Mahindra makes an offer to Ola they cannot refuse

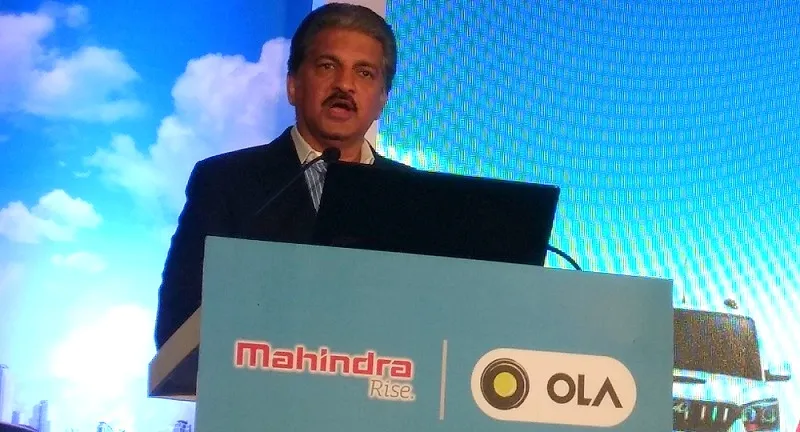

Anand Mahindra, Chairman and Managing Director of Mahindra Group, along with Bhavish Aggarwal, Founder and CEO,Ola, announced that they would be tying up for cars, vehicle sales, financing and sales.

Through this alliance Ola and Mahindra Group aim at an overall vehicle sales and financing of over $400 million.

An offer Ola cannot refuse

Speaking at a press conference in Mumbai, Anand said,

I woke up this morning to walk my talk and be a part of the startup world. When I referred to the changing dynamics of the automobile industry at my annual general meeting, I realised that the shift was moving towards sharing economy. I think the economy is going to move faster in India than anywhere in the world.

He noted that with the launch of Jio by Reliance Industries, more users are going to use smartphones. Expanding on the alliance with Ola, Anand said,

"I have recognised a new reality and Mahindra is poised to play a significant role in the new world. We have two categories of people - those who buy vehicles for objects of desire, while others who focus on shared economy. And we will be a part of both. Being one of the largest automobile groups in the world, we are providing Bhavish and his team an offer they cannot refuse."

Strengthening Ola’s value

With this alliance Mahindra Group will provide Ola with Mahindra Finance, first choice services, insurance and resales support. This partnership also brings in financial inclusion by empowering the driver partners to purchase vehicles at a highly affordable price.

Anand explained that this partnership has brought about the creation of a click-and-brick model.

“We will strengthen Ola’s value. If we are paranoid, even the shared economy guys should be paranoid,” noted Anand.

Bhavish said that this alliance will help Ola inch closer to their dream of building mobility for a billion Indians.

Fighting the SanFrancisco giant

Over the past few months Ola has been in the eye of the storm that blew up from the Uber-Didi deal.

Reports suggest that Ola, by shutting down its TaxiForSure business and firing close to 700 people, to more recently firing 250 people for performance-related issues, is working hard to cut its operational costs.

A report in the Economic Times suggested that Ola’s RoC filing stated the company had run losses over Rs 796 crore during the fiscal year 2015.

Several reports also suggest that the company had spent nearly double what it had earned in a bid to compete with its rival, San Francisco-based aggregator Uber. From the start of this year Uber has been a rather tough competitor for Ola, and has significantly reduced the gap in the Indian market.

Though Ola launched Micro to hit back at Uber, the latter's recent merger with Ola’s investor Didi in China has perhaps contributed to a change in Ola’s dynamics.

Uber now has a 17.7-percent stake in Didi, which has invested at least $25 million in Ola. Indirectly, Uber now has a share in Ola.

Taking this into consideration, speculations are rife about Ola merging with Uber India soon. Reports also suggest that Didi Chuxing and Uber may have signed a non-compete agreement for international markets.

It has been speculated that Didi now cannot directly operate in markets Uber is present in, which means that in India it can possibly invest a little more in Ola but cannot be the single largest owner.

Uber recently launched a dial-in service that allows users to book a cab directly from the smartphone without an app. The feature launched by Uber is currently available in Nagpur, Kochi, Guwahati, and Jodhpur. The company has not, so far, clarified whether the feature will be introduced in other cities at a later stage.

If one looks at the product breakdown, Ola today has over nine different products, including rentals, shuttle, and outstation, while Uber has only four.

Market speculations

Currently, the the market share of Ola is much greater than Uber. The alliance with Mahindra may be Ola's effort to hit back against Uber. Also, the Ola team holds this alliance to be key in opening up new modes of 'mobility.’

Market speculations and experts believe that Ola has been having trouble raising funds. This alliance, as Anand mentioned, could thereforego a long way to help create a better value proposition for Ola.

Also,there have been several speculations this year about Reliance entering the cab aggregator space. This alliance with Mahindra, which would attract more driver partners, could, therefore, be Ola’s way of strengthening its position.