How startups successfully got Indian shoppers to buy furniture online

Hari Rajagopalan, a Bengaluru-based professional, spent a year looking for the perfect sofa in multiple stores in 2012. Dreading a similar experience while buying a cot, he tried out online furniture seller Pepperfry in 2013. “They had better selection and good deals. The delivery took a month, but an offline option would have cost double the amount,” he says. From then on, he stuck with Pepperfry, and has bought more cots and chest drawers, buying only during sale events. “It cost only around Rs 50,000, and customer service is decent too,” he says.

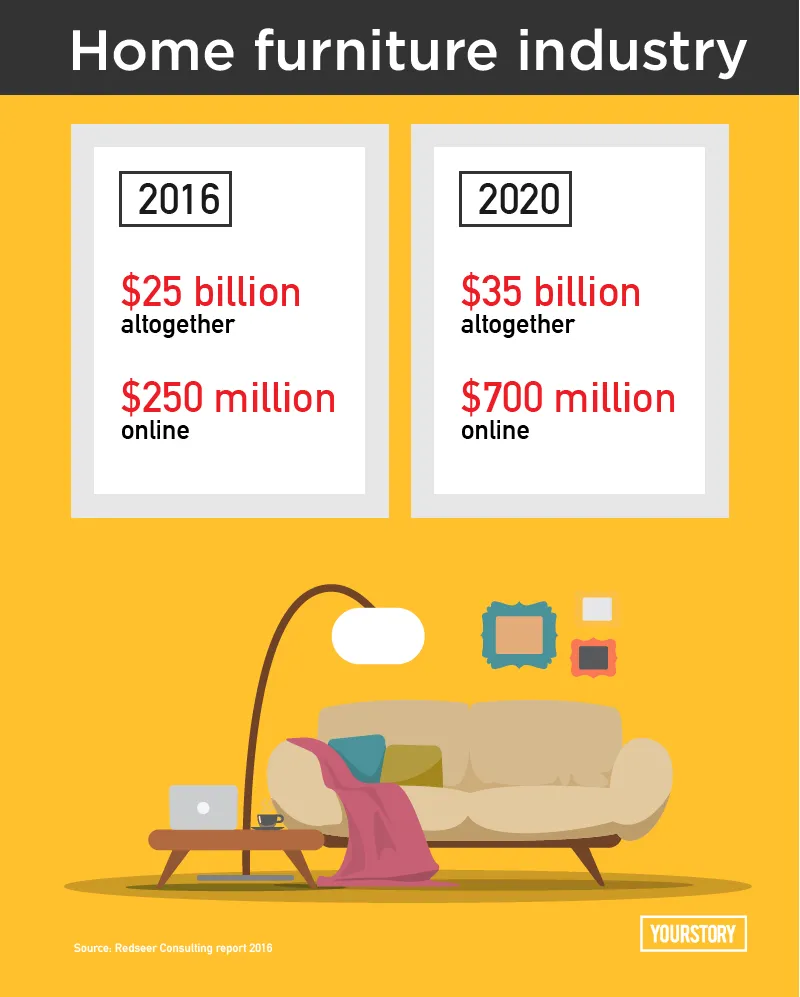

For urban professionals and students, online portals are now the first option for buying furniture - a phenomenon which would have been unthinkable four years ago. Metro cities have witnessed drastic growth, with multiple players coming in and expanding their base. Pepperfry’s competitor Urban Ladder—which operates in 19 cities—gets 80 percent of orders from Tier-I cities.

Organising the sector

India’s furniture sector is 90 percent unorganised. Of the organised, only one percent is online. Different models are looking at different consumer segments. For instance, rentals aim at those looking for short-term essentials, mostly students, or people who have just started working. Furlenco’s Founder and CEO Ajith Karimpana says: “In renting, one does not have to get committed to their furniture. Also, we have different product offerings. We give an entire bedroom or living room or dining room experience.”

