SoftBank acquires ARM for $31.4bn, to leverage IoT wave

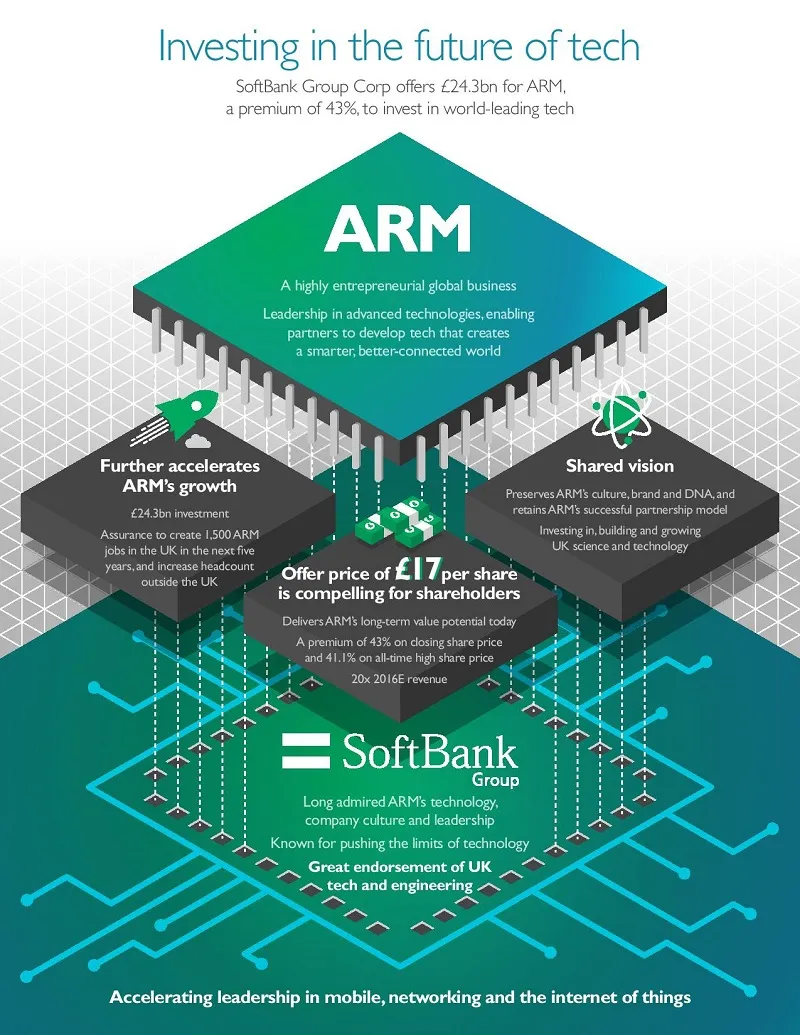

SoftBank Group Corp. (SBG) and United Kingdom's ARM Holdings plc (ARM) confirmed on Monday that SBG would be acquiring ARM for approximately GBP 24.0 billion ($31.0 billion) in an all cash transaction. Talking about the acquisition and the future of ARM, Masayoshi Son, Chairman and CEO of SBG, said,

SoftBank intends to invest in ARM, support its management team, accelerate its strategy and allow it to fully realise its potential beyond what is possible as a publicly listed company. It is also intended that ARM will remain an independent business within SoftBank, and continue to be headquartered in Cambridge, UK.

Elaborating about the background and thought process behind the acquisition, SBG believes ARM is one of the world’s leading technology companies, with strong capabilities in global semiconductor intellectual property (IP) and the “Internet of Things”, with a proven track record of innovation. SBG's board has evaluated ARM in detail and after careful consideration unanimously support this transaction.

The board and management of SBG believe that the acquisition will deliver the following benefits:

Infographic credit- ARM

1. Support and accelerate ARM’s position as the global leader in IP licensing and R&D outsourcing for semiconductor companies. SBG aims to use its expertise and global network of relationships to accelerate adoption of ARM’s IP across existing and new markets.

2. Maintain ARM's dedication to innovation - SBG plans to sustain ARM’s long-term focus on generating more value per device, and driving licensing wins and future royalty streams in new growth categories, specifically “Enterprise and Embedded Intelligence.”

3. Increase investment for innovation - SBG intends to support ARM’s multiple growth initiatives by investing in engineering talent and complementary acquisitions with the aim of ensuring ARM maintains a R&D edge over existing and emerging competitors. SBG believes such an investment strategy in long-term growth will be easier to execute as a non-listed company.

