Why the Indian IT services industry has no option but to reinvent itself

Businesses are showing IT services the way in the era of digital economy. The $160 billion IT services industry has no choice but to reinvent itself and ride through chaos and disruption.

Key takeaways

- Businesses are going for a digital makeover and automation, and demanding better outcomes.

- IT services companies are being asked to switch to on-demand pricing model from the previous fixed price and time-and-effort models.

- Joblessness is going to be real unless people learn new skills such as data engineering and building platforms.

Consider this: Shoppers Stop has pumped Rs 60 crore in its IT infrastructure over the past two years to make it agile and future-ready.

The retailer wants to ensure better customer engagement through cloud-based applications as well as through e-commerce modules that combine in-store and home experiences.

It expects at least 20 percent of its revenues to come from cloud-based engagement in two years.

Anil Shankar, VP–Solutions and Technology, Shoppers Stop, says,

“The changes over the last two years have been faster than in the previous 25 years. To win the consumer today, you need digital experiences integrated into all channels.”

He adds that in the digital world, brick and mortar must serve the consumer everything, everywhere, and every time.

Anil could well be speaking for legacy companies as a whole. As Praveen Bhadada, Partner & Global Head–Digital, Zinnov Management Consulting, says, “It is a known fact that enterprises across industries are going through a phase of massive disruption.”

The old boys are being increasingly challenged by digital upstarts, who are leveraging cutting-edge technologies and innovating around business models to significantly enhance the customer experience.

As a result, enterprises are starting to rethink technology and IT services in order to digitise and define innovative business models that their customers will be excited about. In 2016, over $38 billion was invested in modern infrastructure, tools and disruptive business models around digital.

In fact, new-age digital technologies such as artificial intelligence, Internet of Things, robotic automation, virtual reality/ augmented reality, blockchain, drones, and 3D printing have started proliferating across industry verticals.

This shift towards digital is forcing the IT services players to rethink their business models besides coming to terms with margin pressures on their traditional businesses.

The news of layoffs, boardroom tussles and management shakeups that we have become so accustomed to have been symptoms of the ensuing churn in the IT industry as it tries to adapt to the changing realities.

The exercise at Shoppers Stop demonstrates this well. A small team of 15 or less is implementing the digital makeover across the 100-odd Shoppers Stop group stores. In the past, the service provider would assign at least 75 people for a project this size (Rs 60 crore). Even legacy on-premise solutions will be automated rapidly going forward further reducing the need for manpower. All this is going to leave the IT service provider with redundant manpower on its rolls as well as reduced billing.

Now, clients have started measuring the ROI of digital investments with better customer experience, new revenue streams, better operational efficiencies, empowered workforce and less risk to the businesses.

Moreover, they expect the service companies to be the advisors of their digital journey, be the change agents and deliver exceptional outcomes. Client expect the services companies to come out of the “order taker” mould to being true partners in the digital transformation.

“This is where the construct of IT services is starting to change,” says Praveen.

Why product platforms will drive the IT industry

Let us look at the pricing mechanisms followed by the service providers and how they are changing now.

At one end of the market are clients who outsource the maintenance of their IT infrastructure, including applications, to the service providers. The latter billed them on the basis of time and effort expended on a project initially but switched to a fixed price model from 2010. Now, the clients are asking for linking pricing to outcomes.

At the other end of the market are product companies (like Oracle, SAP, Cisco, Microsoft) which used IT services companies as partners in project implementation. Now, with these product companies going after cloud-based business models, the future of IT services companies will depend on the strategy of these billion-dollar global companies.

To differentiate themselves in the market, IT services companies are also building their own platforms, which are cloud-based and on-premise applications. Here clients can choose the products they want to use on a pay-as-you-go-basis. For example, a bank can now integrate a blockchain application over the cloud across borders and manage remittances of customers without having to depend on intermediaries.

