What Binny Bansal’s investments in startups tell us about the Flipkart Co-founder’s strategy

YourStory takes a closer look at Binny Bansal’s investments in startups to figure out where his interests lie and what these choices tell us about the Flipkart Co-founder’s investment strategy.

As Co-founder of India’s first ecommerce ‘unicorn’ Flipkart, Binny Bansal didn’t just build India best-known startup, he also inspired a whole generation of entrepreneurs. His story is no longer just about building a wildly successful startup but also being a part of the Indian startup ecosystem in more ways than one – as a mentor and more importantly, as an active investor.

While still at Flipkart, Binny began backing a variety of startups as an angel investor. Since then, he has invested in 25 startups. But what’s worth noting is that he has backed several startups multiple times – a clear reflection of his belief in the problem they are solving, and in their potential to generate returns.

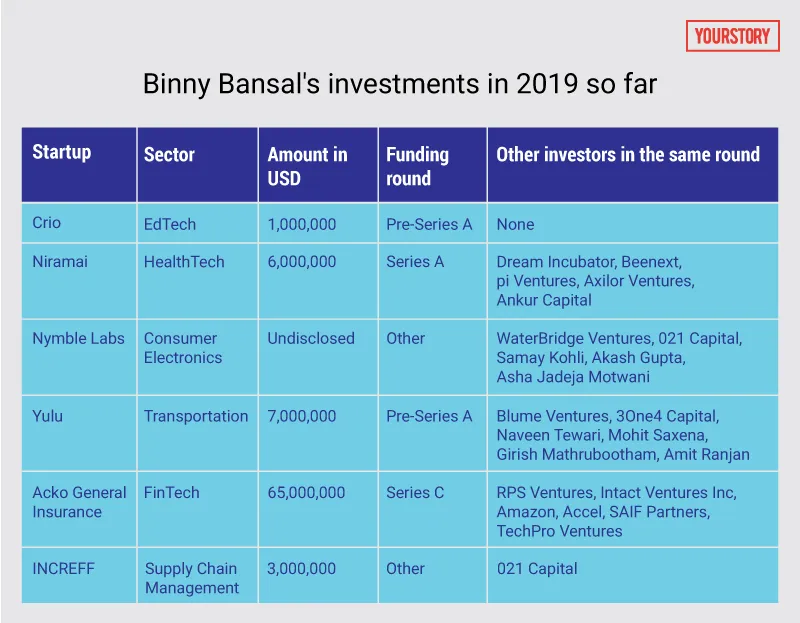

In fact, in the January-March 2019 quarter, Binny emerged as the most active angel investor in the country, having made five investments in just three months. That’s quite the pace compared with the five investments he made through an entire year in 2015 when he first began investing. He followed that up with six investments in 2016, three in 2017, and seven in 2018.

Strikingly, most startups that Binny has invested in are working on futuristic technology to fundamentally change the way things have been done in the past – whether in diagnostics, learning, or even in cooking. (One of Binny’s most recent investments was in Bengaluru-based Nymble Labs, which is building a robot that can cook, named Julia, quite possibly after pioneer TV chef Julia Child.)

While his investment portfolio spans several sectors, a few emerge as favourites. One is healthtech, given that he has made 10 rounds of investments in five startups (see infographic below). Another is ed-tech.

This could well have more to do with the tech itself than health or education per se. Of course, these sectors provide plentiful opportunities to clock solid returns. For instance, as per IBEF data, India’s healthcare sector is expected to reach $372 billion by 2022.

1555785769303.png?fm=png&auto=format)

Let’s take a quick look at what these startups do.

SigTuple: Four-year-old health-tech startup SigTuple, in which Binny has invested thrice, is what is called a ‘deep tech’ startup. It is building a diagnostic fabric comprising medical devices, developing software used in diagnostics and diagnostic setups, and providing infrastructure for diagnostics services.

It is also building screening solutions to help faster diagnosis of a patient’s condition through AI-powered analysis of visual data like X-rays, ECGs, MRIs, etc. They also equip local public health centres and clinics with SigTuple Smart Screening Tech to enable quicker diagnosis.

SigTuple’s smart device AI100 enables digitising different biological samples like blood, urine, and semen with a single click.

On his investment in SigTuple, Binny had remarked, “SigTuple transcends the space of tech-enabled healthcare. It is actually creating the technology - ground up - for making healthcare affordable and accessible, and I am very excited to be partnering with them on this journey.”

SigTuple is also backed by AI-focussed fund Pi Ventures, in which Binny is an investor.

Pandorum Technologies: Another deep science/tech company that Binny has backed, Pandorum Technologies has developed technology to 3D-print human organs, including the cornea and the liver. The science behind this allows tissues to be grown in in-vitro (laboratory) conditions with a pseudo-in-vivo (internal body conditions) environment. The company designs and manufactures 3D functional tissues that can be useful for therapeutics and medical research.

