How MaxWholesale wants to challenge large distributors by taking wholesale tech to kiranas

There are 12 million kirana stores in India, and technology has not touched more than 100,000. MaxWholesale wants to change this.

Rama Chetty owns three department stores in Hyderabad. He is a wholesaler and supplies consumer goods - from biscuits and juices to salt and shampoos – to a network of stores owned by his family. His stocktaking is all manual, and his family network is unable to scale up because they cannot handle any more than the 4,000 stock keeping units (SKUs) they already do. Revenue is stalled at Rs 1 crore per year.

According to Ernst & Young, there are 12 million kirana (grocery) stores in India and close to a million wholesalers that make up the lifeline of the $650 billion retail industry. Barely a fraction of these use any sort of technology that can help them grow.

This is what MaxWholesale, a Delhi-based tech and wholesale company, is solving: the way FMCG companies (suppliers) work with retailers on a real-time basis.

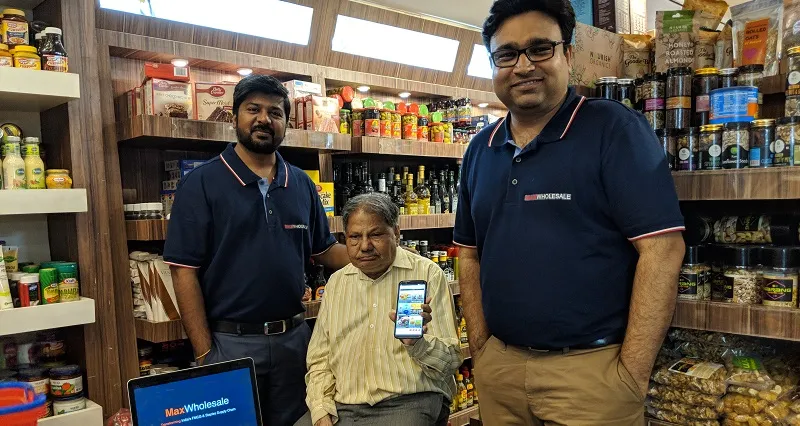

Founded by Samarth Agrawal and Rohit Narang, MaxWholesale’s solution includes not just a tech platform but also warehousing and logistics capabilities. The cost of collecting orders is zero due to automation, and the cost for a shared supply chain is much lower than for an individual. Today, more than 120 FMCG companies and 5000 kirana stores are working with MaxWholesale.

Retailers start with downloading the app from Google Play Store, and registering on it. “Our company calls them for account approval,” says Samarth, explaining the process. “They can then see the products and prices and place orders as and when they need anything in stock. Our warehouse operations team packs the orders within an hour and material is ready to ship. Next morning our logistics team delivers the product.”

The retailer benefits from transparent pricing, while banner ads and other digital marketing methods help store owners discover new and trending products. Next-day delivery helps a store run on thinner inventory, lesser working capital, and yet higher variety.

In the beginning

Samarth did his engineering in computer science and mathematics from IIT Delhi and before starting MaxWholesale, was running a B2C startup, GetChat, where he built an app for small kirana store owners to become mobile-ready, build digital store fronts, manage and share catalogues, and communicate with their customers over chat. He soon saw that kiranas did not worry about technology, and would only use it if it meant that their margins increased.

In 2015, he met Rohit, whose family had been in the retail business for over 60 years with a store in Delhi’s Hauz Khas. Rohit loved Samarth’s product at GetChat and over time, the two became friends. When Rohit shared his procurement and supply chain problems with Samarth, they were soon thinking of how they could solve these problems. The result wasMaxWholesale, which came into being in April 2016.

In 2016, Samarth shifted his core technology to the B2B domain, and Rohit joined him by investing an undisclosed amount in the venture.

Small businesses, big problems

There are millions of kirana stores in India, which collectively account for more than 90 percent of the groceries sold in the country. However, they place small re-stocking orders, which are not profitable for a large FMCG company to deliver.

“Companies are not able to supply to them at the right frequency. Collecting these orders is also an expensive proposition. As a result, at any point in time, a store is out of stock on at least 25 percent of its items,” says Samarth.

Kirana stores make a net margin of 3 percent and hence need to tightly manage their supply chain or bad cash management can burn their monthly income.

The FMCG supply chain consists of manufacturers, carrying and forwarding agents, distributors, wholesalers and retailers. Agents deliver products to distributors and companies appoint area-specific distributors to deliver products to every retailer in their area.

This entire operation is mostly run without any technology intervention. “In place of delivering to thousands of small stores, the distributors prefer delivering to large wholesalers on discount. And retailers are forced to go to wholesalers to pick up stuff,” says Samarth.

While product awareness is generated with digital marketing and TV commercials, distribution remains poor so the product faces challenges in simply getting sold. “There is a huge gap between awareness and availability of a product in India,” points out Samarth.

“There are a lot of micro entrepreneurs like retailers and offline wholesalers, but there aren’t any companies solving these supply chain issues for the ecosystem,” he adds.

Changing the way things are done

MaxWholesale began by identifying a few markets in South Delhi where it started delivering goods. The co-founders went store-to-store, telling retailers about their service, and signed up about 50 of these. Slowly, the orders started coming in. Retailers had questions like whether their delivery would cost them extra, would the products be authentic, and whether they would accept returns in case of damage.

Once the technology and the mode of delivery were accepted, the retailer community started recognising their work, and the startup started building its business.

The major challenges they faced were demonetisation and the implementation of GST, as it slowed down the business. The company is yet to turn profitable, and has received $1 million from India Angel Network. It declined to disclose revenue figures.

“The future is in making the kiranas organise themselves with data. They serve more Indians than any modern retailers,” says Lalit Bhise, founder of Mobisy Technologies, which works with wholesalers and kirana stores to deliver items.

MaxWholesale is currently only working in the Delhi region, and plans to explore other markets in India by the end of next year.