Bringing more structure to the industry can offer more transparency to the customer. Delhi-based Modspace, which delivers customised modular kitchens and home goods, was born out of the need for offering quality. Co-founder Jatin Paul says, “Getting the quality and value aspects together is hard when the product is not standardised. It demands understanding of subjective designs, and catering to individual needs at a particular price point.”

Players like Pepperfry and Urban Ladder focus on those who want to decorate their homes. “Both models can coexist, given the high diversity of the Indian consumers who are unhappy with the offline experience,” says Mrigank Gutgutia, Engagement Manager at Red Seer Consulting. He says that since many customers are particular about the touch-and-feel experience of products, models like that of Pepperfry’s experience zones might come up. Ashish Shah, Co-founder, Pepperfry, says the company provides design, content and consultation for free.

Omni-channel is the way forward, according to Vinay Indresh, Co-founder of Bengaluru-based Homefuly, which brings together interior designers, factories, and vendors. “In Homefuly, discovery and engagement happens online, and transaction happens offline. From your location, we find out the nearby shops that will cater to your needs,” he says. One can’t order on Homefuly, but the firm provides all the required data and services.

Horizontal players are not lagging behind. For Snapdeal, furniture category generates high revenue and margins due to high ticket size. Saurabh Bansal, Vice President and Head Category Management, says, “In order to expand this segment, the category is revamping the entire site navigation based on customer decision process. Thematic segmentation for styles such as Heritage, Contemporary, and Colonial are also underway.”

Customer is the king

A good part of business for online business comes from non-metro cities where there is low penetration of organised retail. Ashish of Pepperfry says: “Our top 15 cities account for almost 90 percent of our business and the eight Tier-I cities contribute to almost 80 percent of the business.” They target urban consumers who are already confident about shopping online.

For Mebelkart, Tier-I cities formed the customer base at first, but now digital marketing has helped garner customers from Ranchi, Patna, and Lucknow, especially given the lack of availability of items like ergonomic chairs or foldable beds in these cities. From 90 orders per month in 2012, they have reached 30,000 per month today.

According to Snapdeal’s Saurabh, customers in Tier II and III cities are highly price-sensitive and choose online route only if the local offline market charges higher for similar products. “We have implemented humanoid reference images and size charts to help customers in the purchase decision. There was a huge demand for both queen and king-sized beds, and after adding adequate options we are seeing a steady surge in sale numbers,” he says.

For any business to succeed, customer feedback has to be taken seriously. Online furniture industry is no different. Furlenco, which targets customers in the 22-40 age group, developed its most successful product—Bounce—based on customer interaction. Ajith says, “Today, people socialise in groups and do not behave formally as in the past. Therefore, we asked potential customers if given a choice what they would like to have for furniture – and they said less space occupying and more casual.”

Quality versus Discount

Furniture is one of those few categories in e-commerce where quality triumphs discounts. According to Rajiv Srivatsa, Co-founder of Urban Ladder, design gets more focus, as customer wants good quality rather than cheap price. “Discounts have decreased in the last six months, and it will continue. Everyone is moving towards profitability now,” he says.

However, Mebelkart gives discounts for larger marketshare. Their average ticket size has gone from Rs 20,000 to Rs 4,000-10,000. “We were the first to launch part payments, like Rs 500 or 1,000 in advance and the remaining on delivery. Our GMV has grown from Rs 4.8 crore to Rs 120 crore in four years,” says Rahul.

IKEA’s entry

Swedish furniture giant IKEA’s impending entry into India by the end of 2016 is expected to impact the furniture sector at least in the urban areas. “Their brand has tremendous lure for the customer. To counter that, its Indian competitors will have to venture into smaller cities,” says Red Seer Consulting's Mrigank.

IKEA is famous for its do-it-yourself (DIY) model. But DIY is new in India. Urban customers and those who have lived abroad, however, might find it agreeable. Rajiv of Urban Ladder believes that IKEA will help push the concepts of brand and design. “It will improve retail store experience too. Lot of offline companies have stagnated for the last 7-8 years,” he says.

