FDI in e-commerce: companies pray for final policy clarity from govt

Most entrepreneurs running online retail companies in India have been hoping for an all-encompassing foreign direct investment (FDI) policy that will clear doubts and confusions once and for all. But that hope remains just that and confusion continues. The latest salvo was by the Delhi High Court in November, when it ordered the government to probe 21 e-commerce companies for FDI violations.

This is but the latest in a series of FDI-related issues that has plagued this newly emerged industry. There have been many reports, on and off, of Enforcement Directorate enquiries being launched against Flipkart and others. As part of the case in front of the Delhi HC, the Government said it was investigating six companies. The Delhi HC then ordered the Government to expand the scope of the investigation to include all 21 companies that the plaintiff, the Retailers Association of India (RAI), had mentioned in its complaint.

Why the confusion?

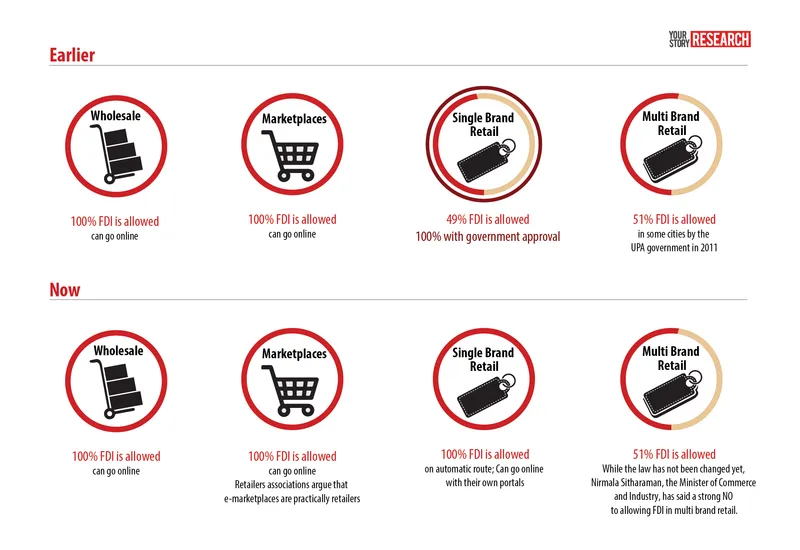

According to the Consolidated FDI Policy:

E-commerce activities refer to the activity of buying and selling by a company through the e-commerce platform. Such companies would engage only in Business to Business (B2B) e-commerce and not in retail trading, inter-alia implying that existing restrictions on FDI in domestic trading would be applicable to e-commerce as well.

According to the Consolidated FDI Policy, single-brand retail trading companies are not allowed to engage in e-commerce. However, in November the Government eased FDI rules in 15 sectors, including single-brand retail. It says, in simple words, if a single-brand retail entity with foreign investment has got approval to set up stores in India it can also engage in online retail. This helps global majors like IKEA. This relaxation in FDI norms, which many took as a step towards towards opening up more sectors to FDI, happened 10 days before the Delhi High Court’s order to investigate the 21 ecommerce websites.

Further Indian manufacturers, in sectors including textile, can have 100 per cent FDI. A number of Indian online retail brands, like Zovi, manufacture in India.

The policies seem clear, right? Wrong. The complication arises in the form interpretation of the law and the ‘behaviour’ of the marketplaces like Flipkart and Snapdeal. The allegation by the retailers association, is that marketplaces are practically behaving like retailers as they are giving big discounts that they are able to finance due to the large sums of FDI raised. Sellers who spoke to YourStory on condition of anonymity confirmed that many times it is the platform that provides the discount and not they. Flipkart and Snapdeal declined to comment for this story.

It is not just this, most online marketplaces have set up complex company structures to circumvent the laws that prevent online multi-brand retailers from taking on FDI. Many companies have set up a B2B wholesale arm, which takes the FDI, along with a retail company with which they maintain an arms length distance.

