Small fashion brands, textile manufacturers struggle amidst the second wave of COVID-19. But there’s still hope

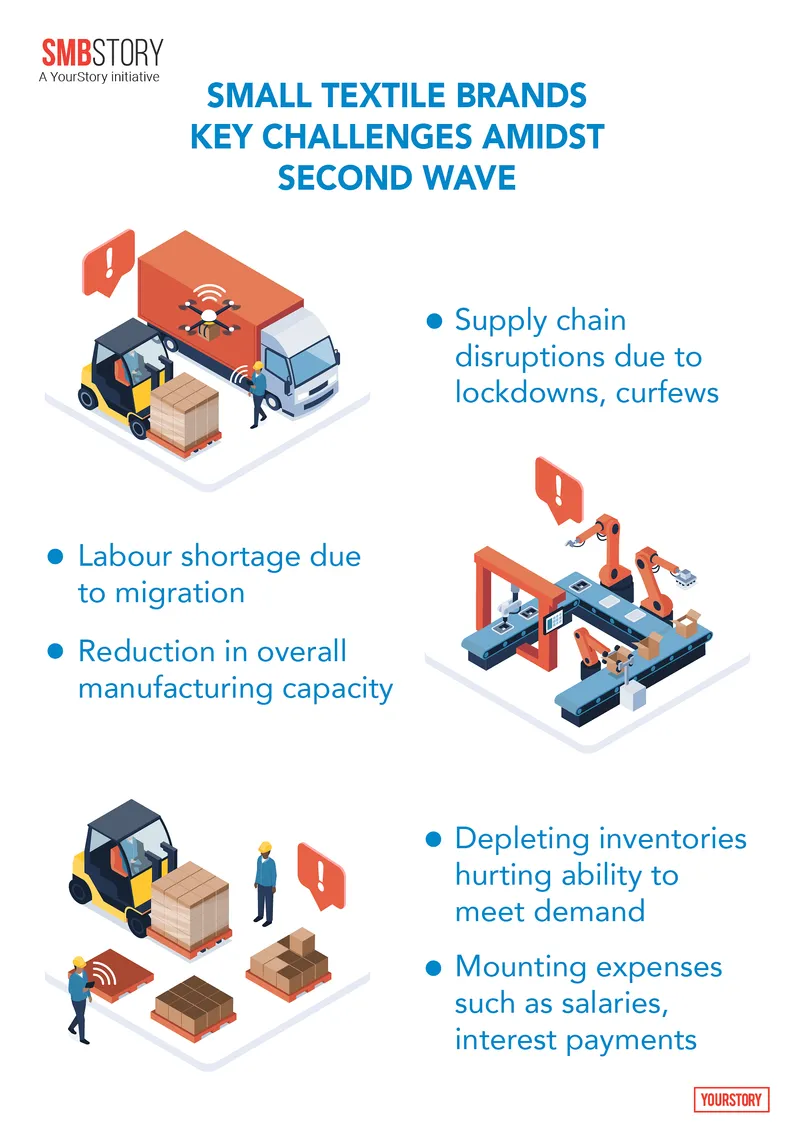

Small-scale, digitally-enabled fashion brands have built the necessary tools to sell online. But they continue to face disrupted supply chains, fast-depleting inventories and labour shortages. Here’s how they are looking to survive.

For years, Rakesh Saini visited local Noida markets to source raw material and accessories for his denim wear and athleisure brand Kross Stitch.

Now, roadside markets and small shops selling threads, yarn and needles have all gone quiet.

The second wave of COVID-19 and the subsequent restrictions in Noida and key markets across the country mean entrepreneurs like Rakesh are also weighed down by supply chain disruptions and labour shortage amidst fast-depleting inventories.

While textile manufacturing units in industrial areas are allowed to run, supporting shops and ancillary markets have remained shut amidst statewide lockdowns, in turn hindering the production at these plants.