The app business

With increasing smartphone penetration, apps’ contribution in sales is sure to rise. About 40-45 percent of Urban Ladder’s business comes from apps. Homefuly plans to launch an app in 2-3 months for their omni-channel platform, which aims to expand to interior designs. They have an m-site up already.

Mebelkart, however, has no mobile presence, as they believe that users want to see the products on big screens. For Furlenco, 20 percent of sales come from mobile app; they expect it to increase to 50-60 percent in the future.

Logistics nightmares

Logistics is undoubtedly the biggest challenge for the sector. Furniture needs dedicated trucks; you can’t mix it with other items. “Due to smaller volumes, truck capacity is underutilised. Hence 10-15 percent of value is spent in logistics,” says Manish Saigal, Managing Director at Alvarez and Marsal.

He adds that logistics companies have to realise that Category C – consumer durables, appliances, electronics, furniture etc. is growing fast. “They have to build solutions for that category – including trucks and trained manpower,” he says. Customers expect the delivery boys to be trained in unpacking and assembling the product like what an offline service offers. But for most online players, delivery and assembly are done by different people at different times.

Mebelkart lets the vendors use their own logistics if they have an established supply chain. Otherwise, Mebelkart ties up with third parties and ships the products itself.

Pepperfry commenced the origin-to-hub shipment in April 2013 and, since then, has significantly reduced costs per unit, claiming to have the lowest shipping costs in the industry- below eight percent of GMV. Ashish says, “We monitor the entire process of how a sale is affected on the platform, right from when an item is listed for sale, till it reaches the customer. Thus we are able to establish standardisation, which is one of the key challenges in the vertical.”

Urban Ladder’s Rajiv says that extra care should be taken in transferring material from the supplier to warehouse without anything being broken. “Supply should be planned well so we can deliver fast after quality checks. There should be full trucks, so nothing is broken,” he adds.

Spread it out

Furniture manufacturing is concentrated in belts, which makes delivery longer and costly. “They need more manufacturing centres. Dispatches should happen in smaller radius like 200km,” says Alvarez and Marsal's Manish.

Pepperfry seems to have got it right. The points of origin for the company's furniture shipments are Delhi, Mumbai, Jodhpur, Jaipur, Bengaluru, Nagpur etc. They have 17 distribution centres across the country. Ashish says, “From the distribution centres to the doorstep of the end consumers we have our own network of more than 400 trucks covering 500+ cities.”

Based on geo location, Mebelkart finds out the city the customer belongs to, and shows relevant products from nearby factories, so as to ship faster at cheaper costs and with lesser chances of damage. But horizontal players just build the catalogue, tie up with suppliers, and leave the logistics companies to manage the rest. Since few logistics companies know how to manage it, their returns and damages have been much higher than that of verticals, according to Manish. “Since the return logistics is a nightmare, many sellers give discounts up to 50 percent, so as to cancel the return request. Many users misuse this,” he says.

Happier customer

Industry experts believe that the next four years will see the sector exploding. A happier customer demands better designs and improved customer service. According to Rajiv, technology’s interplay will take interior design to a larger population, and there will more content and discussions on it.

Virtual reality, augmented reality, and hybrid models are expected to come up, with technology penetration. Urban Ladder's Rajiv adds, “Tech-driven companies will automate customer requests, manufacturing, and backend supply chain, as there will be lot of tech in thinking and effort like global players. Visualisations and 3D will become mature; customers will be able to see on their tablet how their different pieces can come together.”

Since the market is huge and under-penetrated, there is space for multiple players – competition is with the unorganised sector. Horizontal players coming in is good for the industry, notes Arnab of Homefuly. “Verticals give niche solutions, but horizontals educate the consumer space. This will help the industry grow,” he adds.

With more players, comes more range. As products and services become a package, it looks like the Indian customer is looking at a bright phase for her furniture needs.