How India’s EV manufacturing can recover in the post-COVID-19 era, according to SMEV Dir-Gen Sohinder Gill

In an exclusive interview with SMBStory, Sohinder, who interacts with policymakers, academia, technology institutions, certification agencies, and foreign partners to help build India’s EV ecosystem, discusses the current state of EV manufacturing in India and what the future holds for the sector.

The coronavirus lockdown in India brought manufacturing operations of the auto industry, which had been accelerating to meet the deadline for BS-VI norms, to a grinding halt, and hampered sales.

Big auto companies, like Maruti Suzuki and Honda, have had to shutter some of their manufacturing plants around the country to conserve cash, while others - including international auto manufacturers - have had to axe jobs or divest certain units.

The electric vehicle industry in India, that had just turned a corner in the latest fourth quarter, after struggling with adaption, infrastructure and policy for quite a while, took a massive hit too. The lockdown undid a lot of the sector's progress by crippling its network.

But with lockdown restrictions easing a little, the EV sector is starting to pick up speed.

“Things have started limping back to normal in the recent weeks, particularly due to a positive response from customers towards online booking schemes floated by some EV manufacturers,” says Sohinder Gill, Director General at SMEV (Society of Manufacturers of Electric Vehicles), and CEO, Hero Electric.

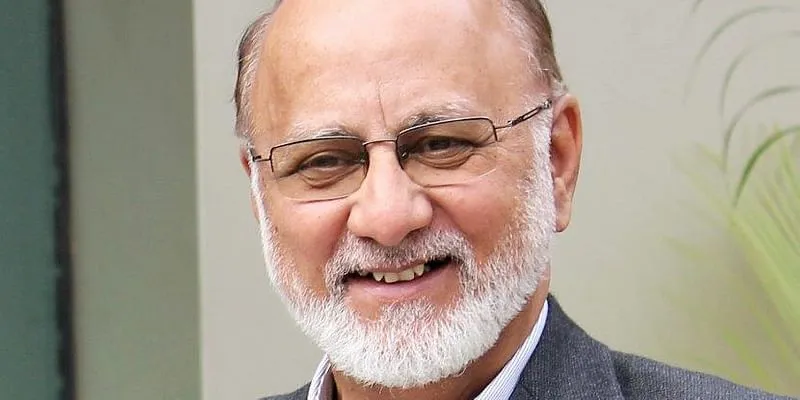

SMEV Director General Sohinder Gill

“Indian electric two-wheeler manufacturers are somewhat optimistic of a robust recovery in the second half of this year due to the surge in demand for personal vehicles,” he added.

According to a ResearchAndMarkets report, the two-wheeler market in India is forecasted to expand at a CAGR of 7.33 percent and reach a sales volume of 24.89 million units by 2024, from 21.19 million in 2019.

With the focus of the nation drifting towards ‘atmanirbhar’ (self-reliance) in the wake of the pandemic, large-scale import substitution in the EV space can pick up if there’s enough local demand to justify localisation.

In an exclusive interview with SMBStory, Sohinder, who liaises with policy makers, academia, technology institutions, certification agencies and foreign partners to help build India’s EV ecosystem, discusses the current state of EV manufacturing in India, and what the future holds for the sector.

Edited excerpts from the interview:

SMBStory [SMBS]: What is SMEV all about and how does it help EV manufacturers?

Sohinder Gill [SG]: I started SMEV in 2009 as a registered association representing the manufacturers of electric vehicles and electric vehicle components in India. SMEV provides a window to EV players and works closely with the Central and state governments to assist in the formulation of policies and processes supporting the EV ecosystem.

We aim to spread awareness about electric vehicles in the country and put India at the forefront in terms of the adoption of EVs. SMEV plays an active role in bringing up discussions on the issues faced by the EV industry and comes up with practical solutions to solve them.

SMEV assists manufacturers in understanding and implementing the various government schemes to gain optimum benefits. Additionally, we coordinate with nodal agencies for faster implementation of pilot projects and help state nodal bodies in preparing state EV policies.

We also encourage manufacturers to adopt best practices of fact-based customer education, fair trade practices, and battery recycling. SMEV strives to become a knowledge centre for promoting indigenisation and encouraging quality manufacturing.

SMEV has more than 100 members from EV segments such as four- and three-wheeler manufacturing, bus manufacturing, two-wheeler manufacturing, auto components and battery manufacturing, etc.

SMBS: What was the status of EV adoption in India before COVID-19?

SG: The electric two-wheelers segment gained significant momentum in the first phase of the FAME scheme, which ended on March 31, 2019. The FAME 2 scheme has in some way been a dampener with the withdrawal of subsidy of the popular selling models.

Despite this, the two wheeler segment grew by 20 percent in FY 19-20 over the previous year. E-rickshaws have also grown significantly in the last two years.

