How TransUnion CIBIL's credit scores help small businesses secure easy loans

The credit information company's CIBIL Rank and CIBIL score are used by lenders to evaluate a small business' credit health. Find out how it works:

Financial institutions such as banks and Non-Banking Financial Companies (NBFCs) undertake risk when lending to individuals and small businesses. This risk is heightened if the loan is free from collateral. These lenders require assurance that the loan amount will be repaid in time.

Indian small businesses and MSMEs often do not have the collateral or any other way to assure lenders that the loan will be repaid on time.

To reduce the risk on non-payment, banks depend on credit information and reports generated by independent credit rating agencies, or credit information companies.

These are specialised financial institutions that maintain a database of credit and financial information of individuals and businesses. They generate Credit Information Reports (CIR) which lenders can use to look at the loan applicants' credit histories and decide whether to approve or decline a loan.

Started in 2000, one of the most popular credit bureaus in India is TransUnion CIBIL, earlier known as CIBIL (Credit Information Bureau India Limited). In 2017, American consumer credit reporting agency TransUnion acquired a 92.1 percent stake in CIBIL, after which it came to be known under its current name.

Today, TransUnion CIBIL claims it has credit data of over 2,400 members, including all leading banks, financial institutions, NBFCs and housing finance companies, and maintains credit records of over 550 million individuals and businesses.

