Logistics cost will remain high for manufacturers, e-tailers even after GST

Logistics costs in India are 13-15 percent of the product cost, while the global average is six percent. According to McKinsey, the current wastage caused by inefficient logistics is equal to 4.3 percent of the GDP, and, if not corrected, will increase to five percent of GDP or $100 billion by 2020.

Anand Thambe is a Nagpur-based lorry driver, who makes at least Rs 30,000 a month by ferrying agricultural produce over long distances in his seven-ton truck. He gets his business from at least seven agents in Nagpur. His got his latest business when a large retailer from Bengaluru ordered seven tons of oranges for Rs 55,000. Thambe was entrusted with the delivery of oranges to Bengaluru, a distance of 975 km, by one of the agents in Nagpur who, in turn, had been contacted by a transport company contracted by the retailer. He picked up the oranges from the mandi in Nagpur, delivered it to Bengaluru over two days, and returned with an empty load. He made Rs 2,000, the agent Rs 8,000 and the transport company Rs 15,000. The retailer ended up paying for the return journey of the empty truck too.

The retailer paying for the empty load on the truck's return journey is indeed an unnecessary expense that makes logistics expensive. It results from inefficiency on the part of multiple parties, and a lack of location-based planning. When combined with the extant multi-tax system enforced by each state, this drives up the cost of produce and goods for the end consumer.

The government is going to introduce the Goods and Services Tax (GST) to make taxation easy for manufacturers and brands. Unfortunately, having a single-point tax is not going to solve the problem as far as the final cost of goods is concerned, because the transport system will continue to be run by agents who do not have the information to become efficient across cities. “The costs are not going to come down until someone creates a system that can track people like Thambe and ensure they do not have to make a return trip with an empty load,” says Jayaram Raju K, co-founder of LOBB, a technology company that provides logistics services to large transport companies, and works with over 7,000 truckers and 200 large transporters.

McKinsey estimates the current wastage or value loss in India’s transport ecosystem to be around $80 billion, and it expects the inefficiencies to go up, because 90 percent of the logistics business in India is unorganised, and is run by truckers who own one or two trucks.

However, the logistics industry is on its way to becoming a $200-billion opportunity by 2020, and is expected to have eight primary warehouse hubs across India thanks to GST. JLL, the real estate consulting and advisory firm, predicts that an organised logistics ecosystem could lead to a boom in manufacturing, e-commerce and agriculture. However, this would first require estimating demand and organising the road and rail network. The railways is stepping up its act by doubling its capex plan. But the bulk of goods continue to move by road and the logistics industry continues to be dependent on small-time agents and truckers. There is a need to estimate the demand from one city to another, so that trucks and rail racks do not have to ply empty. This is what logistics companies like Blackbuck, Rivigo, TCI, Gati and VRL can benefit from.