These platforms require lesser number of IT service professionals on the job. Here, for instance, two people can write code and get an application running on a couple of cloud severs for an organisation, which the latter can use on a switch “off and on” module. In this model, the invoicing falls by three-fourths over the fixed price model.

The key question to ask then is: Are IT services companies preparing for such a model going forward? The answer is a resounding yes.

In large part, the platform focus of IT services companies is driven by the early success of platform companies such as Alibaba, Baidu, Microsoft, Amazon, Google and Facebook. The top 15 global platform companies command over $3.0 trillion in market valuation today. Companies such as Microsoft and Adobe have completely opened their products to third-party applications in a bet to become platform-centric organisations.

Legacy companies such as General Motors are now building connected car platforms; GE Predix as an industrial IOT platform is already a huge success. “These companies have been operating in an asset heavy environment and are thriving by creating an enabling ecosystem around their products,” says Praveen .

Services companies are expected to either enable clients in being platform-driven or deliver outstanding digital experiences with their own platforms.

“IT is moving from being a support function to an important business enabler,” says DD Mishra, Research Director at Gartner. He says the boundaries between technology and business have blurred and in some cases even merged. “We are now in a digital era and every business leader is also a technology leader.”

Now, the involvement and engagement of business in making technology related decisions is actually increasing. Technology buying decisions are centered on creating more value and driving efficiency along with the expectation of optimising cost.

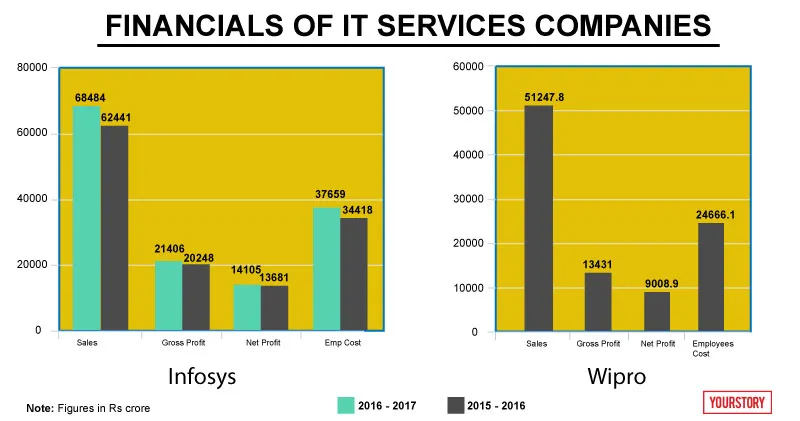

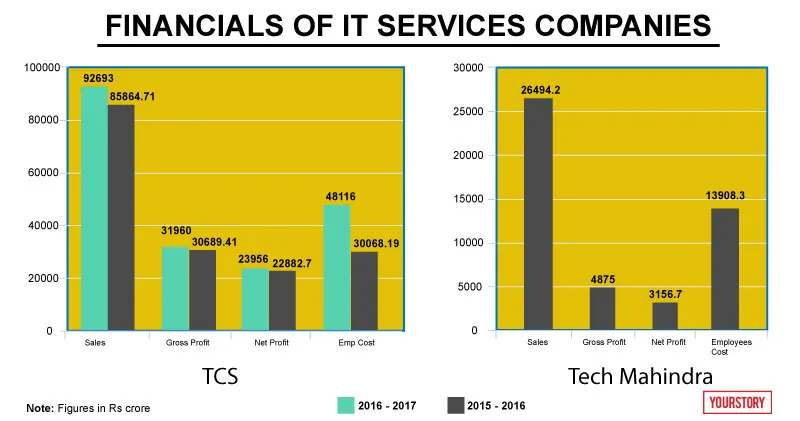

Data culled by YourStory shows employee costs have gone up across the board in IT industry. This means the industry will continue hiring because a lot of money comes from legacy assets. But hiring will reduce over time because clients are demanding more work with automated processes and smaller teams.

The slow reinvention in the IT industry

How are Infosys and Wipro, the mascots of the Indian IT industry which employs more than 10 million people directly and indirectly, coping with the changing realities?