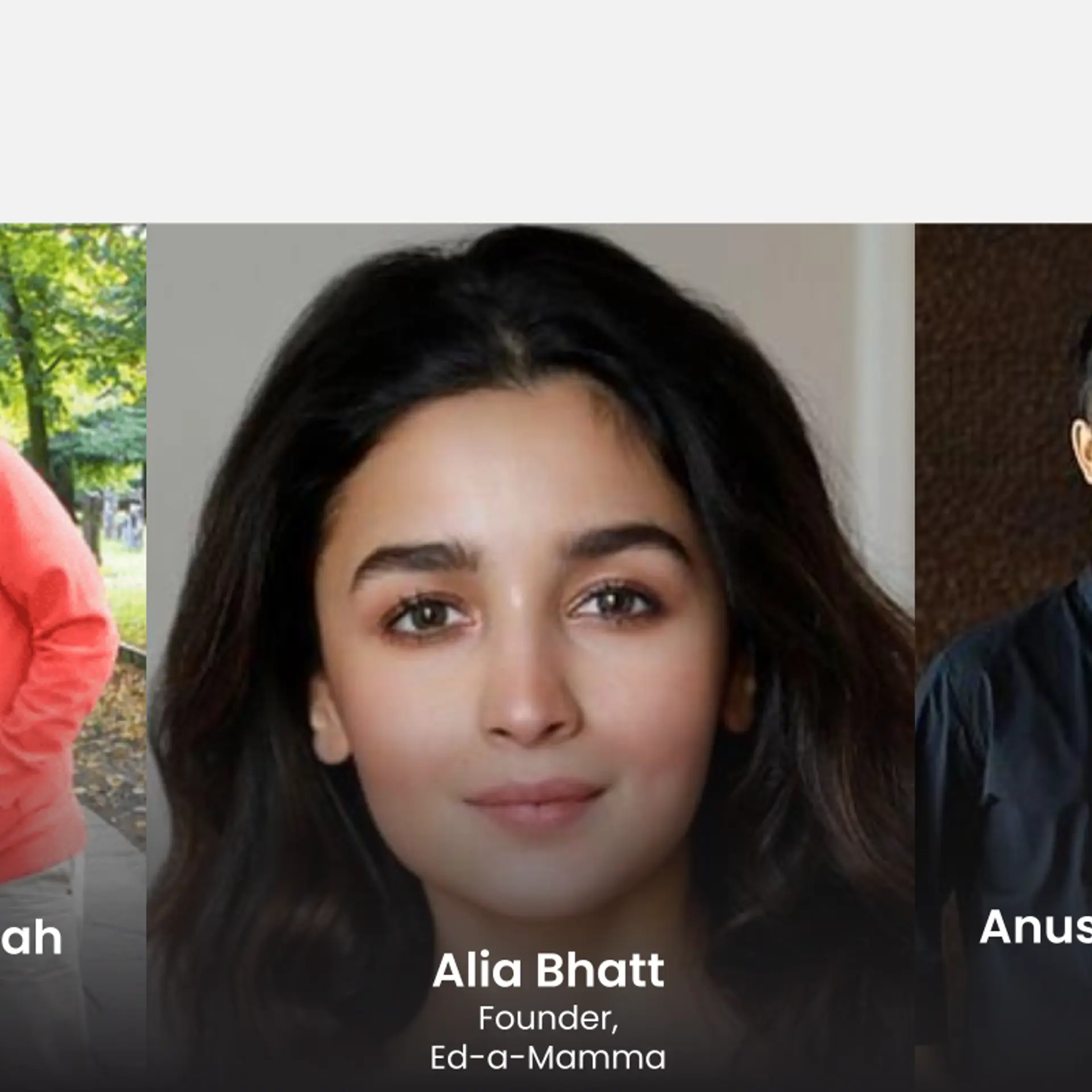

Sujata Ahlawat, VP and Head of Direct-to-Consumer Interactive, TransUnion CIBIL

In an exclusive interaction with SMBStory, Sujata Ahlawat, VP and Head of Direct-to-Consumer Interactive, TransUnion CIBIL, explains why small businesses and MSMEs need a credit rating and how TransUnion CIBIL fulfills this need.

Edited excerpts of the interview:

SMBStory: How has the borrowing capacity of MSMEs and small businesses changed?

Sujata Ahlawat: Currently, the MSME sector contributes to about 29 percent of India's GDP and this contribution is going to increase in the future. However, MSMEs continue to face challenges, with access to affordable credit being one of the most crucial ones.

The challenges in borrowing may be partly due to the MSMEs' lack of knowledge about their loan eligibility criteria as well as the processes and documents required for business loans. Lenders are also a little more cautious as the MSME segment is traditionally seen as a riskier lending option, vis-à-vis other options available.

SMBS: What is TransUnion CIBIL's role in addressing these challenges?

SA: TransUnion CIBIL’s Company Credit Report (CCR) and CIBIL Rank play a role in facilitating MSMEs’ access to credit and loans. CIBIL Rank is an indication of a company’s credit-worthiness, based on its credit history and payment patterns. It ranges on a scale from one to ten and caters to MSMEs who are looking to take a business loan and expand their businesses.

The CIBIL Rank is used by lenders to evaluate a company’s credit health while underwriting a business loan. This makes it a critical influencer when lenders are evaluating a company’s loan-eligibility and underwriting a business loan.

Through the DTC vertical, we help consumers understand and assess their credit-worthiness based on the CIBIL Score —a three-digit numeric summary of an individual’s credit report, ranging from 300 to 900. This is also used by lenders to assess the applicant’s repayment capability before approving a loan.

SMBS: What is the importance of CIBIL rank? What are its benefits?

SA: While the CIBIL Rank may be based on credit history, it is also an indication of the company’s future repayment capability, and lenders use the CIBIL Rank to take an informed decision when evaluating a business loan application. A high CIBIL Rank (from one to four) is viewed positively by lenders and high ranking MSMEs may receive preferential terms from some lenders.

We have seen lenders such as Bank of Baroda and Oriental Bank of Commerce offering preferential rates of interest based on the CIBIL Rank. A high rank also helps in reducing the turnaround time for loan approvals, which is very important as access to capital at the right time is a matter of concern for a lot of MSMEs.

SMBS: How can MSMEs ensure they have a high CIBIL Rank?

SA: MSMEs should focus on paying back to their creditors on time and/or within the credit period so that they can avoid defaulted or late payments. These timely payments will be reported to CIBIL and will contribute to building a a higher CIBIL Rank. This will be key the next time they have to apply for credit.

They should also remember to only take as much of a loan as they need. This helps them stay out of the debt trap. And the most important point is that they should monitor their credit health regularly so that they are always loan-ready and get access to credit whenever they need.