4. Shared culture and long-term vision - SBG believes the two companies share the same technology-oriented culture, long-term vision, focus on innovation and commitment to attracting, developing and retaining top talent.

5. Maintain and grow the UK’s leadership in science and technology - SBG also sees UK as a world leader in science and technology development and innovation and, so intends to invest in multiple ARM growth initiatives, at least doubling the number of ARM employees in the UK over the next five years.

Related read: Decoding the brain behind SoftBank: 14 nuggets of wisdom from Masayoshi Son

Acquisition terms

SBG noted that while the acquisition has been approved at a meeting of SBG’s Board of Directors, it is subject to the approval of ARM’s shareholders and of the English court. ARM's board, which was advised by Goldman Sachs International and Lazard & Co., Limited as to the financial terms of the Acquisition, considers the terms of the Acquisition to be fair and reasonable. Accordingly, the ARM Directors have confirmed that they intend unanimously to recommend that ARM shareholders vote to approve the acquisition.

Under the terms of the acquisition, each ARM shareholder will be entitled to receive £17 (or 1,700 pence) in cash for each ARM share. SBG and ARM intend to implement the acquisition through a "scheme of arrangement” pursuant to English law, under which the acquisition becomes effective upon the approval of ARM’s shareholders as well as the English court.

However, SBG notes that it shall be entitled to implement the acquisition by way of a takeover offer rather than the scheme in two scenarios: (i) while the co-operation agreement continues, with the consent of the takeover panel (an independent regulatory body that regulates takeovers) and with the prior written consent of ARM; or (ii) after the termination of the co-operation agreement, with the consent of the takeover panel only.

Proposed schedule

The two companies expect the closing of the acquisition to occur as soon as practicable in the third calendar quarter 2016 (the period ending September 30, 2016), subject to the receipt of the required court and shareholder approvals.As a result of the acquisition, ARM will become a wholly-owned subsidiary of SBG, but function as an independent business. Masayoshi Son, Chairman and CEO of SBG, said:

This is one of the most important acquisitions we have ever made, and I expect ARM to be a key pillar of SoftBank’s growth strategy going forward. ARM will be an excellent strategic fit within the SoftBank group as we invest to capture the very significant opportunities provided by the "Internet of Things".

Financing and future plans

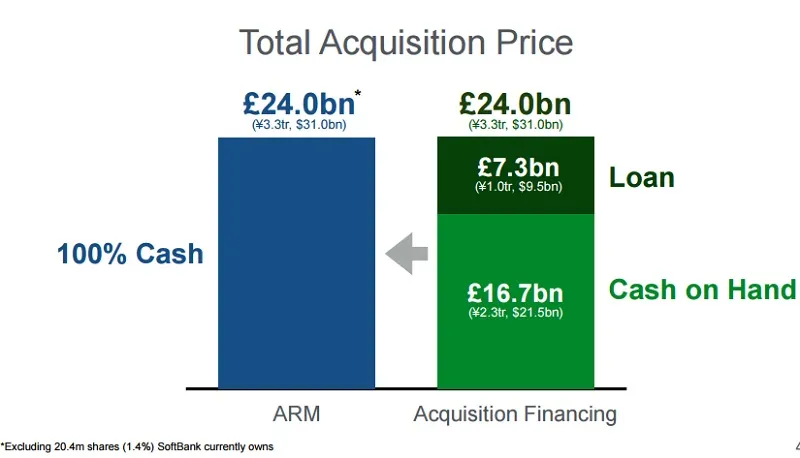

SBG notes that part of the acquisition is being financed by debt to be provided under and up to JPY 1.0 trillion facility arranged by Mizuho Bank, Ltd. The balance of the consideration will be funded from SBG’s existing cash resources and SBG plans to refinance these funds with various long-term financings. SBG does not intend to raise equity finance for this purpose.

Image credit- SoftBank Group

Stuart Chambers, Chairman of ARM, said: "It is the view of the Board that this is a compelling offer for ARM Shareholders, which secures the delivery of future value today and in cash. The Board of ARM is reassured that ARM will remain a very significant UK business and will continue to play a key role in the development of new technology."

SBG also believes that IoT will be the next paradigm shift after the mobile internet wave. It considers security to be the most essential aspect of IoT and considers ARM with its technological expertise to have the best prospects to cash in on the IoT wave.

Website- SoftBank Group

Related read: Nikesh Arora to resign from SoftBank, will continue as advisor for a year

SoftBank to sell $7.9B in Alibaba stock to decrease debt and increase ‘liquidity cushion’