To bootstrap or not to bootstrap, that is the question: TechSparks 2016 gives you both sides of the story

They say “Winter is Coming” for the deluge of VC Money that is flooding the startup ecosystem leading to its boom – making the word ‘startup’ sexy at the very least, if not sustainable. And yet, there have been companies that have thrived in this winter, perhaps hailed it their favourite season, and not only chosen to, but stood their ground on bootstrapping their ways to market leadership. And when both facades of the coin came face-to-face to not confront but rather, complement each other in a crackling panel at Techsparks 2016, the result a well-balanced meal for the entrepreneurs in the audience, that are constantly grappling with the dilemma of how they must finance their big idea.

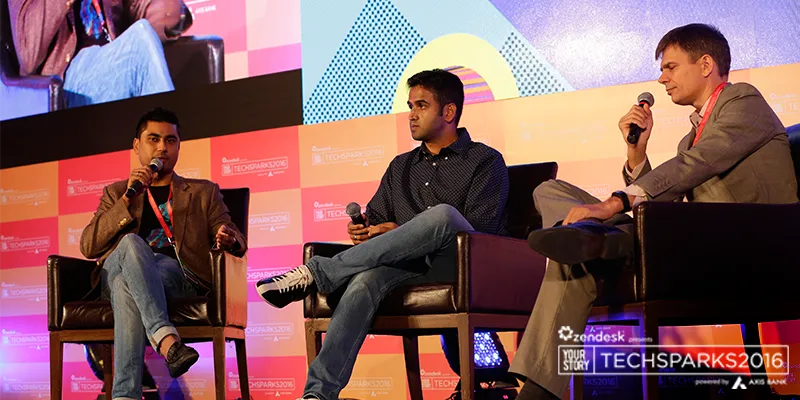

Here are the highlights of the conversation between Klaas Oskam, VC at Signal Hill, and bootstrapped successes Pallav Nadhani, founder of FusionCharts and Nithin Kamath, founder of Zerodha.

What made them plunge into bootstrapping?

The way Pallav puts it - he was an accidental entrepreneur who was just looking for some pocket money. Because the goal was clear as day, the means employed to get there were just as lucid too. “My aim was simple – because I wanted money, I needed to build something that people would pay for. And th next challenge was naturally, how to get more and more people to pay for it,” says Pallav.

Nithin‘s story, on the other hand, defines going with the flow. A trader who gave his first crack at it when he was 17, he went bust a couple of times, ended up short during the 2008 recession, and eventually, decided he wanted to be the broker he never had. That was the genesis of Zerodha. “We turned profitable fast, and never felt the need to raise investment externally, unless we wanted to spend aggressively on advertising and marketing. At that fork in the road, again, I decided that we wanted to stay organic and grow.

Do the bootstrapped fall or falter, in the face of competition from funded peers?

Pallav’s metaphor was bang on. “If I’m still building my house brick by brick, I will not get swayed by the fancy interiors of my neighbours. I focused on my value offerings, rather than benchmarking myself against competition. And as I increased value to my customers, I raised my prices. My mantra is simple – ‘Perseverance over Pace,’” says Pallav.

When the talent also have a ‘talent’ for attrition

A real challenge in an era that is consistently witnessing a glaring talent crunch, being up against funded players may well mean losing your top talent to the “greener side”. “Poaching culture is rampant in the startup space, where all it takes for your senior management, who you have meticulously honed for three years, is a paycheck with 4x the amount. But you must know better than to get caught up in this game of one-upmanship. Do not screw up your unit economics trying to retain your talent. It creates the wrong culture, not to mention burdens your treasury greatly. Instead, build culture that makes people want to stay,” says Pallav.

Nithin couldn’t agree more. Apart from benefitting from an interesting turn of events that changed his company’s identity from being a mere “dalal-firm” to a fintech startup – as this term became a buzzword, suddenly, it was “sexy” for his employees to work with them. Not getting carried away by this chance fortune, he says building a sound culture conjures up a sense of belonging, of home, for the employees. And it all stems from having policies that make them happy. “We don’t do meetings or set revenue targets for our employees, as it impacts the unbiased nature of the role they are supposed to play in a client’s life. All these policies keep them loyal and happy,” he reveals.

The verdict:

When you’re bootstrapped, you tend to have a leaner model where everything is agile. Decisions are internally taken and executed. “When you have external investors you have promised targets to, you are tightly-bound and given little room to conduct experiments to improvise on your product. On the other hand, the very velocity of the experiments is different in a bootstrapped firm, where diversification and improvisation, quick retaliations and responses to failure are the name of the game,” says Pallav.

As for Nithin, simply being accountable for and to someone else’s money scares him – when it comes to clients as well as investors. So, when an investor had asked him to explain his company as a suite in Poker, Nithin explained to him, “I’m an ace and queen suited. It’s a decent hand that I am going to slow play. Moreover, on this table, I know of the other hands, so I know the value of my own, and am at an advantage.”

“If you raise too much too soon, you will be overwhelmed when you do not even know the basic plumbing of your company. And this is truer in India, the ‘land of techies’ where all we want to do is build-build-build, and has barely gotten the time to learn how to ‘sell’,” Pallav concludes.

A big shoutout to all our sponsors - Zendesk, Axis Bank, Sequoia Capital India Advisors , Digital Ocean, Microsoft, AWS, Akamai, Target, Verisign, Kerala Startup Mission, Brand Launch Centre, Tork and Blink.