank( Bank associated with the customer).

While proceeding with the payment you need to choose the payment mode like Credit/Debit card and fill in the details.

Once you finish filling up the details the data is sent to payment gateway system which then transfers the data to a bank associated with a card. Bank creates request with payment system like visa or master card depending on the card used. These payment systems check if the customer has required amount on balance to pay for the purchase, if yes the bank directly connects with the merchant and the amount is transferred to merchants account within several days.

Related Post: Points to consider for Payment Gateway Integration in Mobile application

Impact of failed payment:

Two-factor verification is the most relevant step when it comes to payment processing. After two-factor verification is completed a payment request is made to issuing bank which debits the required amount from customers account. Issuing bank confirms the status of payment to the acquiring bank. The customer then receives the notification regarding the payment via a payment gateway.

Why Does Payment processing fail?

Payment process can fail at any step during its communication from one party to another,

Failure of payment can occur due to network or system failure as the customer should be connected to the internet until the entire transaction is completed.

There are almost 4 parties involved in the complete transaction process. Payment can fail during the communication of issuing bank with acquiring a bank or can fail during communication of payment gateway with the acquiring bank. There are several infrastructures on which online payment system work most of which are not that optimized to handle such issues.

Role of Payment Gateway in the refund process.

Payment gateway’s role is to check for the status of payment with the acquiring bank, payment gateway’s job doesn’t stop if the payment status with the acquiring bank is ‘failed’. When this happens, payment gateway keeps polling the acquired bank for the payment status that is updated as ‘Failed’ has changed to ‘Successful’. If the status is changed then the online business where the transaction was done is informed and is given two options,

- To collect the payment and deliver the goods/services for which the payment is made.

- Not to collect the payment as it is no longer in the position to serve the customer for any reason like goods for which the payment was made are no longer available. In this case, the amount will be refunded to the customer within 5-10 business days.

Do not worry about the failed payments and refunds, the amount deducted will always reflect back to the mode of payment selected while making payments. If the payment is made using digital wallet then the amount will be refunded to a digital wallet and not the bank account.

So shop online and stop worrying about failed payments as you have knowledge about what happens behind the scenes!

![Top 10 Cheap Indian Press Release Distribution Services [Updated]](https://images.yourstory.com/cs/1/b3c72b9bab5e11e88691f70342131e20/LOGO-DESIGN-PR-INDIA-WIRE-03-1595693999405.png?mode=crop&crop=faces&ar=1%3A1&format=auto&w=1920&q=75)