“Over the past few years, technology disruption has fundamentally transformed our clients’ business landscape with established business models being surpassed by innovative new business models and emerging competitors,” says Ravi Kumar, Deputy COO and President, Infosys. He adds that clients are now focusing on ‘Optimization’ and ‘Reinvestment’ which is in line with Infosys’ framework of ’Renew and New’.

For Infosys, the focus now is on doing more with less in its traditional “run and maintain” business and reinvesting the resulting savings into growth areas that would “future proof” client business and give it a competitive advantage. Some of the key growth areas for it are digital, modernization, data & analytics and Cloud.

“We are nurturing strong partner ecosystems across these new services as we strongly believe these will continue to be the skills of the future. These internal investments have helped us grow our new services significantly over the past 18 months,” says Ravi.

The company has made six acquisitions over the last three years and is looking to make an impact on its platforms business. This year it launched Nia, its AI platform. and completed piloting a cloud-based blockchain application in the Middle East. It has built a platform-based on AWS for its clients and is helping product companies like HP and Oracle to help enterprises in their digital transformation.

Last week, Happiest Minds Technologies acquired OSSCube, a US-based digital transformation company, for an undisclosed sum. This acquisition will enable the IT services company to own offerings in the consulting-led digital space, especially around open source platforms. Happiest Minds will enhance its offerings in areas of cloud, big data, e-commerce, enterprise mobility and open source.

“The business leaders are getting involved in IT decision-making. Also risk and reward models are cropping up,” says Salil Godika, Co-founder, Chief Strategy & Marketing Officer, Industry Group Head at Happiest Minds Technologies. The company has started a centre of excellence around IoT and data analytics to prepare for the knowledge-plus economy.

“The industry is clearly in a transition and platforms that power knowledge are replacing the core of the business,” says Salil.

What happens to the old business?

The old business of application development and maintenance, which still constitutes 85 percent of the revenues, will continue to drive the revenues of the companies. Over the next decade when enterprises go for a hybrid model, where cloud applications and legacy applications will interact with each other, the consumer facing applications, in retail centres, such as dealer management systems and PoS systems will move to the cloud.

However. the master trade data and industrial machine data will be managed as on-premise solutions with a data analytic solution built on top of it in the cloud. Here, security will become a major business avenue. But all this will require a digital transformation of the organisation and rendering it paperless.

But all this is still a long way from happening, if a new study by Wipro Digital, the digital business unit of Wipro, is to be believed.

Half of senior executives polled across companies feel their company is not successfully executing 50 percent of their strategies. The study surveyed 400 senior-level US executives to gauge the digital transformation strategies within their organisations.

"Digital transformation efforts are coming up short on intended ROI, in part because digital transformation is as much a leadership issue as it is a strategy, technology, culture, and talent issue," says Rajan Kohli, Senior Vice President and Global Head, Wipro Digital. He adds that real digital transformation occurs when courageous leaders align goals in practice and theory, manage opportunity more than risk, and prioritise the future over retrofitting the present.

The future

According to Gartner, by 2018 Indian CIOs are expected to spend around a third of their IT budgets on the digital economy. Analytics, cloud services, mobility and digitalisation/digital marketing are the top four spending priorities, as per a survey of CIOs in India. Globally, spending on digitalisation is expected to jump to 28 percent of IT budgets by 2018 from 19 percent during early 2017.

These shifts mark an opportunity for IT services providers. But there is a catch though. Indian universities are not prepared to cater to the talent needs of the changing world of technology. This would mean IT services companies would have to spend millions of dollars on training new employees. This is where companies like PluralSight and Jigsaw Academy could make an impact by reskilling and training the existing talent pool.

While the opportunities are certainly large, the challenges will put the IT industry to test. Consolidation and acquisition of new-age companies then may become necessary to stay relevant. But one thing is certain. Jobs will be the biggest casualty throughout the technological churn. Are we ready? The answer is still blowing in the wind.