Clear launches crypto tax platform, integrates with over 100 exchanges

Under its new crypto tax service, users will be able to optimise crypto taxes in terms of offsetting losses along with managing GST and TDS on crypto transactions.

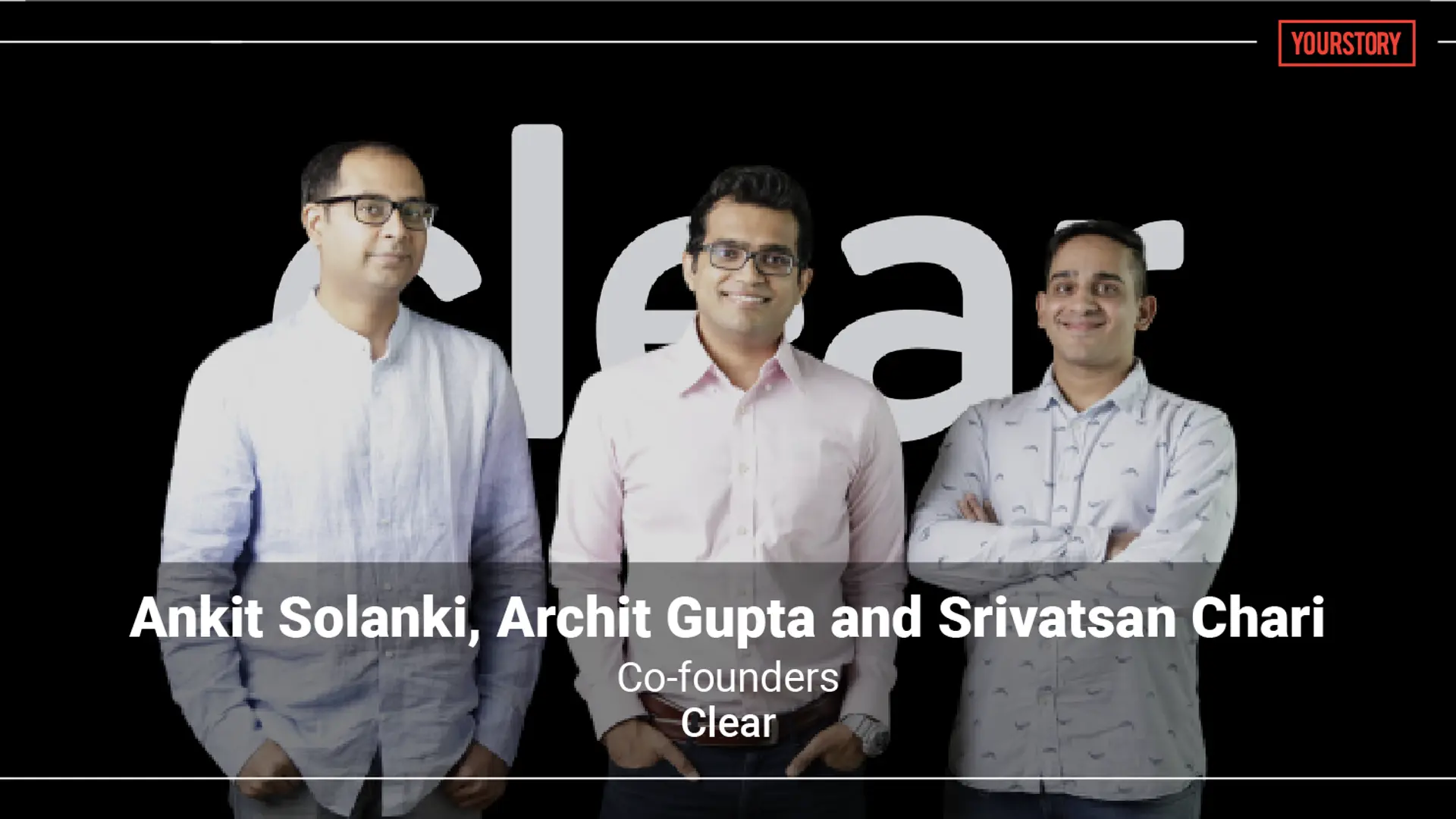

Tax filing platform (formerly ClearTax) on Monday unveiled its crypto tax platform.

The new crypto tax service allows users to optimise crypto taxes in terms of offsetting losses along with managing GST and TDS on crypto transactions, the company said in a statement. It has also integrated with over 100 exchanges like , , , and more to enable users to sync their transactions with its tax platform in real-time, it added.

In the process of developing this platform, the company has also identified over 25 different use cases based on which users can file their taxes. These include transactions, airdrops, gifting, business expenses, capital gains, or any other relevant category, Avinash Pollepaly, Senior Director-Crypto Business Head at Clear said in a Twitter Spaces session.

It also uses advanced algorithms and historical market data for accurate tax calculations.

"A lot of startups do a P&L [profit and loss] generator for this... but there are obvious pitfalls," Pollepaly told YourStory in a Spaces session.

"If you take this P&L report to your CA [chartered accountant]... it won't have a very holistic approach. Most CAs will blindly take the report and file it under capital gains because that is the easiest thing to do. So by just doing this, the customer can be at a loss... We have taken a holistic approach to say we will hand-hold the customer all the way till the end and not just generate a simple P&L in a way to ensure that they save as much tax as possible," he added.

Clear acquires compliance risk management startup CimplyFive

Taxing crypto assets has long been a goal for the Indian government. To this end, in her Union Budget Speech this year, Finance Minister Nirmala Sitharaman announced a 30% tax regime on VDA capital gains. While further, an additional 1% tax will be deducted at source on all VDA transactions. Finally, any loss from the transfer of VDAs cannot be set off against any other income.

Edited by Kanishk Singh