Goal is to establish 50,000 startups by 2024: President of India

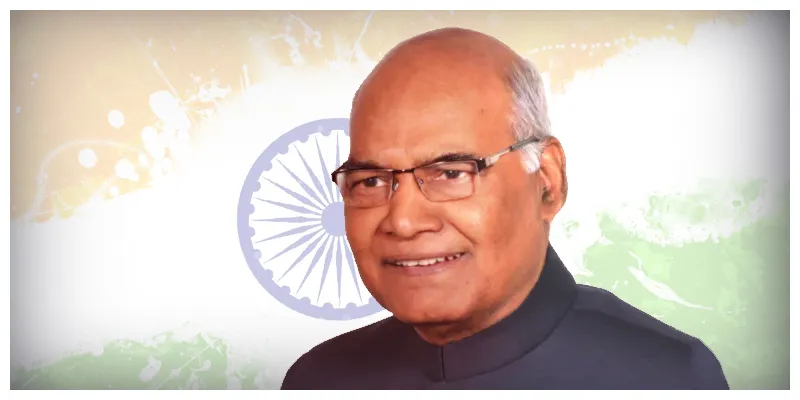

Addressing the joint sitting of Parliament, President Ram Nath Kovind said India has joined the league of countries with the most number of startups in the world.

President Ram Nath Kovind said on Thursday the government will take steps to further improve the startup ecosystem in the country with an aim of having 50,000 such enterprises by 2024.

Addressing the joint sitting of Parliament, Kovind said India has joined the league of countries with the most number of startups in the world.

"To improve the startup ecosystem, the government is simplifying the rules. This campaign will be further expedited. Our goal is to establish 50,000 startups in the country by 2024," he said.

Startup India initiative of the government aims at fostering entrepreneurship and promoting innovation by creating an ecosystem that is conducive to the growth of budding entrepreneurs.

So far, as many as 19,303 startups have been recognised by the department.

Since last year, the commerce and industry ministry has started conducting ranking exercise of states and union territories to encourage them take proactive steps towards strengthening the ecosystems within their jurisdictions for budding entrepreneurs.

Recently, The Department for Promotion of Industry and Internal Trade (DPIIT) under the ministry that prepared the 'Startup India Vision 2024' document, also suggested setting up of 500 new incubators and accelerators by 2024; 100 innovation zones in urban local bodies; deployment of entire corpus of Rs 10,000 crore Fund of Funds; and expanding CSR funding to incubators.

The vision document's other measures include setting up of Rs 1,000 crore 'India startup fund' to support high technology startups; providing Rs 1,000 crore of seed funding, and operationalisation of seven research parks by 2024.

As part of regulatory easing, the vision document proposes to reduce compliance burden, setting up of regulatory sandbox for testing of financial products; tax incentives for investments in startups; reduction of Goods and Services Tax (GST) rates; tax exemption for ESOPs; and exemption of angel tax on all investments by Alternate Investment Funds.