Enabling people to make smart personal finance decisions, this platform offers financial learning ecosystem

Maharashtra-based Koppr is a financial wellness platform that offers courses on managing finances, relevant content, and financial services.

Before the pandemic, one could afford to outsource their financial planning without an ounce of worry. But the circumstances have since changed and COVID-19 has taught us the importance of self-awareness.

This is where comes into the picture. It’s a portal that promises to be a ‘complete financial wellness ecosystem’ that strives to address every financial need. Snehal Fulzele and Mandar Marathe launched the Thane-based startup in 2020 as a B2B financial wellness platform, and in 2021, they pivoted to being a D2C financial services business to cater to a glaring market gap.

“Koppr was established with the vision to make the knowledge of handling personal finances easy and accessible for one and all. We help individuals enhance their financial health and secure their financial future through access to low-cost, AI-driven, unbiased and customised personal financial advice and tools. Essentially, Koppr helps you make smart money moves, all the time!” explains Mandar, in a chat with YSWeekender.

The background

Both Mandar and Snehal attained their degrees in computer science engineering from Veermata Jijabai Technological Institute in Mumbai. Mandar began his professional journey as a software engineer with Infosys in 2004. He later completed his MBA and switched careers to enter the digital marketing field with Digitas in Boston. Mandar returned to India in 2010 to head Client Servicing for Reprise Media in Mumbai. In 2014, he co-founded Briefkase – a digital marketing agency for startups and SMEs. Over five years, this popular agency had over 100 clients.

Snehal pursued a Masters in Computer Science from Carnegie Mellon University before starting his company Cloud Lending Inc, a SaaS platform for lending and leasing companies, in 2013. He sold it to Q2 Software Inc for over $130 million in 2018.

Claiming to offer a complete financial wellness ecosystem, Koppr encourages its patrons to adopt the Learn-Plan-Act-Track method for their finances. They do this by creating real-time financial profiles that have a ‘Koppr Score’ – a rank that tracks the user’s income, expenses, wealth and investments, keeping their financial goals and risk profile in mind. This enables Koppr to be considered a one-stop platform for managing all financial needs.

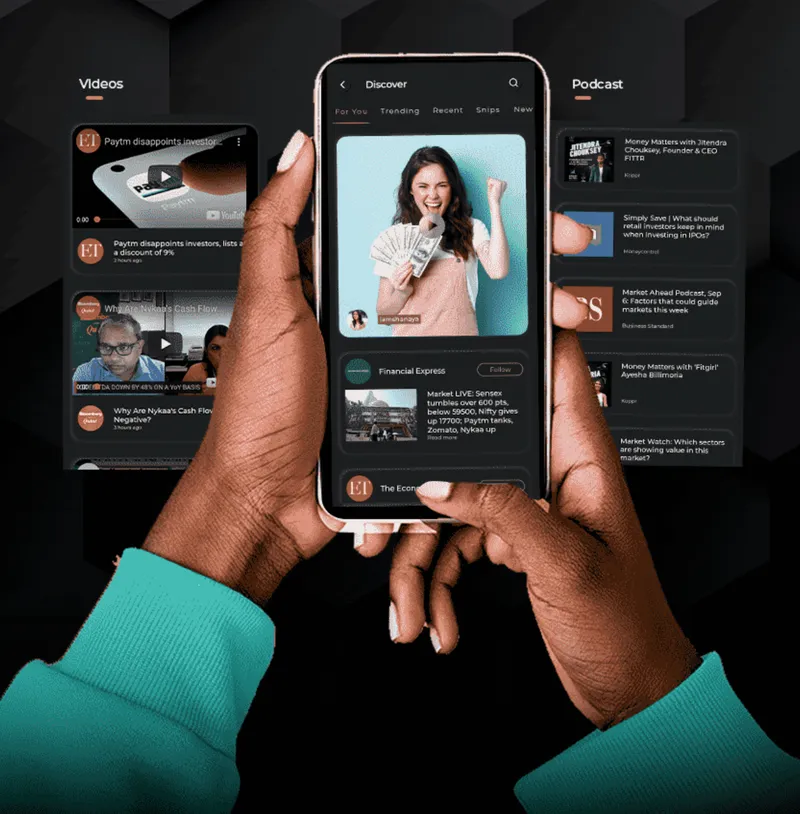

“Koppr helps people address questions like why and when do you need a financial planner. We teach financial basics through interesting mediums like films, videos, blogs and podcasts,” shares Mandar.

He came up with the name Koppr (pronounced Copper) as a spin on copper coins, which are known to be one of the earliest forms of currency. It fit the need for a name that would resonate with the younger generation while being related to the field of finance.

Koppr’s team of 20 employees works across departments like engineering, products and marketing. All the content produced for users is created in-house to provide a personalised experience.

What’s on offer

“Koppr is an all-in-one expert-led, community-driven platform that offers personalised financial advice to millennials and young adults in India at every step of their financial journey,” Mandar explains.

The platform offers many services which can be tailored to the needs of their audience. Their tribes or question-answer communities are personalised financial groups led by financial experts where users can ask their most pressing financial questions and receive answers from those in the know.

They also host several financial courses aimed at the clearing of concepts. These are in the form of one-on-one sessions, as well as lectures and presentations.

Users can consume personalised financial content from over 150 channels and a variety of subjects. The content spans curated news articles, videos, blogs, and podcasts.

One can also make investments and protect their ongoing investments as Koppr, offers access to a fully-automated trading platform for real investors.

Apart from the above, the platform also offers cryptocurrency loans, and plans to allow users to earn interest and trade on the market, as well as buy health insurance.

The app is available on Google Play Store. The co-founders say most users fall in the age category of 21-28 – those who are just beginning to look after their own finances.

Growth in numbers

According to a report on the Financial Analytics Market published by MarketsandMarkets, the global Financial Analytics market size is expected to grow from $6.9 billion in 2018 to $11.4 billion by 2023, at a CAGR of 10.7 percent between 2019-2023.

Koppr began with a seed funding of $250,000 from founder Snehal and some private investors.

Talking about their growth, Mandar says, “To date, we have acquired close to 25,000 members and over 500 people who have paid for our courses, and attended the one-on-one sessions with experts as well as our Expert Charcha sessions or webinars.”

The team at Koppr believes it stands apart from competitors as its content is curated by financial experts that include registered investment advisors, chartered accountants and certified financial planners. They are particularly popular for their personalised services aimed at a younger target audience when it comes to dealing with pitfalls during their financial journey.

Their biggest challenge has been to bring together a team in the tough times of COVID-19. All their hiring was done remotely and they have not managed to get the team together since.

Another challenge has been to find a niche for their product. They are constantly experimenting and have gone through multiple pivots. Having finally understood their target audience, they are now building their core offering in the sphere of cryptocurrency, for which a new launch is poised to happen in three months. They are also looking to create and launch millennial-friendly investment solutions in India, as their current focus is entirely on the Indian market.

Mandar signs off by sharing, “Koppr is looking forward to creating a one-stop solution where young adults in India consider us a go-to platform for all their financial issues and concerns. Managing your finances can be tough, but attempting to do so without having the right mindset is even tougher. Koppr empowers you to make smart personal finance decisions through the right knowledge and tools.”

Edited by Kanishk Singh