“If we had stocked up on needles and thread earlier, our day-to-day operations would not have been affected badly,” says Rakesh, whose manufacturing unit’s productivity has rapidly declined over the last two months.

Rakesh sources material from vendors in Delhi markets, who acquire it from textile hubs in Gujarat and Punjab. These too have come to a standstill.

“Supply chains are in poor condition. Even as festivals approach, we are unlikely to meet increasing demand as our production is hampered by supply chain disruptions and shortage of labour,” he says.

Compounding his worries, upto 70 percent of his factory workers have not returned to Noida after leaving for their hometowns for Holi in March amidst rumours then of an impending lockdown.

“During the first wave, people assumed the pandemic was nothing major and would disappear. This time, everyone is more scared,” Rakesh says, adding that online sales at Kross Stitch have declined by 60 percent.

The entrepreneur also runs Trois, which manufactures fabric exclusively for Berrylush, a Noida-based D2C women’s apparel brand. Despite being digitally-enabled, Berrylush faces challenges sourcing raw material from suppliers across textile hubs.

“In Surat, factories are supposed to run for 24 hours a day. Now, they are not allowed to run the whole day, and this has impacted our raw material. For instance, if we were supposed to receive two lakh metres of fabric in a shipment, we are receiving only 40,000 metres now,” says Alok Paul, cofounder, Berrylush.

Alok Paul, cofounder, Berrylush

By optimising the use of the raw material available, the small D2C apparel brand is attempting to build its inventory so it can meet demand when production is hampered.

“Last year, we recovered well and exceeded our financial projections. We were expecting to clock between Rs 7 crore and Rs 8 crore in revenue in 2020, but we managed to record Rs 14.68 crore instead. This was largely because we focussed on building inventory. This time too, we are doing the same,” Alok says.

He remains optimistic about the business’ future as sales have not dropped significantly. Counterintuitively, the brand’s vacation wear and social wear for women continue to sell.

“Our customers don’t buy our products just for their utility. Rather, our vacation and social wear act as feel-good factors in these difficult times. Our products are non-essential, yet people buy from us and feel joy wearing such apparel at home, taking pictures on their terraces, posting them on social media, etc,” he explains.

Impact on textile hubs

Berrylush is likely on the road to survival, but supply chains continue to be impacted by local lockdown restrictions across major textile hubs including Ludhiana, Tirupur, Bhilwara, and Surat.

Curfews have resulted in restricted movement of goods, leading to non-availability of fabric, yarns, etc. in these towns. Restrictions in Coimbatore and the complete shutdown of textile units in Tirupur have resulted in several challenges for textile manufacturers.

Venus Sadh, an entrepreneur who runs a fabric dyeing and printing business in Surat, also echoes the voices of other textile manufacturers in the country who say that the second wave has impacted their businesses more severely than the first.

With no options for moratoriums on interest payments that were provided during the first wave, businesses like Venus’s Sapphire Fab are in many instances reeling with a near 100 percent decline in sales.

“We are traders who source raw material, make fabric, and sell to business-to-business (B2B) customers. However, shipments have been cancelled and exports have come to a standstill. Despite zero sales, we have to pay salaries to our employees. A large number of local printing mills facing similar scenarios have shut down,” Venus says.

ICRA labelled the second wave of COVID-19 as a ‘strong headwind’ to fashion retailers. It expects recovery back to pre-COVID levels to take until FY23.

Still, encouraged by the recent partial opening of the Surat markets, Venus, like entrepreneurs Rakesh and Alok, is hopeful that his business will survive the worst of this crisis.

“We can’t think about growth at all. As of now, our only focus is ensuring survival,” he adds.

Large fashion retailers, however, face a different problem. They are dealing with the challenge of clearing excess inventory. The likes of Tommy Hilfiger, Calvin Klein, Arrow, and Jack and Jones are reportedly planning to push their spring-summer collections till October.

