The rise of incubation advisories and their impact on the early-stage startup ecosystem

Incubators play a crucial piece in the growth of a startup. In fact, the number of incubators is considered as a good indicator of how mature a startup ecosystem is.

Until a few years ago, unless you were a part of the startup ecosystem, chances are you didn’t know what an incubator was. Then came the extremely popular HBO dramedy Silicon Valley. As Erlich Bachman incubated Richard Hendricks’ Pied Piper to a multi-million dollar valuation, startup incubation became a globally recognised phenomenon.

Today, incubators are a crucial piece in the startup growth puzzle. The number of incubators is considered as a good indicator of how mature a startup ecosystem is.

India, having the third-largest startup ecosystem in the world, has over 500 startup incubators. Even though the country lags behind China (2,400+ incubators) and the US (1,500+ incubators), the vibrant ecosystem of startups has paved the way for the third-largest incubation advisory industry globally, which is gradually gaining popularity.

So, what is an incubator, and what role does it play in the early-stage startup ecosystem?

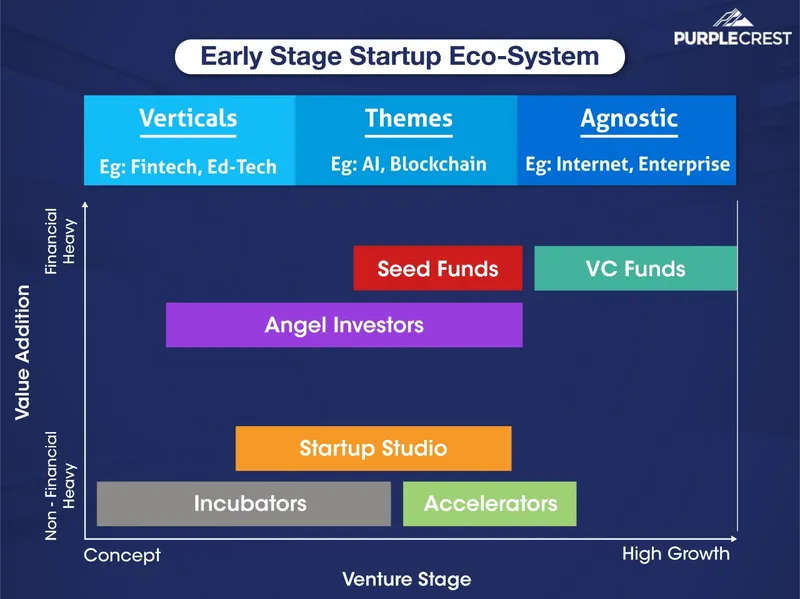

Incubators, as the name suggests, ‘incubate’ disruptive ideas with a hope of creating a business model and a company, starting often with even single entrepreneurs. The duration of an incubation programme or advisory is often long — one to five years in many cases.

The outcome being chased is an innovation, one that survives and sustains much after the incubation period.

As a startup, you can approach an incubator with just an idea. Incubators help you refine that idea and build an MVP (Minimum Viable Product). An incubator is probably the only institution in the startup ecosystem that comes in at the Pre-Seed or idea stage.

The above is very different from the role and goals of a startup accelerator, which is a more well-known entity due to names such as Y-Combinator, Techstars, etc.

A typical accelerator helps in doing 18-24 months of business building in just a few months, with a clear goal to make the venture VC-funding ready.

There are other entities that are active in the early-stage ecosystem as well. For example, a startup studio helps at both ends of the spectrum (concept to product-market fit) since it also has in-house experts who can help build and market the product.

Angel investors and Pre-Seed/Seed funds often double up as advisors and mentors to the founders during the incubation phase.

The silent blossoming of incubators and incubation advisors

Incubators and incubation advisors are experiencing growth in both demand and supply.

Let’s look at supply first. Whether it’s the more established institutional incubators like NASSCOM’s 10000 Startups, CIIE IIM-A, and SINE IIT Bombay or growth in the supply of ‘Incubation Advisors’ (Flexingit has seen an 84 percent growth in consultant registrations during March and April, 2020), incubators are finally coming into their own in India.

The noble urge to contribute towards innovation that fundamentally improve the world, the vicarious participation in a disruptive business, building process, and the desire to be around high-energy founders wanting to ‘make a dent in the universe’ — these are some of the reasons we have heard from incubators and advisors alike, for entering this space.

Further, exits over the last three-four years, have freed up capital and mentoring capacity. Then, there has also been a rise of corporates and family offices in the startup investment and incubation ecosystem.