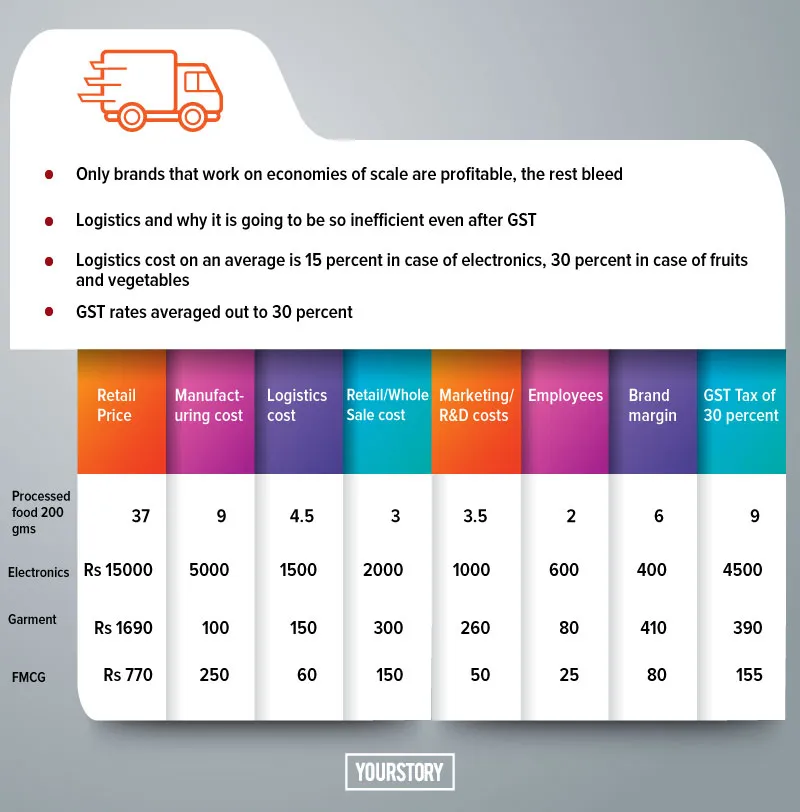

Currently, the logistics cost is 25 percent in the case of agri produce, and 13 percent on an average for electronic items. It goes up in the case of pharmaceutical and biotechnology industries. There are over 30 logistics companies that started two or three years ago and all of them are struggling as they have not been able to bring the costs down thanks to the fragmentation of truck and transport assets in the country. This chart by YourStory shows that manufacturing and logistics are the biggest cost contributors.

GST is but the first step?

Indian brands and manufacturers have so far registered warehouses in multiple cities across the country and have created a system to manage payment of excise tax in each state. They have also contracted local manufacturing units to serve a region along with having multiple warehouses in the country.

“The biggest advantage of GST will be in reducing the paper work necessitated by state taxes and excise taxes,” says Maulik Mistry, founder of Pure Snacks, which retails the nutritional bars under the brand name Mojo.

According to Indian Brand Equity Foundation, there is 1,800 million sq. ft of warehouse space in India, with over 5,300 cold chain units. Only eight percent of the warehousing space in India is organised. With GST, there will be a few things that will change.

- Brands can have centralised manufacturing and warehousing.

- The single-point tax will reduce paperwork for the industry.

- There can be a better use of cold-chain resources, and agricultural produce can be moved across the country without any loss in value.

- It can make agents more efficient at buying and selling of goods.

- It frees up capital for brands to play around with margins for the retail trade.

- The consumer can benefit with best prices.

The difficult part is the last three points, because agents are not using technology to understand requirements across each region.

“One has to work directly with the brands to price products cheaper for the retail ecosystem and reduce the logistics costs by estimating demand. This is done with technology,” says Anish Basu Roy, Co-founder of Shotang, a technology-led distribution company.

So while the entire industry believes that logistics cost is going to come down with the introduction of GST, it seems of unlikely given the fragmented state of the industry. Trucks are sold to individual owners, and transport companies will not bet on owning an asset or having a book of drivers on their payroll. The price is controlled by the agents who serve every village and town. This is where the pricing is not transparent and the organised logistics is unable to do anything about it. They are all dependent on agents or middlemen for orders.

“The logistics industry is information-starved and pricing is dependent on the agents' lobby,” says Ankit Sethia, Founder of HipShip, a logistics company that plans to bring about transparency in pricing across different regions.

So when industries like e-commerce talk about cheaper prices they are actually burning cash to bring the product at the customer's doorstep.

The opportunity in agriculture

While agricultural produce is not taxed, there is a mandi tax to be paid by the middleman. According to Ernst&Young, the value loss during transportation of agri-commodities is around 35 percent, thanks to inefficient methods of storage and transportation. This combined with the mandi system or the middlemen that play the role of aggregators in Indian agriculture, further escalates the cost of the produce. The produce changes hands at least five times across cities and towns.

So the question to ask is whether policy is fighting the fabric of the Indian culture itself, which is used to consuming local produce in most cases. The fact that produce can change so many hands is fascinating, meaning organised retailing and digital payments have not penetrated 75 percent of even urban society. Reports state that only 10 percent of the retailing in this country is organised, and the consumers of organised retailing, including e-commerce, is not more than 75 million shoppers. The industry bleeds in perishable goods because of wastage and inefficient transport costs. Whereas, in consumer goods, apparel and the electronics industry only brands with the economies of scale have managed to stay profitable. The large companies are happy to work with multiple transport providers and yet manage their maximum retail price to garner at least 20 percent gross margins.

No doubt GST is excellent for tax collection. It will, however, not be able to bring down the logistics cost in the short run, since 90 percent of the industry is fragmented, and manufacturers and large transporters work with this very industry to reach the customer.