Niramai: A third healthtech startup in Binny’s portfolio, Niramai provides breast cancer diagnosis using Thermalytix, its portable, non-invasive, radiation-free, and non-contact solution. The startup, which recently raised Series A funding, has over 20 installations in hospitals and diagnostic centres in nine Indian cities. Niramai is the only Indian company listed on 2019 cohort of AI 100 startups in the world by global business data intelligence platform CB Insights. It is now expanding globally too.

Supercraft 3D: Another investee, Supercraft3D provides visualisation solutions for doctors and manufactures body implants.

Beyond healthtech

Binny has also invested in ed-tech startups Unacademy and Hashlearn, besides several others:

- social entertainment platform Roposo

- real estate startup Plabro

- news app Inshorts

- fintech lender Avail Finance

- foodtech player Yumlane

- gaming startup MadRat

- hardware startup GreyOrange

- consumer internet platform Purple Style Labs

- consumer electronics platform Nymble Labs

Also read: Binny Bansal invests in supply chain management startup INCREFF

Been there, done that, ready to do more

Flipkart has always claimed to be a tech company rather than an online retailer or marketplace. As COO and later Group CEO, Binny has been there, done that. Hence, Binny’s mentorship to his investee startups is focused on doing what he does best: helping startups scale the tech behind the business and help build strong teams.

Earlier this year, Binny launched xto10x Technologies with former EKART head Saikiran Krishnamurthy. The venture will offer tech tools and a learning platform for startups all over the world looking to scale up rapidly. In doing so, it combines Binny’s experience in building and scaling Flipkart and as an angel investor.

“He is strong in execution and has skills which most people lack; he is very strong in team building too,” says a consultant who has worked closely with Binny.

Also read: Investors from Flipkart, India’s first unicorn, are breeding the next wave of startups

Opening new doors

There is an unwritten ‘bro-code’ among entrepreneurs/investors: If a prominent entrepreneur invests in a startup, chances are high that quite a few others would follow suit.

LinkedIn Co-founder Reid Hoffman (who was with Paypal before LinkedIn) was the one who connected Paypal Co-founder Peter Thiel to Facebook in the early 2000s when the social network was just another startup in Silicon Valley. Both entrepreneurs went on to be the initial external investors in Facebook and mentored the then-20-year-old founder Mark Zuckerberg, using their own experiences. (Hoffman was a philosophy student and researcher in personal identity and community incentives – which are relevant to social web, online networks, and marketplaces.)

Hoffman also brought his friend Mark Pincus, Founder of online social network Tribe, as an investor in Facebook. In The Startup of You, a book that Hoffman co-authored, he says about this partnership: “I wanted to involve Mark in any opportunity that seemed intriguing, especially one that played to his social networking background – it’s what you do in an alliance.”

It’s the same in India. One look at Binny’s investments shows that his peers, including Sachin Bansal, Ola Co-founder Bhavish Aggarwal, and VC firms like Accel Partners and Tiger Global, seem to trust his instincts.

An industry veteran, who has worked closely with the Bansals, told YourStory that there is a select set of angels preferred by VCs too.

“Investors look at startups favourably when prominent angels are involved. Institutional rounds from Tiger Global and Accel Partners are easier for startups if Bansals are angels in them. It’s not just about mentorship for startups that angels do, but opening doors too.”

The source, who is close to the dealings within the ecosystem, adds that for the billionaires and millionaires in the startup world, investing in startups is just re-allocation of their assets after bank deposits and buying properties. “They can also continue to be active in the startup ecosystem with more involvement.”

Binny is also a limited partner (LP) in a few VC firms, including Blume Ventures, India Quotient, Stellaris Venture Partners, Tracxn Labs, and Pi Ventures. Other prominent startup founders who have invested in VC firms include Infosys Co-founder Kris Gopalakrishnan (in IDG Ventures), MakeMyTrip Founder Deep Kalra (in Pi Ventures), and TaxiForSure and Vokal Co-founder Aprameya Radhakrishna (in Kae Capital, Blume Ventures, IIFL, and Stellaris Venture Partners), among others.

Binny is also the main backer of venture capital fund 021, founded by his financial advisor Sailesh Tulshan. Not surprisingly, the other limited partners in this fund include ex-Flipster Mukesh Bansal, Co-founder of Myntra and now Curefit; Sameer Nigam (Co-founder of PhonePe); MakeMyTrip India CEO Rajesh Magow; ex-Myntra CEO Ananth Narayanan; and former Flipkart executive Mekin Maheshwari.

Also read: Why Binny Bansal chose to launch tech startup xto10x Technologies for his second innings