WS Retail was earlier a subsidiary of Flipkart, but was hived off. According to a news report, Cloudtail India, which is a joint venture between Amazon and N R Narayana Murthy’s Catamaran Ventures, is the biggest retailer on the e-commerce major’s India marketplace. Amazon is not part of the case in Delhi HC, but its sister platform Junglee is. A detailed email query sent to Junglee was unanswered.

Experts say e-commerce companies in India have no choice but to raise risk capital funding.

“E-commerce firms seldom get funding from banks, leaving the entrepreneurs with no choice but to depend on VCs and other sources of funds from overseas. Many Indian e-commerce companies are moving out of India to get easier access to funds,” said Arvind Singhal, Chairman of Technopak advisory firm.

So for many of the large marketplaces, who are building up the online retail industry from scratch, it is a choice of not growing at the rapid pace if they have to follow the law in letter and spirit or putting up these complicated structures so they are compliant at least in letter, if not in spirit. So why go for FDI when the policies are so complicated? Praveen Sinha, serial entrepreneur and Co-founder of fashion portal Jabong, said only foreign investors are willing to and capable of pumping in the billions of dollars that is required to build up this young industry.

“If we are so protective, why is there no funding available to those entrepreneurs within India? Why is the government and banks not giving them a better rate? There are enough investment firms and conglomerates in the country, but not many dare to experiment,” Praveen said.

What the companies say

But, it is not just the biggies that are facing issues. The constant threat of court cases and enquiries have affected smaller players too. Many of the companies that feature in the Delhi HC’s list of 21 declined to comment for this story. Those that spoke to YourStory have categorically said that no Government agency has reached out to them for an investigation.

Myntra’s CEO Ananth Narayanan said: “We are compliant with the laws on FDI, and nobody from the government has reached out to us yet in this regard.” Myntra is a subsidiary of Flipkart.

Many others, who are part of the list of 21, say they follow a pure marketplace model, so they do not understand why they feature in the list. “We are a marketplace, where wholesalers, resellers, and boutique managers, directly sell to consumers through our platform. We are a commission agent – we don’t get involved with the prices or discounts,” said Sujayath Ali, Co-founder of Voonik, which is backed by Sequoia Capital and Seedfund. They have no warehouses either. Amazon, Flipkart and Snapdeal have built massive warehouses. However, the ownership of the inventory in the warehouses rests with the seller until the goods are sold. “We don’t have a B2B arm for getting FDI and then a B2C separately. We are one entity - Voonik Technologies Private Ltd,” Sujayath added.

The e-commerce companies which YourStory talked to were uniform in stating that these investigations were ordered due to the lack of clarity in how they operate. American Swan is not multi-brand player. “We are a single online private label; we don't sell any other brand,” said Sharad Thakur, Chief Business Officer. American Swan has different arms working on B2B and B2C. “As per the current FDI norms we are in compliance for all the laws, and we will be in compliance with whatever new regulation come into force,” Sharad added.

Suchi Mukherjee, Co-founder and CEO of Limeroad, said she has only heard from the Press about the Delhi HC case and not from the Government. “We took the FDI policy very seriously right from the beginning and have followed the law in letter and spirit. We are a pure play marketplace and service provider. We respect the regulations and have always been in the clear,” said Suchi, adding that it would be good to have complete clarity on e-commerce soon. Limeroad counts Tiger Global and Lightspeed Venture Partners among its investors.

But we have no FDI!

Some companies that have been listed in the retailers association's complaint do not even have foreign investments, like Darveys. CEO Nakul Bajaj said: “Even if we raise FDI, we are still a marketplace in which it is legal to have 100 per cent FDI. We do want the authorities to know what's going on with our company as it would give us and the authorities more clarity.”

Darveys is not alone in this category. Famozi’s Founder-Director Puneet Khanna, in fact, came to know that they are part of the list of 21 only when YourStory got in touch with him. “Our name should have not featured on the list. I believe it is there by mistake. We have highlighted this to the footwear manufacturers association as well,” said Puneet, adding that the company has not raised any foreign funding. Famozi is backed by Future Group.

Zovi is also awaiting communication from the government. CEO Manish Chopra says: “We are an Indian manufacturer and we have got all the permissions already. So there is no action needed from our front right now.” He added that issuing a clear policy will help.