On the demand side, other than the ‘lure of the unicorn status’, few drivers are at play behind the startups that join an incubator or an incubation programme. These include:

- Huge competition at late seed/Series A stage for financing, talent, customers, and mentors. For instance, 1,300+ new tech startups were started in 2019 alone.

- The lower average age of founders and team. In 2015, less than 30 percent of founders in India were above the age of 35, and the remaining are likely to find value in mentorship and access to business networks during the incubation phase.

- The need to be around like-minded founders and teams has also been one of the earliest drivers of demand — more in terms of co-working space.

- Evolution from startups mainly in ecommerce to entry in more and more niche industries that require deep expertise from Day 1.

From early days, when the business model of incubators was rent and sales of shared services such as accounting, legal, etc., the rise over the last few years has thus been driven by more value-added offerings on one side and intensity of competition among startups on the other.

Why good incubators succeed

Antler, a global early-stage VC, which works more like a structured incubator, recently entered in India with Rajiv Srivatsa, Co-founder of , at its helm.

In the words of Maria Wlosinska, Co-founder of Unlock, one of Antler’s portfolio startups, “Antler puts the whole infrastructure in place. Whether it’s capital, co-founders or mentors. It really helps you to de-risk”. That, in a nutshell, could be the value an incubator brings to the table.

If building a business is a long marathon, then good incubators prepare the founders and their team on multiple dimensions of that marathon.

Here are a few ways in which, we think, incubators bring value to startups in their portfolio;

Mental Stamina and Toughness

This is a hidden factor for success. According to Bill Gross, who started Idealabs more than 20 years ago, the biggest difference between startup success and failure is accounted for, by Timing. An incubator can help in assessing if the timing is right for an idea.

A good incubator goes further. It helps in building and strengthening the mental stamina (and toughness) required to persevere when the timing seems round the corner, but not yet there. This hidden success factor is also essential in preventing founder burnout, which unfortunately is growing rapidly in the community.

Social Capital

Many of us might have heard the phrase ‘It’s not what you know, it’s who you know’. Most founders work very hard in building knowledge, but not as hard in building and maintaining Social Capital.

Mark Granovetter, best known for his work on ‘The Strength of Weak ties’, has proven that weak connections play a very important role in an individual’s accomplishments (e.g. 80 percent of time, people find jobs - and founders their founding teams - through weak connections).

Incubators usually provide the infrastructure — shared office spaces, where social capital (professional networks) can be built. Good incubators go beyond that. They impart the knowhow in building and strengthening social capital — often an underrated asset, and hence another hidden factor of success!

Mentors

There are only two kinds of relevant mentors — those with startup experience and those with industry experience. Many reputed incubators bring both to the table.

Like Paul Buchheit, the creator of GMail; Brian Chesky, Founder of AirBnB, are mentors at Y Combinator, most good incubators have mentors with a prior startup or deep-industry experience.

Other benefits

Domain specific expertise, some sort of financing or access to third party financing, shared services such as HR, accounting, legal, marketing execution, etc., are some of the other benefits that incubators provide.

In structured incubation programmes, there are masterclasses, networking mixers, and other events that are part of a framework/process to help the startups learn and apply the learnings in creating a product-market fit.

Incubation in the time Of COVID-19

The pandemic of COVID-19 is undoubtedly a tragedy of massive proportions, taking a huge toll on human lives and many livelihoods. However, like tragedies and recessions in the past, it’s also a breeding ground for new problems that require innovation.

Marc Andreessen recently attributed our current state to the inability to build enough. This is a big call to action for startups to innovate and incubators to help them build what can sustain.

It is not easy though. Funding has become tougher, work from home is not easy for all types of problem-areas and the pandemic along with social isolation, has taken a huge toll on the mental health of people.

In these tough times, incubators and incubation advisors are seen to be adopting a different approach to add value to startups. At PurpleCrest, for instance, we were able to help increase the runway of a B2B venture by 12 months, through over 40 percent reduction in operating costs when the pandemic started. We call this the Resilient Growth approach; growing by using a disruption-proof method.

The approach integrates a resilient mindset, network/collaboration-powered business model, faster product iteration cycles, and multiple distribution channels, in the process of incubation.

The 'Resilient Growth' approach is one of the many approaches that are likely to emerge in a post-COVID incubation advisory world.

The road ahead

As the startup ecosystem matures in India, incubators and incubation advisory will more firmly establish its place like elsewhere.

In a world where uncertainty is becoming a norm and recessions are occurring more frequently, startups are likely to find much-needed support from these patient advisors.

These advisors and institutions see much less financial success than other entities in the value chain but likely derive much more satisfaction from their contribution. And that could also explain the silence behind the blossoming.

Edited by Saheli Sen Gupta

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)