When things go out of control, trust your intuition

I decided to leave my startup job without having any solid financial backup. I was not very sure about what I was going to do in future. I thought I had done the necessary work for the startup where I was heading content marketing.

I joined Babygogo in January and helped in pivoting the product from a doctor-focused app to one focused on parents. We got some exciting results in a short time from our efforts in content marketing (starting from May).

- One of our videos went viral, fetching more than one million views in about three days.

- A single viral article increased our blog traffic to 25,000 visitors in a few days.

- Also, we improved our traffic-to-app-conversion ratio significantly.

There was much more work to be done, but now they had a solid digital marketing team. Honestly, I was losing my interest in the work so I decided to pull the trigger and resigned as any work done forcefully or without interest yields no output.

I did not have a lot of money in my bank account, because whatever I earned was spent on my household expenses.

All of my savings had been invested in the stock market. I thought I’d sell a portion of my stocks to get the amount of money required to run my house till December.

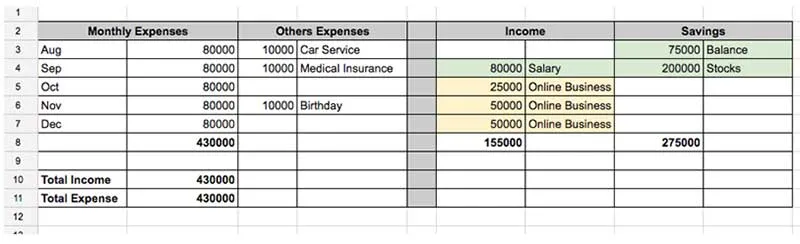

I also prepared a rough financial plan to keep things going till the year-end, while I planned to put some efforts into the work of Cash Overflow (that I started out of my hobby last year).

I never tried to monetise Cash Overflow traffic so I was not sure how much income could be possible from a small traffic of 30,000 per month (yellow colour for expected income).

I was trying to be logical, but my wife had a more logical version to which I did not have any answer. She said, “No one is asking you to leave the work. Your efforts are yielding good results and everyone is happy with your performance. You will get a salary raise with the next round of funding of the startup, and looking at the performance of Babygogo, they have a bright chance of raising their next round in a couple of months.”

She advised me to keep working for the startup and handle their marketing work but also start spinning out something of my own to make a regular online income.

It could indeed be a logical move if worked on correctly. I’d start making some money from one of my side projects and then leave the job. It sounded good. I should have listened to her, but I listened to my heart instead. I took an intuitive decision and as always, my wife supported my decision.

Honestly, I was afraid of taking the risk as it could turn out to be a major loss, but I was also confident of figuring out a source of income by December. I was relying on the money from the sale of my stocks to hold me in good stead until the year-end.

I put in my papers in August.

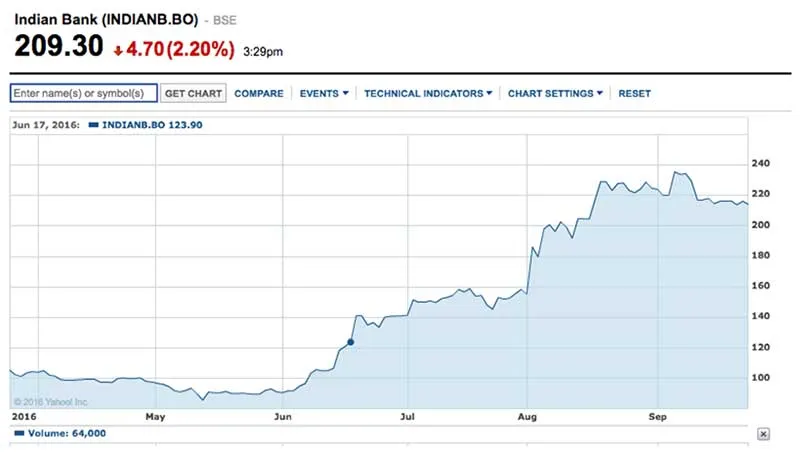

Then, guess what? Something magical happened, and two of my stocks skyrocketed almost 2.5X.

Interestingly, I had invested most of my money into these two stocks only.

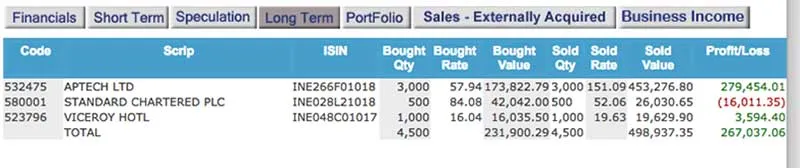

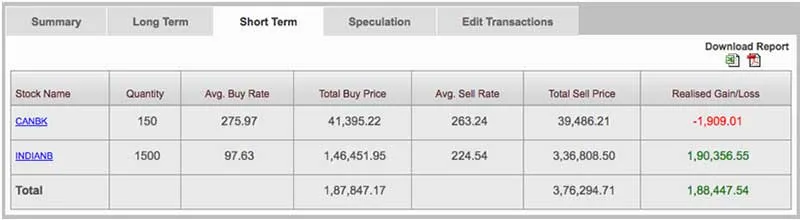

I made a profit of about Rs 4,50,000 from my stocks. I immediately transferred the required funds into my savings account and reinvested rest of the money in the stock market again.