However, the sales of e-buses are mostly dependent on the tenders issued by the state governments and on the subsidies. Electric cars had a stunted growth mainly because of limited available options till now.

New entrants like Hyundai and MG have entered the market recently, and along with new offerings from Tata and Mahindra, we expect a jump in sales of electric cars this year.

Further, the B2B segment is showing good growth potential for electric scooters and electric cycles.

SMBS: When COVID-19 struck, what happened to component makers?

SG: Most component makers were waiting in the wings for EV volumes to grow in order to invest. COVID-19 has further delayed their plans. Those who had started the EV component business are obviously in the same boat as OEMs.

However, it seems that some of the business houses are taking a leap of faith and beginning to invest in EVs, sensing an opportunity in batteries and IoT and EV-specific components.

Sohinder is also CEO at Hero Electric

SMBS: What is your vision or recovery mindset for EV manufacturers to expand their business in the post COVID-19 era?

SG: Electric two-wheeler manufacturers are optimistic about a recovery, and are planning their product portfolios and aligning their businesses to meet the customer demand. E-rickshaw makers are also trying to innovate solutions of partitioned spaces and fixed seats to offer safe solutions.

Electric car manufacturers are hoping the trend of good sales witnessed in the last quarter continues. They hope more people become environmentally conscious and factor that into their purchase of vehicles. E-bus adoption would depend on how much money the government can spare amidst its own woes of rapidly depleting exchequer.

Thus, on the whole, the mindset of EV manufacturers is not as negative as the fossil fuel vehicle manufacturers who fear a significant degrowth in their top and bottom-line. There is a strong possibility that many EV manufacturers may continue to expand their capacities and capabilities in the post-COVID era.

SMBS: What are the main challenges for EV adoption in the next two or three years? What should be done to address these challenges?

SG: The main challenge lies in the lack of an integrated approach between the various ministries and the industry. Lack of mass awareness, lack of financing and lack of infrastructure are other factors that need to be tackled to boost the growth of EVs.

We haven't been able to push the adoption of EVs with a single-minded focus.

COVID-19 perhaps could be a positive turning point to renew the focus towards EVs because everyone, including the policy makers, have realised how air pollution can be reduced by substituting fossil fuel vehicles with EVs.

Perhaps the time has come to go back to the drawing board and redraw the plans for a quick take-off of EVs with some bold initiatives such as taking a relook at the demand incentive, portraying EVs as a solution to the clean environment under the "Swachh Bharat Campaign", instructing banks to finance the switch, and mandating delivery businesses to convert their fleets to EVs.

SMBS: What is the role of the government in boosting EV adoption?

SG: Looking at the countries that have made good progress in EVs, it is evident how important and crucial the government support is. In India, reducing the dependence on fossil fuels and cleaning the environment are certainly our national agenda and EVs are a definite answer to both these issues.

Properly planned and meticulously executed policies can do wonders, as seen in China and Norway. In India, we have had a policy paralysis of a sort till recently, which is now beginning to clear up. Going forward, it seems the government is clear and has made up its mind on how to promote EVs in the larger interest of the country.

SMBS: What is your opinion on subsidies? To what extent will they help boost EV adoption and how should they be implemented?

SG: Direct incentives in the form of subsidies are certainly required to boost EV growth in the initial years to bring about a near price parity with conventional vehicles in order to catalyse the conversion. Such policies should, however, be tapered once the adoption reaches a threshold level.

We think that front-loading of a heavy dose of subsidies to bring one million EVs on road in a short span of two to three years will work much better than spending the same money in a prolonged dose of diluted support over a period of five to six years.

SMBS: What is an ideal energy mix India should adopt to make EVs truly clean? How do we achieve this?

SG: Currently, we are getting almost eight percent of our energy supply from clean energy sources, which is more than sufficient for the present volume of EVs on the road. The ambitious renewable energy programmes of our country are certainly enough to keep pace with the likely demand in the next five to ten years.

The Ministry of Power’s idea of the creation of a clean energy grid for EV charging stations is a step in the right direction towards making EVs truly clean.

SMBS: What is the extent of the possibility of import substitution in the EV space?

SG: It's all a question of scale. We believe that demand generation should precede localisation as there will be plenty of interest in the component sector to switch over to EV business if they see volumes coming.

The MNRE, along with Niti Aayog, is working on a separate battery manufacturing policy, wherein the government will offer some upfront fiscal subsidy to local lithium battery manufacturers.

In other components such as power trains, supply-side incentives can similarly trigger localisation in addition to the demand generation.

However, import dependence will continue for minerals that we do not seem to have in sufficient quantities, such as lithium and rare earth for permanent magnets.

Edited by Aparajita Saxena