Finally…

If the companies are able to function, why do they want clarity from the Government. If the investor sentiment goes south then sectors with policy ambiguity could experience a tightening of funding. This will impact the smaller players.

Also, policy uncertainity is never good for business or for entrepreneurs to take decisions. “We are planning to raise funding. But considering all the confusion regarding FDI, we don’t know how to go about it,” says Shivani Poddar, Co-founder of online fashion brand Faballey. “We keep hearing that different e-commerce companies that follow very different business models are under investigation, so which model do we follow?”

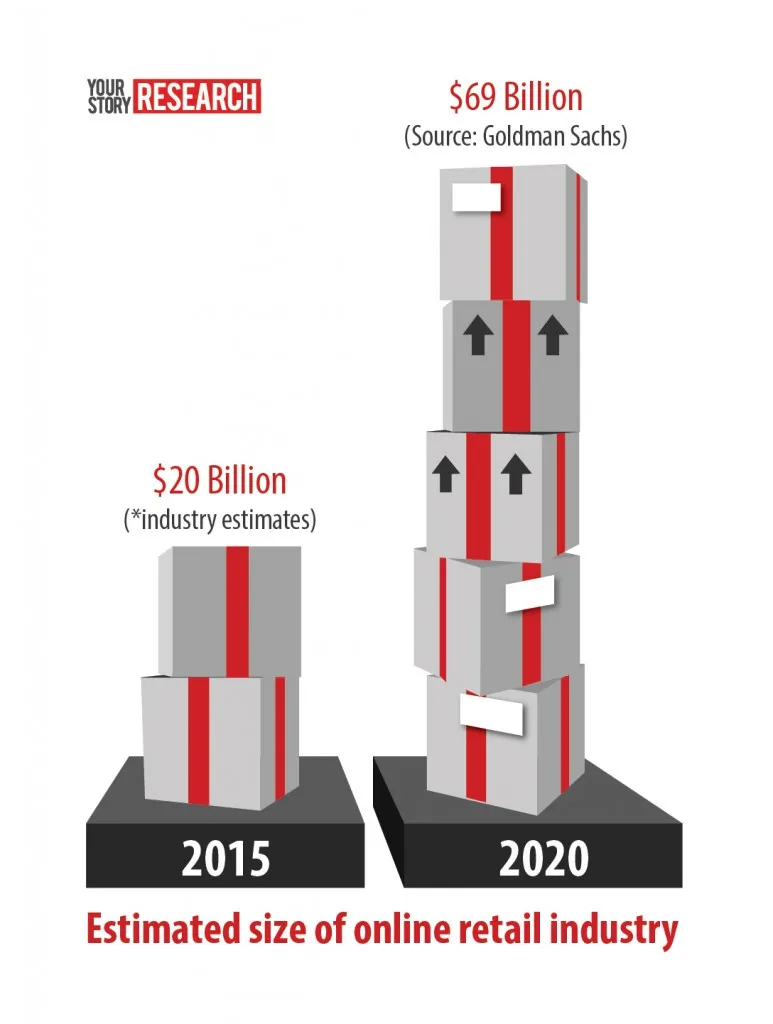

Also, online retail is a nascent and fast growing industry. It is estimated to be in the range of about $20 billion at present. Goldman Sachs estimates the industry to reach $69 billion in size in 2020. Companies like Flipkart, Amazon and Snapdeal, along with smaller players, are creating, directly and indirectly, an entire supply chain and logistics infrastructure from scratch. Their growth helps a number of other entrepreneurs and industries, from technology, to packaging material producers, and the merchants selling on the platform.

“We need the government to realise that ecommerce is here to stay. It generates a lot of employment, and the customer is benefited. It is counterproductive to procrastinate on such litigations; policy clarifications are needed now,” said Radhika Jain, Partner at financial advisory firm Walker Chandiok & Co LLP.

However, a level playing field is also important. If online multi-brand players can use FDI to fund their growth, so should offline players. The Government is expected to come out with a consolidated e-commerce focused policy document. The industry will be hoping that it is forward thinking and will finally take way at least one issue that has troubled the online retail industry from the start.