On Aptech, I made a long-term capital gain, which means that I don’t have to pay any taxes on my income of Rs 2,79,454. On Indian Bank, I made a short-term capital gain, so I have to pay income tax @15 percent of Rs 1,90,356.

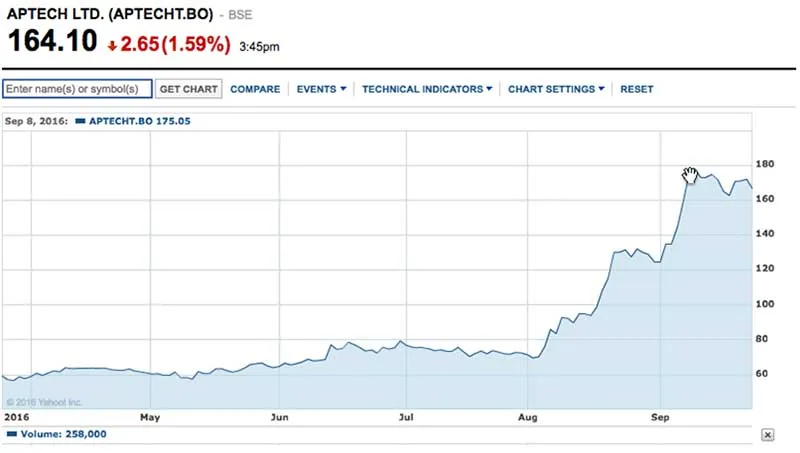

Have a look at the last six-month graphs of both the stocks.

Aptech

Do you think I am a smart investor?

No, it was just my luck.

In any case, I was going to sell my stocks because I had already put in my resignation on August 1. I had done thorough research when I had bought both the stocks last year, but it was a coincidence that they gave me spectacular results in August and September only.

I started investing in the stock markets in 2010, and this was the first time any of my stocks gave me double returns. On my journey of learning value investing, I have booked major losses in 2010 and 2013 in the stock markets.

I won’t advise you to blindly invest in shares because that gave me good returns in the bad times. It could have been the opposite way as well.

Do you think I will be lucky every time?

No, I am not sure, but yes, I hope so.

Do you think that everyone should make decisions like this?

Absolutely not. Even I was afraid to make decisions like this.

Then what do I want to tell you through this article?

I just wanted to share my experience of taking decisions in my bad time.

Hard work + intuition + persistence = my luck

99 percent of the time, I play the role of a logical man. I make Excel sheets and count the pennies as normal people do.

One percent of the time I look within, listen to my inner voice, and consult with myself.

Since I was not enjoying my work, it was very clear that I would leave the job sooner or later. I waited for an entire month (July) to understand if I was going through a temporary phase, but I was not.

I had some money for the next few months, and from there I got the confidence to take the tough decision right then instead of lingering over it for a couple of months.

If I had taken the decision of continuing my job, my work would have suffered. There was far less chance of another viral video or article because I was not able to put my heart into my work. I would be at a loss and even the startup that was paying me a regular income would be at a loss, which I could never accept.

I am inspired by this beautiful story as told by my favorite author Vineet Nayar in the Economic Times article.

Someone out there is waiting to throw you on a train you believe to have missed, if only you decide to take that chance.

“It was 3 am when the train stopped. A boy, just eight years old, stepped out of the train attracted by the fascinating scene outside.

The train starts moving. Someone shouts. The boy is jolted out of his dreams and runs to catch the train. He catches the side bars but fails to pull himself up. He keeps running and tries again and again but fails each time.

Fear and doubt creep into his mind. The train gathers speed.

A critical choice faces him — give up or take a chance and keep running. He runs again, faster, taking one more chance to get on the train, feeling hopeless but not giving up yet.

Seeing the boy losing the battle, a vegetable vendor runs towards him and throws him into the last compartment of the train, to be reunited later with his family, sleeping unaware.

I have always wondered why I kept running. Why did I take that chance despite fear and doubt overpowering my mind? Did my taking the unlikely chance of running create the magic of someone helping me get on the train?”

The critical decision making phase comes many a time in our life and many choose an easy path rather than choosing the one with obstacles. I’m not saying that choosing the easiest one is not good. It is the best when you don’t have any backup or substitute. And I chose the one with obstacles because my heart wanted to.

What would you do if you had to take a critical decision in a state of fear and doubt?

I am not sure how many times I will take intuitive decisions like this in the future, but yes, I got positive results from the decisions made in the past after listening to my heart, even if those sounded illogical at the time. I believed in myself and I did it.

You just have to trust yourself once you have made the decision. Making a decision means choosing one option from the available set of many options. When you choose one option, you decide not to choose the rest of the options.

Don’t be doubtful about the options that you left on the table. Don’t be in a state of confusion after making your final decision. You have to be persistent with your efforts to make things a reality.

The article was published originally on Cash Overflow