Domestic rating agency ICRA labelled this second wave of COVID-19 infections as a ‘strong headwind’ to fashion retailers. It expects recovery back to pre-COVID levels to take until FY23.

Pivot and persist

To tide over this crisis, many smaller textile and fashion brands, who are fighting to get their sales back to pre-COVID levels, are also choosing to pivot to manufacturing new product lines such as face masks and leisure wear - embracing a strategy that many adopted last year.

For some, this move has paid off. For others, not so much.

In the case of Mumbai-based organic kidswear brand Greendigo, the pivot to making cotton masks worked because of its target customer base.

“Masks were only available at medical stores and no one catered to kids’ sizes. We quickly pivoted and started making organic cotton masks for kids. These masks flew off our shelves and were well-received in the market as they were comfortable, breathable and washable,” say Greendigo co-founders Barkha Bhatnagar Das and Meghna Kishore.

Greendigo Cofounders - Barkha Bhatnagar Das (L) and Meghna Kishore (R)

In addition, the ecommerce-enabled brand did not experience an alarming dip in its sales of kids apparel since young children outgrow their clothes every few months, explains Meghna.

“We also experienced a large number of orders being sent out as gifts for occasions such as the arrival of a newborn, a baby’s milestone birthday etc,” Barkha says.

Jaipur-based Nandani Creation’s foray into mask manufacturing did not go so well. The firm, which runs ethnic wear ecommerce site jaipurkurti.com, attempted to import an expensive, N95 mask-manufacturing machine from China last year and make synthetic masks.

“The machine got stuck at customs for three months and we missed the boom. Eventually, we managed to work on some government tenders, but overall it was not a great move,” says Anuj Mundra, MD, Chairman at Nandani Creation and Jaipurkurti.

The pivot to synthetic mask manufacturing may not have worked for the brand, but its venture into loungewear paid off. In 2020, Anuj introduced loungewear to the brand’s product portfolio as customers were spending more time at home.

“Sales of cotton wear such as t-shirts and pajamas went up last year and helped us survive,” Anuj says.

But now, much like Kross Stitch and Sapphire Fab, his business is feeling the impact of supply chain disruptions amidst the second wave.

“Last year, we were able to stock raw materials and inventory. This time, people involved in the supply chain are not willing to work as they are more scared. Our production is hampered. We are also unable to build inventory as we exhaust our stock in meeting demand,” he says.

Anuj adds his business' online channels have taken a 20 percent hit compared to a 100 percent decline in his offline sales at four physical stores.

In Hyderabad, entrepreneur Vandana Kalagara echoes Anuj’s sentiments. Her clothing brand Keebee Organics is able to sell in-stock items online but is unable to source raw materials easily.

“The impact is similar to the first wave. Our manufacturing is halted now due to lockdowns and restrictions. Despite introducing some casual wear to boost sales, we are almost out of stock of our products,” she says.

Keebee cofounders Vandala Kalagara (left) and Smruti Rao (right)

The Road Ahead

Even as textile manufacturers and brands such as Kross Stitch, Berrylush, Sapphire Fab, Greendigo, and Keebee Organics battle it out to survive challenges amidst the second wave of the COVID-19 pandemic, the longer-term growth prospects for the industry are expected to be favourable.

Macro trends such as rising income levels, increasing penetration of organised retail, continued availability of natural resources such as cotton, jute, wood, etc and favourable government policies for 100 percent FDI (automatic route) in textiles and setting up of mega textile parks are likely to continue driving demand for textiles, according to an IBEF report updated in late May, 2021.

The report also suggests that demand in the textiles sector is expected to grow at 12 percent CAGR to reach $220 billion by 2025-26.

And so, as lockdown restrictions gradually start to ease across the country, digitally-enabled textile brands and their textile vendors appear poised to capitalise once domestic demand for fashion returns to pre-COVID levels and export demand is restored.

Edited by Tenzin Pema