Why regulating crypto in India is a Herculean task

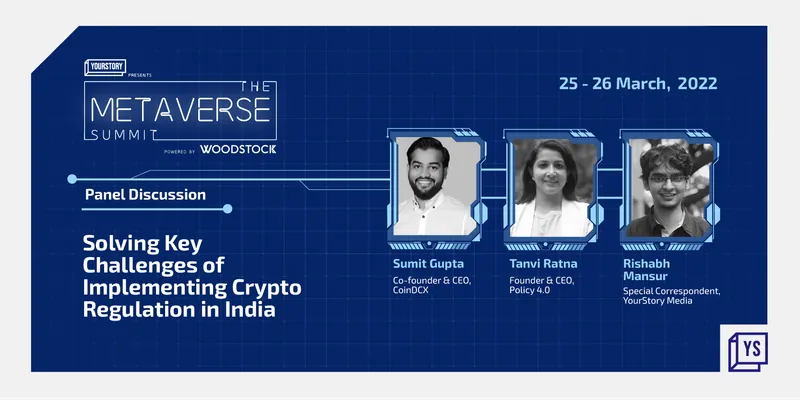

At YourStory Metaverse Summit 2022, Sumit Gupta, Co-Founder at CoinDCX, and Tanvi Ratna, Founder and CEO at Policy 4.0, break down the complexities of implementing crypto laws in India

After years of wavering its stance, the Indian government has finally started to warm up to adoption of digital assets, as it seeks to keep up with the global movement. The announcement of the crypto tax regime by introducing flat 30 percent taxation on income from crypto and digital assets in the Budget 2022-23 indicates the possible future of cryptocurrencies as a financial asset in the domestic markets in times ahead.

That said, certain figures and authorities, including the Reserve Bank of India (RBI), have been a stringent critic of crypto assets, reiterating its tough stand on the new age asset class on the grounds that these may cause financial instability.

There have been dribs and drabs for crypto development in India, with the two schools of thought divided over the right approach towards the asset.

Why are things ‘challenging’ in India?

Founder and CEO at Mumbai-based think tank Policy 4.0, Tanvi Ratna, who has had a ringside view of the industry and closely evaluated the policy side of things, lists down a couple of reasons as to why regulating crypto in India comes with its own sets of unique challenges as compared to other nations.

Finding a middle ground in India is difficult. On one side, we have the tech superpower/leader narrative with new age fintechs building innovative products from India for the world, and on the other hand we have the ethos of being a closed economy, following the “conservative” approach since ages. We have been saved from the catastrophes of several global financial crises owing to our conservative approach. Hence, finding a middle ground becomes extremely difficult when it comes to new age digital assets in India.

“One institution has benefited from being conservative, and continues to believe in that. And then you have this other side of the country which is leading the world and technology with leaders gearing up to launch the next Google and Amazon from here. There is almost a generation gap. How do you find that middle ground, it's not easy to mediate. And unless there is enough political attention or capital being put on this, it won’t happen,” says Tanvi, during a panel discussion at YourStory’s Metaverse Summit.

Also, look at the sheer size of the country with a population of 1.4 billion, with authorities still dealing with the challenge of imparting financial literacy.

Fundamentally, if we sift through all the dilemmas, the one that is at the heart of it all is the fact that crypto belongs to a parallel economy, a new kind of financial system and something that regulators aren’t familiar or comfortable with. Hence, they are struggling with putting checks and balances.

Finally, the very nature of the dynamic space adds on the complexity of forecasting and bringing in proven solutions on the table right away. “It's a dynamic space. Like, there's nothing that you can point to in the world and say that this works or do this. Fundamentally, everyone is sort of grappling with us, I don't think any country has really gotten it. They might have made laws, but the laws may not hold. The capacity building piece really needs to be taken seriously across governments everywhere,”says Tanvi.

At the same time, with new things coming up in the space almost everyday, regulators are finding it difficult to catch up with it. There is so much to learn, starting from the fundamentals. This knowledge gap will then have to be bridged through joint collaborative efforts, says Sumit Gupta, Co-Founder and CEO, CoinDCX. The confusion over the digital asset will also continue till the time it doesn’t get a legal tender status, for it to get a clarity in definition. “And the solution to that could be to define it (crypto) based on its use case,” says Sumit.

The leader is of the view that even the global regulations are at an evolving stage, and India is patiently looking at their developments to take a decision back home.

“Countries are figuring their way out and trying to lay out solid regulations, but the space is ever evolving. So this is one big challenge where India wants to look at what other countries have done, but there is still some sort of evolution happening. Whichever country cracks this problem first will attract the innovation and talent pool, and create a massive wealth generation opportunity for its citizens,” says Sumit.

A roller coaster ride: How exchanges are reacting?

Given the set of challenges and prevailing confusion over the future of crypto, it's been a roller coaster ride for crypto exchanges, including CoinDCX. Being in the industry for the past 5-6 years, the team follows a “self regulatory code of conduct” made by the industry, in the absence of proper laws, and tries to keep everything flexible and fluid in order to absorb changes across the board in the sector.

“Running a crypto business is fundamentally challenging. If you're running a crypto business in India, that's all way more challenging, because things are so dynamic here, you have to rapidly evolve because you don’t know when something unexpected might come out. We are working on building some systems so that our investors have everything super compliant and the processes are set up according to the evolving laws,” says Sumit.

In the absence of clear regulations, there are no standardised guidelines, at present, that exchanges have to abide by. Hence everyone has created their own sort of assessment.

“We follow the AML and KYC obligations and make sure that only good actors and participants are there in the system. We cannot have hard regulations right now because space is evolving. So the solution to this is a soft touch regulation or fluid regulation, which can evolve in itself, as we see more developments happening outside the country,” he adds.

Need to work together

Despite all the confusion and chaos, the whole space has tremendously evolved over the years. Efforts have been stepped up, new products are being built, the knowledge gap is being bridged and the dialogue has started to take place in a much open and mature manner.

“The policy stance has started becoming a little more nuanced. Interactions are taking place. But the nature of the dialogue is where the change has to come, in terms of structuring the policy, how it will trickle down in the final policy document and so on. I think that's where you will still see a lot of chaos,” says Tanvi.

Reaching feasible solutions will require a lot of capacity, capability to understand the space and have some tested or proven solutions. “Unless they try to really absorb this new kind of system, and don't keep pushing it into the regulatory framework, we will not really get anywhere,” she adds.

In the end, it's a gradual process that would take years, and would require a shift in mindset. The Indian government will have to see what works the best for them, and the 25 million users, investors and entrepreneurs already involved in the segment.

“We have all the right ingredients and can definitely win if we adopt the right regulations. We need to follow a policy roadmap, where we do not attempt to solve all the problems at once, but whatever we are comfortable with first. Taxes could be one of them,” says Sumit.

Edited by Ramarko Sengupta