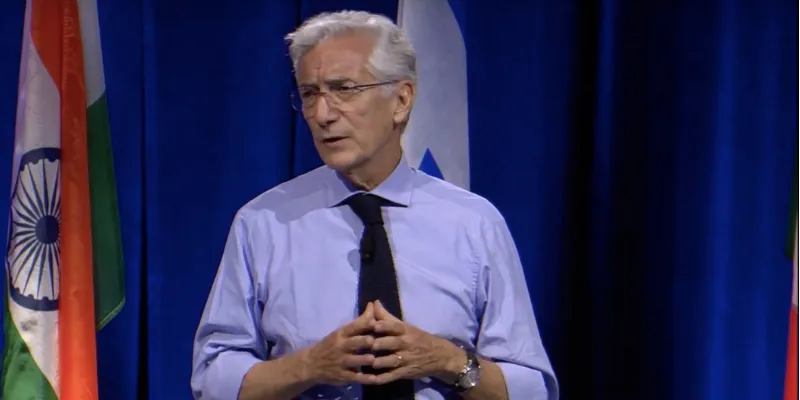

‘There’s never been a better time to look at impact investment’ - Sir Ronald Cohen

Venture Capitalist and Private-Equity investor Sir Ronald Cohen speaks on impact investment and how it is the way forward for a better world.

“When you bring an impact lens to a business, you affect both the risk and the return dimension of your decision,” said Sir Ronald Cohen, addressing a gathering of 900 attendees from 54 countries, comprising social entrepreneurs, investors, and activists.

Speaking about the importance of impact investment, the business of it and the urgency to shift the lens to social good, he said that risk, return and impact were the three pillars for social entrepreneurship.

In his 18-year-long tenure at the Social Investment Task Force (SITF), the 73-year-old alumnus of the Oxford University and Harvard Business School has held multiple positions in the social sector.

“I came to Britain as a refugee at the age of 11. My family lost everything in Egypt where I was born. I have therefore a desire to help those who are left behind. And, because I come from the financial world and the entrepreneurial world, I would like to harness the force of innovation of entrepreneurship and of capital markets to enable those who are trying to help populations here and elsewhere to access the capital they need to do it,” he said.

Extending a helping hand

As the chairman of the Social Impact Investment Taskforce, which was established by the G8 (Group of Eight) and The Portland Trust, Sir Ronald is the co-founder of Social Finance UK; co-founder Director of Social Finance USA, Social Finance Israel, Big Society Capital; and was co-founder Chair of Bridges Ventures.

“Impact investment is the way to put the world on the path to impact economies and this path will help us reach a better world. There has never been a better time than right now to head in this direction,” he said.

Filling the gaps with Impact Investment

Sir Ronald is also the chairman of UK-based Global Steering Group. In India, the GSG aims to raise $1 billion by 2030 through major impact investment funds in India - India Education Outcomes Fund and India Impact Fund of Funds.

“We at the GSG are pledging that by the end of 2019 we will deliver affordable, acceptable leading investments which enables us to put the impact profit-loss balance sheet alongside traditional financial ones,” he added.

Apart from India, the Global Steering Group is active in Argentina, Uruguay, Australia, Bangladesh, Brazil, Canada, Chile, the European Union, Finland, France, Germany, Israel, Italy, Japan, South Korea, Mexico, New Zealand, Portugal, South Africa and the US.

“We have to be able to back those who are unable to disrupt their markets to put themselves at a competitive advantage by delivering impact, by delivering profit. Revolutions need to stand for something more than just formulas, they have to stand for an improvement in major challenges the world faces.”

We can all play a role

Can ‘Impact’ and ‘Returns’ coexist? Sir Ronald says they can. “Impact can and is being measured. It is measured by specific investments and specific intervention like social impact bonds. I predict that within the decade, many competence and companies will be publishing impact weighted accounts alongside their financial accounts.”

“New entrants… are proving that impact affects the return dimension, it affects it because you begin to discover the new sense of opportunities which you never faced before. Demand and price point become a priority. With the right product and right service, you can grow and compete for the right businesses.”

India - a playground for investing!

With an estimated two million social enterprises, India is one of the most dynamic social entrepreneurship environments globally, said Sir Ronald. With a myriad of socio-economic problems, the country also has a vibrant startup community with sustained support from investors globally.

“India offers a big potential in the world because impact investment has already taken routes of $5 billion to $6 billion, which can be defined as an investment where the impact is measured through financial returns. As I look ahead, I can see that we have no choice but make investing in social good a success.”

The Global Impact investing sector stood at $135 billion in 2015, and is expected to grow at a compound annual growth rate of 17.9 percent by 2020. While the ecosystem continues to evolve, initiatives like the UN’s Sustainable Development Goals have strengthened the framework for Impact Investment.