[Product roadmap] Ezetap began with a single payments offering and decided to pivot to a SaaS model

A product roadmap clarifies the why, what, and how behind what a tech startup is building. In our first article in this series, we take a closer look at Bengaluru-based Ezetap, which started out in 2011 with a single payments offering and has now moved to a SaaS business model.

India has over the years transitioned from a cash-based, opaque economy to a digital and transparent one, leading to a surge in the growth of the fintech sector. And startups like Bengaluru-based smart payments provider are leading the way to make India the hotbed of financial transformation.

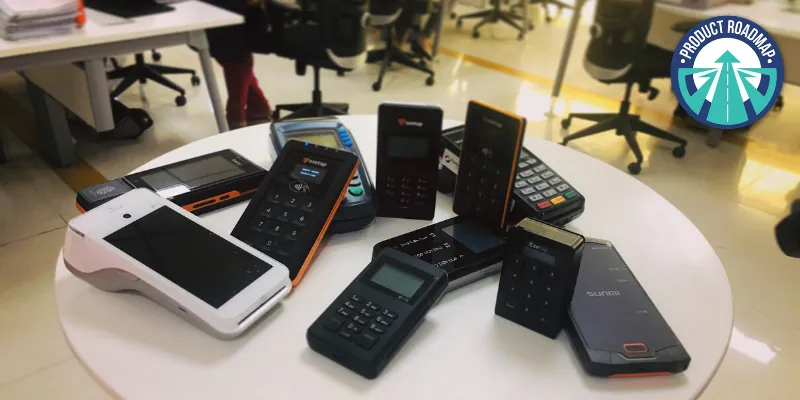

Founded in 2011 by Abhijit Bose and Bhaktha Keshavachar, Ezetap functions in the mobile Point-of-Sale (mPoS) market, and has since then diversified into integrating that payment experience with other software applications and systems used by merchants.

Bhaskar Chatterjee, Head of Products, Ezetap.

It continues to work towards its vision: “to be the single solution through which businesses complete any financial transaction with their customers, supporting every instrument and method that their customers want to use.”

At a time when PoS companies earn money through transaction fees, Ezetap has moved payments to a Software-as-a-Service business model, allowing merchants to accept digital transactions from physical cards, online payments, and mobile wallets through a single click via UPI.

The omnichannel payments platform has end-to-end capabilities to handle digital payment processing through integrated software solutions. Through a SaaS payments system, the startup has changed the payment processes of brick-and-mortar retailers, e-commerce players, enterprises, government bodies and financial inclusion organisations. Built-in services include reconciliation, EMI, loyalty, brand offers, cashbacks, and dynamic currency conversion.

“It has a routing layer, powered with some intelligence, which helps users work with the bank of their choice. The real differentiator is that Ezetap is agnostic of device, location, payment forms and payment partners so we can work with any device across use cases and form factors,” said Bhaskar Chatterjee, Head of Products at Ezetap.

The first prototype

At the beginning of the decade, access to the internet and smartphones was becoming ubiquitous across India. The fintech startup saw an opportunity to enable adoption of payments in India.

Ecommerce was growing by leaps and bounds, and Ezetap was one of the first companies in India that tried to convert COD shipments into digital payments – this was one of the first use cases where Ezetap was deployed in 2013.

In a conversation with , Bhaskar Chatterjee said,

“We built an EMV-compliant payment device that could take payments in conjunction with a commercially available smartphone and a card reader designed and assembled in India. We also created a payments SDK that would work behind a company app, hiding the complexity and compliance rigmarole of payments behind the ‘pay’ button.”

The co-founders of Ezetap, Abhijit and Bhaktha, who had experience in payments and hardware companies, combined their skills and knowledge to create this product.

The startup iterated on the first designs of the MPoS card reader, which worked via a smartphone’s audio jack. Later versions involved working with Bluetooth; the last version, v3, was then successfully deployed across India. V3 had a Bluetooth and a Wi-Fi capability because of which shop owners were able to accept payments by connecting the V3 device with the available Wi-Fi connection.

Bhaskar said,

“Hardware revisions were done in parallel, and Ezetap built a robust payments platform to complement hardware capabilities. This platform was scalable, services-based, and designed to be integrated into diverse IT ecosystems.”

All the components in Ezetap's stack were built on a services-based architecture that allowed for components to be added on top, and cloud-based architecture to ensure scalability.

Best-in-class payment experience

The mPoS versions worked successfully in the market for about five years. The first product was workable and met an important demand in the market. Later versions improved upon the first product, in terms of usability and performance.

In 2018, the startup decided to stop assembling and manufacturing their own devices in India and moved to sourcing them from vendors abroad. By then, the economics provided by third-party sourcing had become more favourable.

The product head said the requirement to build more architecture arose from “an ever-evolving demand to deliver the best-in-class payment experience to customers”.

As Ezetap started diversifying into different industry segments, the team noticed the need to be able to support enterprise-class integrations – especially when worked with one of the largest deployments of Airtel.

And as it entered the world of retail deployments, Ezetap had to support affordability, loyalty, and consumer incentive solutions.

“The Indian fintech ecosystem was exploding at the same time and innovation was happening with wallets, UPI, and others. The need to create a platform was felt so we could address diverse needs across industries with common patterns of integration and solutions,” Bhaskar said.

Growth learnings

All the core technology was built in-house for both the hardware and software aspects of the business. Over time, the startup put together an engineering team to work on the entire payments stack. The team handled everything - from the firmware on the device to the backend server architecture and the bank integration.

The Ezetap staff travelled with ecommerce delivery agents on motorcycles to the residences of end consumers to get real, “follow-me-home” feedback. Similar feedback loops were run in other industry segments like telecom, insurance, collections, among others.

All acquired feedback was incorporated into training programmes for users, usability enhancements, logistics feedback for delivery hubs, and advice on incentive programmes for app users.

Bhaskar said,

"Fundamentally, we were always looking for patterns that would repeat across industry segments or integrations. When we saw a use case pattern, we tried to productise that pattern and make it repeatable very quickly.”

(Edited by Teja Lele Desai)

![[Product roadmap] Ezetap began with a single payments offering and decided to pivot to a SaaS model](https://images.yourstory.com/cs/2/730b50702d6c11e9aa979329348d4c3e/BhaskarChatterjeeEzetap1-1580969581924.png?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)