Govt. claims that transactions worth Rs 361cr made on BHIM so far

On Wednesday, the Lok Sabha was informed that transactions worth Rs 361 crore have so far been made using the newly launched BHIM (Bharat Interface for Money) application for mobile phones.

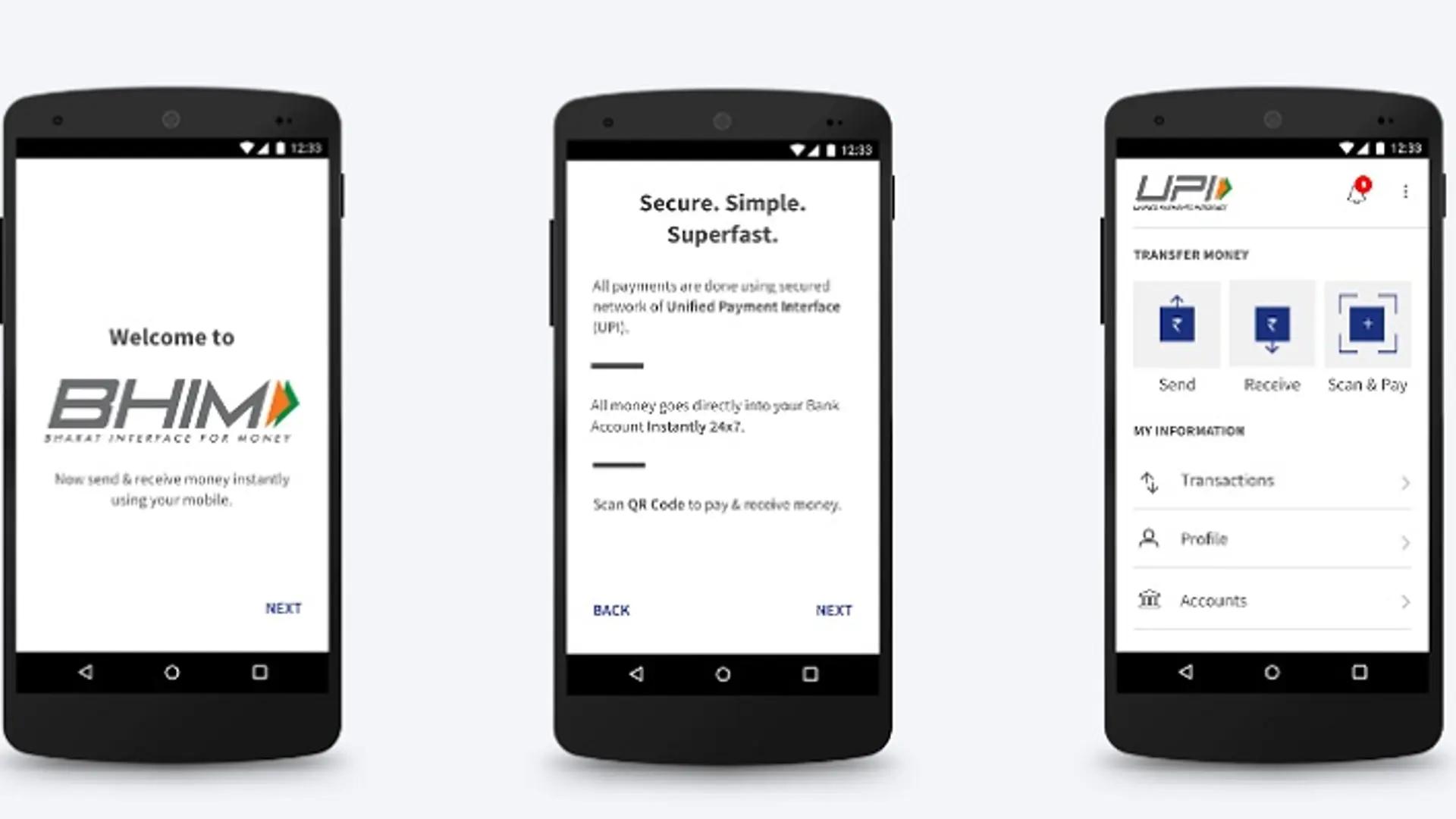

Working on the UPI (Unified Payments Interface) infrastructure, Minister of State for Planning Rao Inderjit Singh also said that the BHIM app has brought various banks under one umbrella, making it convenient for users.

Launched on December 30 last year, reports have suggested that the app had already crossed 10 million downloads within 10 days of its launch.

Responding to questions during Question Hour, Inderjit Singh said that while Scandinavian countries have achieved a rate of 90 percent in digital transactions, in India, the figure was three percent.

According to him, if the figure (for digital transactions) reaches 22 percent, it would help curb black money in the system. Lately, with the boom in digital payments, there have been questions raised regarding the security of these mechanisms, to which the minister said that no system is “101 percent foolproof”, and that India, being a software-rich nation, will be able to plug the flaws on its own.

So, how do UPI and BHIM work?

Launched in February last year by the National Payments Corporation of India (NPCI), the UPI allows you to make payments using your mobile phone as the primary device for transactions, through the creation of a ‘virtual payment address’, which is an alias for your bank account.

On the BHIM app, it would be <mobile number@upi> or <preferred user id@upi>. This user id would be your primary address, which can be used to send or request money through other IDs linked to it.

The UPI is also available for feature phones, by dialling *99#.

Further, on the BHIM app, users can register their bank account with BHIM and set a UPI PIN for the account. Your mobile number here becomes your payment address, and voila - you are ready for transacting through the app!

One can also change the virtual address if the unique suggested address is available.

The BHIM app also made it to Finance Minster Arun Jaitley’s budget speech last week. He claimed that 125 lakh people had adopted the BHIM app so far. The government also plans to launch two new schemes to promote the usage of BHIM- the Referral Bonus Scheme for individuals and a Cashback Scheme for merchants.

The Finance Minister also put forward a strong target of touching 2,500 crore transactions in the year 2017-18 through UPI, USSD, Aadhaar Pay, IMPS and debit cards.